The unlikely combination of freshwater fish and cannabis is producing outsized medical cannabis crops that Green Relief Inc aims to capitalize on, as the Canadian company plots a stock market listing and global expansion.

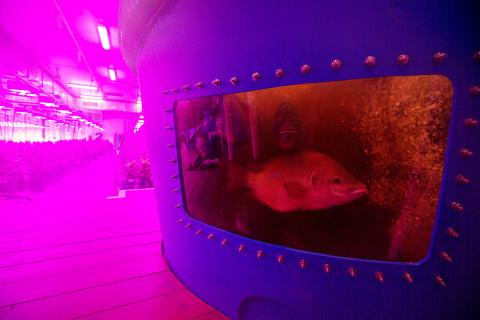

In an underground southern Ontario facility surrounded by farmland, Green Relief operates a cutting-edge aquaponic farm, using filtered fish waste to fertilize cannabis plants, which in turn clean the water for the fish.

The company says it is the world’s only licensed producer to grow medical cannabis this way, a pesticide-free process that took two-and-a-half years to fine tune. The only signs of this operation, which is built into a hill and insulated by about a meter of dirt and grass, is above-ground ventilation equipment sticking out of the ground.

Photo: Reuters

“This is the agriculture of the future,” said Warren Bravo, a former concrete contractor who co-founded the company with friend Steve LeBlanc in 2013. “If you’re not latching on to sustainable agriculture technologies now, you’re going to be a dinosaur.”

Green Relief’s closed-loop system, which raises 6,000 tilapia and 4,500 plants at any given time, uses 90 percent less water than conventional agriculture, while delivering 10-20 percent better yields than traditional methods, Bravo said.

Every five weeks, Green Relief purges one of its 16 fish tanks, donating about 300 market-size tilapia to Second Harvest, a food charity which delivers the fish to a homeless shelter’s kitchen.

A C$60 million (US$45.9 million) expansion is under way at the company’s rural base outside Hamilton, about an hour’s drive west of Toronto, which will add 15,000-20,000 kilograms to annual output. The project also includes manufacturing and packaging operations, to process plants from its satellite operations.

That includes a recently acquired 9,290m2 indoor soccer complex in Hamilton, which will produce about 15,000 kilograms of cannabis after a C$9 million retrofit.

With partners, Green Relief is also building facilities in Thunder Bay, Ontario and Halifax, Nova Scotia, that are to each produce about 20,000 kilograms annually, Bravo said.

Backed to date with C$18 million from private investors, Green Relief is preparing to list on the Canadian Securities Exchange, and possibly NASDAQ, to help fund its growth plans. An initial public offering is likely “within months,” depending on market conditions, and will build on a current financing that prices 100 million shares at C$3.50 each, Bravo said. Green Relief could break even within months and expects to be profitable this year, he added.

Bravo had been chief executive until he last month handed the job on an interim basis to John Durfy, who has a background in markets and investment.

As majority shareholder and director of business development, Bravo is busy securing properties in Italy and Australia while advancing such joint ventures as an alliance with Switzerland’s Ai Fame and Ai Lab.

“Canada’s in a very fortunate position right now,” he said, referencing the country’s world-leading legalization of recreational cannabis in October last year. “We get to take the lead in a brand new industry.”

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary

Intel Corp yesterday reinforced its determination to strengthen its partnerships with Taiwan’s ecosystem partners including original-electronic-manufacturing (OEM) companies such as Hon Hai Precision Industry Co (鴻海精密) and chipmaker United Microelectronics Corp (UMC, 聯電). “Tonight marks a new beginning. We renew our new partnership with Taiwan ecosystem,” Intel new chief executive officer Tan Lip-bu (陳立武) said at a dinner with representatives from the company’s local partners, celebrating the 40th anniversary of the US chip giant’s presence in Taiwan. Tan took the reins at Intel six weeks ago aiming to reform the chipmaker and revive its past glory. This is the first time Tan