The government on Tuesday removed a ban on investment in 30 products in China, paving the way for Taiwanese petrochemical firms to invest in naphtha crackers across the Taiwan Strait.

The 30 approved items cover 23 in agriculture and seven in petrochemicals, the Executive Yuan said in a statement on its Web site.

The statement did not specify the names of the products, which were represented by product code numbers, but the Investment Commission said they include seven byproducts of oil refining.

Since Kuokuang Petrochemical Technology Co’s (國光石化) proposed naphtha cracker project failed to receive approval from the government because of environmental concerns and state-run CPC Corp, Taiwan’s (CPC, 中油) naphtha cracker in Greater Kaohsiung is due to be retired in 2015, continuing to restrict petrochemical firms from investing in China will not solve a potential shortage of ethylene supply, Investment Commission deputy executive secretary Emile Chang (張銘斌) said by telephone yesterday.

“Removing the barriers for local firms to invest in China was inevitable,” Chang said.

With the restrictions eliminated, companies can produce petrochemical products such as ethylene, propylene and butadiene in China and sell them to oil refiners like CPC and the Formosa Plastics Group (FPG, 台塑集團), Chang said.

CONSORTIUM

Meanwhile, a consortium composed of seven Taiwanese companies — including Ho Tung Chemical Corp (和桐化學), LCY Chemical Corp (李長榮化學) and USI Corp (台灣聚合化學品) — is planning to develop a petrochemical complex project in the Gulei Peninsula, Zhangzhou, in China’s Fujian Province.

The government’s policy is to encourage local petrochemical companies to produce upstream raw materials overseas and improve the quality of their downstream products in Taiwan in order to protect the environment, Chang said.

Since building a naphtha cracker requires a large investment, each local petrochemical company can apply for one investment project at a time, Chang said.

He said the Ministry of Economic Affairs would also ask companies planning to set up joint ventures with Chinese partners to aim for more than 50 percent shareholding to secure their ownership in China.

Since constructing a new naphtha cracker would take at least 10 years, Chang said it might not be possible for CPC to fix its ethylene supply shortage problem by 2015, when its cracker in Greater Kaohsiung is scheduled to shut down.

“Removing investment restrictions is a way to help local petrochemical companies explore new markets and also to secure CPC’s long-term business,” he added.

Reports of the latest easing drove the plastics sub-index up 2.06 percent yesterday.

Formosa Plastics Group member Formosa Chemicals & Fibre Corp (台灣化纖) gained 3 percent to close at NT$82.40, while affiliate Nan Ya Plastics Corp (南亞塑膠) added 2.24 percent to close at NT$63.90.

Taiwan Styrene Monomer Corp (台苯) surged to its daily limit at NT$22.40, while Taita Chemical Co Ltd (台達化) closed up 3.2 percent at NT$12.85 and Grand Pacific Petrochemical Corp (國喬) moved up 5.16 percent to NT$22.40.

ICS, PANELS

The government also removed some restrictions on wafer, semiconductor and panel makers buying shares in their Chinese peers, according to the Executive Yuan’s statement.

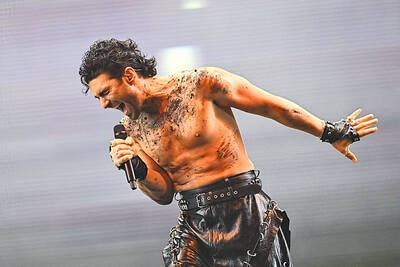

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary

Intel Corp yesterday reinforced its determination to strengthen its partnerships with Taiwan’s ecosystem partners including original-electronic-manufacturing (OEM) companies such as Hon Hai Precision Industry Co (鴻海精密) and chipmaker United Microelectronics Corp (UMC, 聯電). “Tonight marks a new beginning. We renew our new partnership with Taiwan ecosystem,” Intel new chief executive officer Tan Lip-bu (陳立武) said at a dinner with representatives from the company’s local partners, celebrating the 40th anniversary of the US chip giant’s presence in Taiwan. Tan took the reins at Intel six weeks ago aiming to reform the chipmaker and revive its past glory. This is the first time Tan