Advanced Semiconductor Engineering Inc (ASE, 日月光半導體) chairman Jason Chang (張虔生) promised yesterday that “every drop of wastewater” from the company will meet environmental standards in the future, Greater Kaohsiung Mayor Chen Chu (陳菊) said.

ASE is also expected to submit an improvement plan today on its wastewater treatment, as required by the Greater Kaohsiung’s Environmental Protection Bureau, so that the company can resume operations at its K7 plant as soon as possible, Chen said.

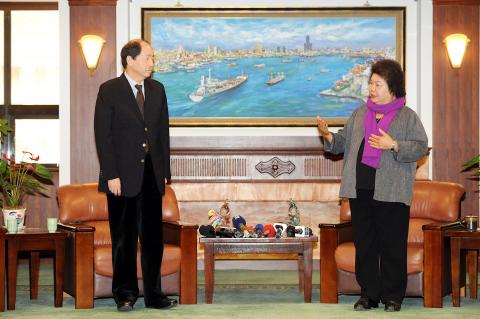

CLOSED-DOOR MEETING

Photo: Chang Chung-yi, Taipei Times

Chen made the remarks after a closed-door meeting with Chang and other senior ASE executives, including chief operating officer Tien Wu (吳田玉) and president Raymond Lo (羅瑞榮) of the company’s Greater Kaohsiung plant.

On Friday, the Environmental Protection Bureau ordered the closure of several assembly lines at ASE’s K7 plant in the city’s Nanzih Export Processing Zone.

The factory was caught in violation of environmental protection rules, discharging wastewater contaminated with heavy metals into the nearby Houjin River (後勁溪).

Chang said he hoped the plant could resume operations as soon as possible to safeguard the interests of ASE customers and workers, the mayor said.

The production lines responsible for the high levels of nickel found in the K7 plant’s wastewater were shut down, which affected 40 percent of the 5,000-strong workforce.

LOSS OF US$18 MILLION

ASE said on Friday the partial shutdown at the K7 plant may result in a monthly loss of up to US$18 million, adding that the plant accounts for about 9 percent of the company’s monthly sales.

Andrew Chen (陳治宇), an analyst with Yuanta Investment Consulting Co (元大投顧), said the semiconductor supply chain has one to two months of inventory to handle a drop in packaging and testing services caused by the shutdown.

Chen said as long as the lines can reopen soon, the impact on the supply chain will be limited.

Other analysts agreed, saying that by relocating some packaging and testing equipment to other plants in the Nanzih Export Processing Zone, or shifting production to another complex in Taoyuan County’s Jhongli (中壢), ASE would be able to tolerate the impact in the short term.

They added that the fourth quarter of this year and the first quarter of next year make up the slow season for the global IC industry.

The analysts also said that some integrated circuit (IC) designers have contacted ASE’s rivals to check the possibility of taking orders from these fabless IC suppliers if the K7 plant shutdown is lengthy.

Without a quick reopening, ASE would face difficulties retrieving orders lost to its rivals, including South Korea’s Amkor Technology Inc, Singapore’s STATS-ChipPAC Ltd and Taiwan’s Siliconware Precision Industries Inc (矽品精密), they added.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose to No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc (廣達) at 348th, Pegatron Corp (和碩) at 461st, CPC Corp, Taiwan (台灣中油) at 494th and Wistron Corp (緯創) at

NEW PRODUCTS: MediaTek plans to roll out new products this quarter, including a flagship mobile phone chip and a GB10 chip that it is codeveloping with Nvidia Corp MediaTek Inc (聯發科) yesterday projected that revenue this quarter would dip by 7 to 13 percent to between NT$130.1 billion and NT$140 billion (US$4.38 billion and US$4.71 billion), compared with NT$150.37 billion last quarter, which it attributed to subdued front-loading demand and unfavorable foreign exchange rates. The Hsinchu-based chip designer said that the forecast factored in the negative effects of an estimated 6 percent appreciation of the New Taiwan dollar against the greenback. “As some demand has been pulled into the first half of the year and resulted in a different quarterly pattern, we expect the third quarter revenue to decline sequentially,”

ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip assembly and testing service provider, yesterday said it would boost equipment capital expenditure by up to 16 percent for this year to cope with strong customer demand for artificial intelligence (AI) applications. Aside from AI, a growing demand for semiconductors used in the automotive and industrial sectors is to drive ASE’s capacity next year, the Kaohsiung-based company said. “We do see the disparity between AI and other general sectors, and that pretty much aligns the scenario in the first half of this year,” ASE chief operating officer Tien Wu (吳田玉) told an