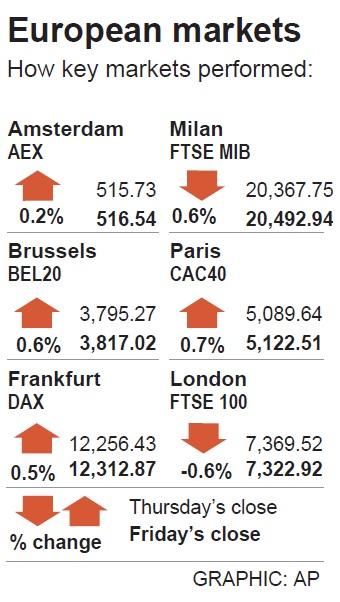

European stock markets on Friday ended the week higher on bargain hunting, shrugging off weakness on Wall Street where tough talk on trade from US President Donald Trump’s administration revived concerns about a global trade war.

In London, stock prices sagged under pressure from South Africa’s political turmoil, which hit mining stocks on the FTSE 100.

However, prices in Frankfurt and Paris, which had started the day in negative territory, ended the session higher as investors snapped up cheap bargains before they closed their books on the final day of the first quarter.

BMO Private Bank chief investment officer Jack Ablin said investors frequently engage in “window dressing” at the end of a quarter, selling off stocks that have not performed well and boosting holdings that have outperformed.

The STOXX Europe 600 rose 0.2 percent to close at 381.14 on Friday, widening its first-quarter advance to 5.5 percent and rising 1.22 percent from 376.51 a week earlier.

The gauge also posted its best March performance since 2010, as easing concern over a win for France’s anti-euro candidate in the country’s upcoming elections boosted lenders.

“As first quarters, go it’s been a solid start to the year for 2017,” London-based CMC Markets market analyst Michael Hewson wrote in a client note. “Economic data by and large has been pretty good across the board from the US, UK, Europe and Asia, while rising inflation has prompted some optimism that we could see some trickle-down effects into higher wages.”

The STOXX Europe 600 rose for a third consecutive quarter, its longest run since a streak of five quarterly gains in 2014. A chorus of strategists and investors say the reflation rally in Europe has more to go, boosted by those seeking sanctuary from lofty US stock valuations.

Investors are also assessing the US Federal Reserve’s rate trajectory. Some officials this week turned more hawkish after the central bank last month raised rates and maintained its forecast for further increases this year.

The weakness on Wall Street was put down to the fact Trump signed an executive order tasking staff to pinpoint countries and goods responsible for the US’ nearly US$50 billion monthly trade deficit. The move was accompanied by a series of aggressive comments from administration officials on trade, much of it aimed at China.

Still, some analysts believe the concrete actions from the Trump administration might be more moderate than the rhetoric suggests.

In London, investors digested unrevised data, which showed the British economy expanded by 0.7 percent in the final three months of last year, despite jitters over Brexit.

The rand plunged after South African President Jacob Zuma fired minister of finance Pravin Gordhan. The news sent shares in miner Anglo American PLC down by 2.9 percent, while finance group Old Mutual PLC topped the fallers’ board with a 7.3 percent tumble.

“Stocks with exposure to South Africa plunged amid deep fears about the state of the country’s government following the sacking of respected finance minister Pravin Gordhan,” ETX Capital analyst Neil Wilson said.

Miners also were hit by softer metal prices, with Antofagasta PLC down 0.7 percent, BHP Billiton PLC shedding 2.9 percent and Rio Tinto PLC losing 2.5 percent.

BYPASSING CHINA TARIFFS: In the first five months of this year, Foxconn sent US$4.4bn of iPhones to the US from India, compared with US$3.7bn in the whole of last year Nearly all the iPhones exported by Foxconn Technology Group (富士康科技集團) from India went to the US between March and last month, customs data showed, far above last year’s average of 50 percent and a clear sign of Apple Inc’s efforts to bypass high US tariffs imposed on China. The numbers, being reported by Reuters for the first time, show that Apple has realigned its India exports to almost exclusively serve the US market, when previously the devices were more widely distributed to nations including the Netherlands and the Czech Republic. During March to last month, Foxconn, known as Hon Hai Precision Industry

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and the University of Tokyo (UTokyo) yesterday announced the launch of the TSMC-UTokyo Lab to promote advanced semiconductor research, education and talent development. The lab is TSMC’s first laboratory collaboration with a university outside Taiwan, the company said in a statement. The lab would leverage “the extensive knowledge, experience, and creativity” of both institutions, the company said. It is located in the Asano Section of UTokyo’s Hongo, Tokyo, campus and would be managed by UTokyo faculty, guided by directors from UTokyo and TSMC, the company said. TSMC began working with UTokyo in 2019, resulting in 21 research projects,

Ashton Hall’s morning routine involves dunking his head in iced Saratoga Spring Water. For the company that sells the bottled water — Hall’s brand of choice for drinking, brushing his teeth and submerging himself — that is fantastic news. “We’re so thankful to this incredible fitness influencer called Ashton Hall,” Saratoga owner Primo Brands Corp’s CEO Robbert Rietbroek said on an earnings call after Hall’s morning routine video went viral. “He really helped put our brand on the map.” Primo Brands, which was not affiliated with Hall when he made his video, is among the increasing number of companies benefiting from influencer

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) yesterday expressed a downbeat view about the prospects of humanoid robots, given high manufacturing costs and a lack of target customers. Despite rising demand and high expectations for humanoid robots, high research-and-development costs and uncertain profitability remain major concerns, Lam told reporters following the company’s annual shareholders’ meeting in Taoyuan. “Since it seems a bit unworthy to use such high-cost robots to do household chores, I believe robots designed for specific purposes would be more valuable and present a better business opportunity,” Lam said Instead of investing in humanoid robots, Quanta has opted to invest