TD Ameritrade Holding Corp and its largest stakeholder, Toronto-Dominion Bank, agreed to buy Scottrade Financial Services Inc for US$4 billion, combining two of the largest online brokerages while expanding the US operations of Canada’s second-largest lender.

TD Ameritrade will acquire Scottrade’s brokerage operations for about US$2.7 billion in cash and stock, the firm said in a statement on Monday.

Toronto-Dominion, which owns about 42 percent of TD Ameritrade, agreed to purchase Scottrade’s online bank for US$1.3 billion in cash, adding to its US branch network that stretches from Maine to Florida, the Toronto-based lender said in a separate statement.

Photo: EPA

The deal is expected to be completed by Sept. 30, next year, with clearing operations moving to TD Ameritrade systems the next year.

About 28 million shares in TD Ameritrade are to be issued to Scottrade shareholders and Toronto-Dominion is to purchase another 11 million shares in the firm, which will help fund the US$1.7 billion cash portion of the price.

The companies expect US$450 million in annual cost savings, with a quarter of that coming in the first year after the close.

“This combination will allow us to leverage our strengths, increase our scale and further accelerate our asset gathering capabilities,” TD Ameritrade chief executive officer Tim Hockey said in a conference call to discuss the deal.

The acquisition of Scottrade adds to a flurry of recent deals in an industry that is facing pressure from lower trading volumes and sluggish revenue growth.

E-Trade Financial Corp in July bought Aperture New Holdings Inc, parent of the futures and options trading platform OptionsHouse, in a US$725 million cash deal, and Ally Financial Inc a month earlier purchased TradeKing Group Inc for about US$275 million.

Toronto-Dominion gains Scottrade Bank, a business with about US$13 billion in cash and securities, US$4 billion in loans and leases and US$15 billion in sweep deposits as of Sept. 30.

Scottrade Bank offers personal banking for Scottrade brokerage customers, business lending, loan servicing and commercial equipment financing. Toronto-Dominion is to take US$175 million of goodwill tied to the acquisition and its common equity tier 1 ratio is to decrease by about 30 basis points after the deal.

The acquisition is expected to add to earnings in the first full year after closing.

Toronto-Dominion’s stake in TD Ameritrade will be 41.4 percent after the deal, the lender said.

Toronto-Dominion has spent more than US$17 billion building a US branch network since 2005 and has sought to fortify its wealth-management business since buying New York money manager Epoch Investment Partners in 2013 to attract more wealthy US clients.

The lender has more recently focused on buying credit-card portfolios, although chief executive officer Bharat Masrani said as recently as lat month that he is still interested in “tuck-in acquisitions” and other US assets if they make strategic sense.

TD Ameritrade, based in Omaha, Nebraska, has a market value of US$19.5 billion. Closely held Scottrade, based in Town and Country, Missouri, last year had US$1.04 billion of revenue, Wells Fargo & Co analysts led by Christopher Harris said in a report this month.

Online platforms are used by consumers, wealth advisers and other investors to trade securities outside of traditional brokerages. The brokerages have been squeezed in recent years amid competition from automated investment systems, known as “robo-advisers,” and a shift away from stock picking and day-trading toward passive vehicles.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

A proposed 100 percent tariff on chip imports announced by US President Donald Trump could shift more of Taiwan’s semiconductor production overseas, a Taiwan Institute of Economic Research (TIER) researcher said yesterday. Trump’s tariff policy will accelerate the global semiconductor industry’s pace to establish roots in the US, leading to higher supply chain costs and ultimately raising prices of consumer electronics and creating uncertainty for future market demand, Arisa Liu (劉佩真) at the institute’s Taiwan Industry Economics Database said in a telephone interview. Trump’s move signals his intention to "restore the glory of the US semiconductor industry," Liu noted, saying that

STILL UNCLEAR: Several aspects of the policy still need to be clarified, such as whether the exemptions would expand to related products, PwC Taiwan warned The TAIEX surged yesterday, led by gains in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), after US President Donald Trump announced a sweeping 100 percent tariff on imported semiconductors — while exempting companies operating or building plants in the US, which includes TSMC. The benchmark index jumped 556.41 points, or 2.37 percent, to close at 24,003.77, breaching the 24,000-point level and hitting its highest close this year, Taiwan Stock Exchange (TWSE) data showed. TSMC rose NT$55, or 4.89 percent, to close at a record NT$1,180, as the company is already investing heavily in a multibillion-dollar plant in Arizona that led investors to assume

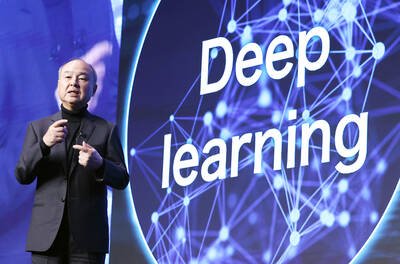

AI: Softbank’s stake increases in Nvidia and TSMC reflect Masayoshi Son’s effort to gain a foothold in key nodes of the AI value chain, from chip design to data infrastructure Softbank Group Corp is building up stakes in Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the latest reflection of founder Masayoshi Son’s focus on the tools and hardware underpinning artificial intelligence (AI). The Japanese technology investor raised its stake in Nvidia to about US$3 billion by the end of March, up from US$1 billion in the prior quarter, regulatory filings showed. It bought about US$330 million worth of TSMC shares and US$170 million in Oracle Corp, they showed. Softbank’s signature Vision Fund has also monetized almost US$2 billion of public and private assets in the first half of this year,