US stock indices on Friday nudged higher after energy companies clawed back some of their sharp losses from earlier in the week.

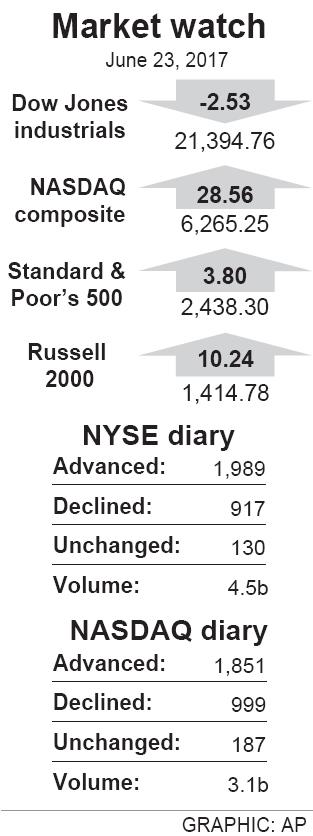

After meandering up and down through the day, the S&P 500 on Friday rose 3.80 points, or 0.16 percent, to end at 2,438.30, rising 0.2 percent from 2,433.15 on June 16.

The Dow Jones industrial average on Friday slipped 2.53 points, or less than 0.1 percent, to close at 21,394.76, up 0.05 percent from a close of 21,384.28 a week earlier, while the NASDAQ composite gained 28.56, or 0.5 percent, to close at 6,265.25, compared with 6,151.76 on June 16.

More than twice as many stocks rose than fell on the New York Stock Exchange.

Energy stocks led the way, and those in the S&P 500 climbed 0.8 percent for the largest gain of the 11 sectors that make up the index. Rising prices for oil and natural gas drove the gains.

EQT Corp, a producer of natural gas and crude, had the day’s biggest gain in the S&P 500, jumping US$4.16, or 8 percent, to US$56.19.

Cabot Oil & Gas Corp climbed US$0.88, or 3.8 percent, to US$23.74.

However, Friday’s gains were not enough to keep energy stocks from closing out their worst week in nine months. They had earlier sunk four straight days, as oil dropped to its lowest price since August last year on expectations that the world has more crude supplies than users need. Energy stocks lost 2.9 percent over the course of the week.

What kept broad indices afloat for the week were big gains for healthcare and technology stocks.

Healthcare stocks climbed as the US Senate unveiled its proposal to revamp how Americans get medical care.

Meanwhile, technology companies are forecast to report strong growth in the upcoming earnings season, and Oracle Corp’s profit report on Wednesday sailed past analysts’ expectations.

“In terms of the overall market, what you really worry about with oil is what it does to earnings,” Federated Investors Inc portfolio manager Steve Chiavarone said.

A big pickup in corporate profits has been one of the main reasons for the stock market’s continued climbs this year, and energy companies had been forecast to provide some of the strongest growth this year.

With the price of oil about 15 percent below where it was a year ago, energy companies’ profits might be at risk, but as long as oil’s price can hold close to where it is, “that’s good enough given that there’s corporate profit growth everywhere else,” Chiavarone said.

The biggest decliner in the S&P 500 was Bed Bath & Beyond Inc, which reported weaker-than-expected earnings for last quarter and revenue short of Wall Street forecasts. Its shares fell US$4.09, or 12.1 percent, to US$29.65.

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

United Microelectronics Corp (UMC, 聯電) forecast that its wafer shipments this quarter would grow up to 7 percent sequentially and the factory utilization rate would rise to 75 percent, indicating that customers did not alter their ordering behavior due to the US President Donald Trump’s capricious US tariff policies. However, the uncertainty about US tariffs has weighed on the chipmaker’s business visibility for the second half of this year, UMC chief financial officer Liu Chi-tung (劉啟東) said at an online earnings conference yesterday. “Although the escalating trade tensions and global tariff policies have increased uncertainty in the semiconductor industry, we have not

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new