Yahoo Inc appears to be making progress in efforts to sell itself, despite some initial skepticism.

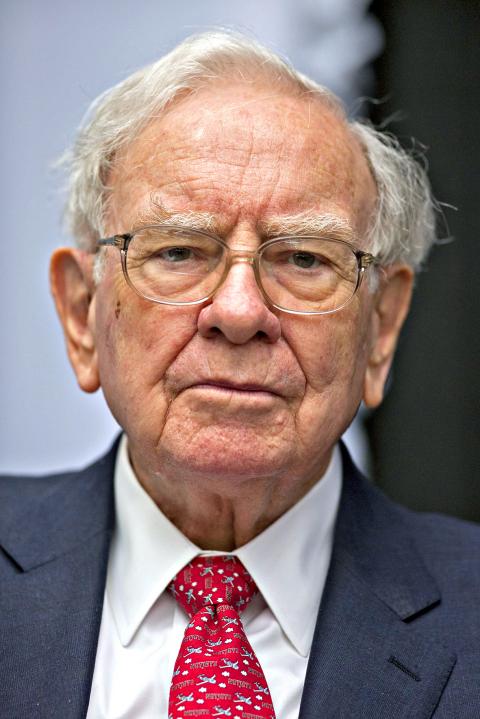

The latest piece of evidence: Among those vying for the company is the unusual combination of billionaire investor Warren Buffett and Dan Gilbert — the founder of Quicken Loans Inc and owner of the Cleveland Cavaliers.

That consortium is one of several suitors that have moved into the second round of bidding for Yahoo, according to people briefed on the matter.

Photo: Bloomberg

Gilbert is leading the bid, said the people, who were not authorized to speak publicly.

Buffett’s conglomerate, Berkshire Hathaway Inc, is offering to provide financing, as he has done with the investment firm 3G Capital in its takeovers of HJ Heinz Co and Kraft Foods, and is leaving the negotiations to Gilbert, according to the people.

The unusual presence of Gilbert and Buffett in the bidding suggests just how far Yahoo and its advisers have cast their net to find potential buyers for the embattled Internet company.

The two are joined in the second round by a range of other bidders, including Verizon Communications Inc and private equity firms such as TPG Capital and a group that comprises Bain Capital LLC and Vista Equity Partners, people briefed on the process have previously said.

Several other strategic bidders are also in the second round.

Yahoo declined to comment. Representatives for Quicken Loans and Berkshire did not return requests for comment.

The companies in the second round of bidding are seeking to buy one of the best-known names in Silicon Valley — although one that ceded a longtime hold on the Internet to younger rivals such as Google Inc and Facebook inc. Repeated efforts to reinvent itself, led by a string of chief executives, including now-Yahoo chief executive officer Marissa Mayer, have failed to take hold.

As Yahoo and its bankers canvassed for preliminary bids, the company received criticism, including from some prospective bidders and from the activist hedge fund Starboard Value LP, over the state of the sales process.

However, the company can point to progress. It settled a looming board fight with Starboard, offering the investment firm four director seats. One of those is held by Starboard chief executive officer Jeffrey Smith, who now sits on the special board committee overseeing the potential sale.

Yahoo executives, including Mayer, and advisers have been sitting down with bidders in the second round, furnishing those suitors with additional details.

Among them is Gilbert, who built his US multibillion-dollar fortune with the financial empire. However, he is also an active investor in his own right, having taken stakes in a number of online startups.

Yahoo would be orders of magnitude larger than those other technology investments and significantly more troubled. However, Gilbert’s consortium, like other bidders, has been interested in the still-significant digital footprint the company possesses, including its popular finance and sports sites.

Backing him is his friend Buffett — who has long spoken of his aversion to technology companies, outside of an investment in IBM Corp. However, the role of Berkshire in the Gilbert bid would be financial, with Buffett’s conglomerate collecting interest from its financing with the opportunity to convert those holdings into an equity stake in the company.

Both men are familiar with Yahoo in other ways. Buffett turned to Yahoo Finance for the first-ever live stream of the question-and-answer session at Berkshire’s annual shareholder meeting on April 30.

In addition, one of Berkshire’s directors is former Yahoo president Susan Decker.

Providing advice to the Gilbert consortium are former Yahoo chief operating officer Dan Rosensweig, now chief executive officer of the education company Chegg, and former Yahoo advertising senior vice president Tim Cadogan, now the head of the online advertising platform OpenX. Neither has expressed interest in rejoining Yahoo, one of the people briefed on the matter said.

Buffett and Gilbert have another — albeit more troubled — tie to the Internet company. In 2014, Berkshire, Quicken Loans and Yahoo briefly united to offer a “Billion Dollar Bracket Challenge” tied to the National Collegiate Athletic Association basketball tournament that year, although the contest was called off and devolved into a morass of lawsuits.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

A proposed 100 percent tariff on chip imports announced by US President Donald Trump could shift more of Taiwan’s semiconductor production overseas, a Taiwan Institute of Economic Research (TIER) researcher said yesterday. Trump’s tariff policy will accelerate the global semiconductor industry’s pace to establish roots in the US, leading to higher supply chain costs and ultimately raising prices of consumer electronics and creating uncertainty for future market demand, Arisa Liu (劉佩真) at the institute’s Taiwan Industry Economics Database said in a telephone interview. Trump’s move signals his intention to "restore the glory of the US semiconductor industry," Liu noted, saying that

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

STILL UNCLEAR: Several aspects of the policy still need to be clarified, such as whether the exemptions would expand to related products, PwC Taiwan warned The TAIEX surged yesterday, led by gains in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), after US President Donald Trump announced a sweeping 100 percent tariff on imported semiconductors — while exempting companies operating or building plants in the US, which includes TSMC. The benchmark index jumped 556.41 points, or 2.37 percent, to close at 24,003.77, breaching the 24,000-point level and hitting its highest close this year, Taiwan Stock Exchange (TWSE) data showed. TSMC rose NT$55, or 4.89 percent, to close at a record NT$1,180, as the company is already investing heavily in a multibillion-dollar plant in Arizona that led investors to assume