CPC Corp, Taiwan (CPC, 台灣中油) yesterday said it would increase gasoline and diesel prices by NT$0.4 per liter today to reflect the recent rise in global crude oil prices and the New Taiwan dollar’s depreciation against the US dollar.

The state-run refiner said its weighted oil price formula — 70 percent Dubai crude and 30 percent Brent crude — showed prices last week rose to US$54.06 per barrel from US$52.87 per barrel the previous week.

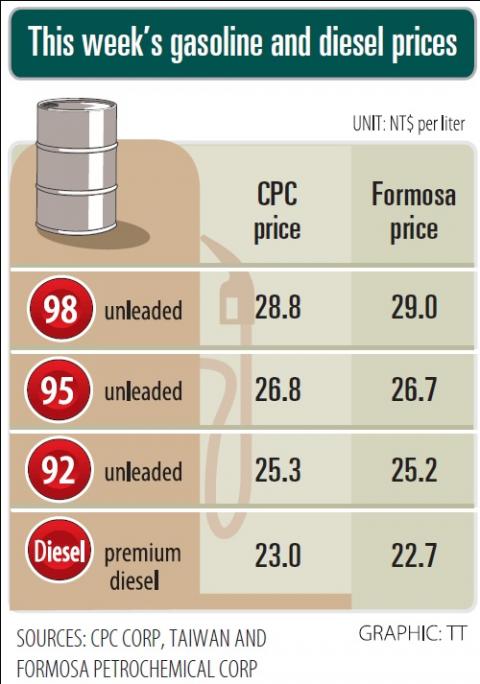

Fuel prices at the pump are set to be NT$23 per liter for premium diesel, NT$25.3 per liter for 92-octane unleaded gasoline, NT$26.8 per liter for 95-octane unleaded gasoline and NT$28.8 per liter for 98-octane unleaded gasoline.

Formosa Petrochemical Corp (台塑石化) on Saturday said it would raise gasoline and diesel prices to NT$22.7 per liter for super diesel, NT$25.2 per liter for 92-octane unleaded gasoline, NT$26.7 per liter for 95-octane unleaded gasoline and NT$29 per liter for 98-octane unleaded gasoline.

CPC yesterday also announced a rise in this month’s wholesale prices for liquefied petroleum gas (LPG) and liquefied natural gas (LNG), adding more upward pressure on consumer prices.

Effective today, prices for household LPG will rise by NT$1 per kilogram, NT$0.5 per liter for LPG used in cars and NT$0.25 per cubic meter for household LNG, CPC said.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to