Portugal’s president said on Monday that fallout from the financial troubles of the founding family of Banco Espirito Santo SA (BES) could affect the wider economy, while the bank said it was appointing a special financial adviser to help boost its capital structure.

Portuguese President Anibal Cavaco Silva is the first high-profile politician to speak of a possible economic impact from the Espirito Santo crisis, after the family asked for creditor protection for one of its key holding companies on Friday last week.

Another of the family’s companies, Rioforte SA, last week failed to repay on time more than US$1 billion in debt owed to Portugal Telecom, which had a knock-on effect on the latter’s merger with Brazil’s Grupo Oi, forcing it to take a cut in its stake in the new entity.

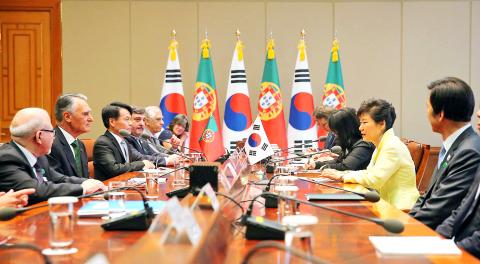

Photo: EPA

“If some citizens, some investors suffer significant losses [from the Espirito Santo group] they may delay investment decisions, or some of them may find themselves in very big difficulties,” Cavaco Silva said in comments during a visit to South Korea, which were aired on local television.

“We cannot ignore that there will be some impact on the real economy,” he said.

In Lisbon, Portuguese Economy Minister Antonio Pires de Lima said that a crisis engulfing the BES group could affect the country’s recovery, but insisted Portugal’s “upturn is stronger.”

“The crisis in the Espirito Santo group will not do us good, but the recovery is stronger and it is there to stay,” he told journalists on Monday.

The turmoil at Portugal’s largest lender comes at a delicate time for the country, which has just come out of a joint EU-IMF rescue program despite a surprise drop of 0.6 percent in its GDP in the first three months of the year.

Many analysts fear the knock-on effects of the crisis could further undermine Portugal’s faltering economy, one of the weakest in the eurozone. The economy is expected to grow by 1 percent this year, the first year of growth since 2011.

BES is under scrutiny following disclosures of financial irregularities at the Luxembourg-based Espirito Santo International SA (ESI), which filed for creditor protection on Friday. ESI indirectly owns 49 percent of the company that holds the Espirito Santos’ stake in BES.

BES was controlled and managed by the Espirito Santo family until just a few weeks ago, but they have since reduced their stake and left top jobs at the bank. Respected economist Vitor Bento is the new chief executive after Ricardo Espirito Santo Salgado, the family patriarch, resigned from the position.

Bento told clients in a message on Monday that he was “working hard to regain the confidence of markets, to generate sustainable benefits and to open a new chapter for the bank.”

The bank also said on Monday that it was finalizing the appointment of a special adviser who would help it to better structure its capital base.

Portugal’s central bank has said BES has enough capital to cope with any losses resulting from the fallout of the financial troubles of the family, whose companies owe the bank 1.2 billion euros (US$1.62 billion), and that it could tap private investors if there is a further need.

BES raised 1.045 billion euros in a capital increase last month, but subsequent details about its lending to Espirito Santo family companies and its troubled operations in Angola raised fresh questions about whether it needs more.

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his