The Ministry of Economic Affairs and 20 overseas Taiwanese firms yesterday inked letters of intent to invest NT$37.8 billion (US$1.29 billion) in Taiwan, injecting some fresh momentum to the nation’s meager private investment amid global economic woes.

The figure represented an increase of 19 percent, from the NT$31.8 billion the ministry solicited last year under the same program targeting overseas Taiwanese entrepreneurs, mostly from China, to boost private investment.

“As the external economic situation is not good, we have to look for growth in the domestic market,” Vice Minister of Economic Affairs Francis Liang (粱國新) said during a forum arranged by the government to boost investment in Taiwan.

Fixed investment from the private sector is expected to shrink 1.03 percent this year from last year as LCD companies and memory chipmakers scale back equipment investment amid falling orders, the Directorate-General of Budget, Accounting and Statistics forecast last month.

The newly promised investments came primarily from traditional sectors such as machinery tools, biotech, tourism and retail, while expansion in the technology sector, a pillar of Taiwan’s economy, stagnates.

Jinn Her Enterprise Co Ltd (晉禾企業), the world’s biggest manufacturer of screws and bolts, plans to spend NT$10 billion on building a logistics warehouse in Greater Kaohsiung, making it the biggest investor among the 20 firms that promised to divert their investment back home.

“We have been scouting around for a place to build our [fourth] logistics warehouse over the past several years,” company chairman Tsai Yung-yu (蔡永裕) told a joint media briefing yesterday. “We chose [to build a warehouse in] Taiwan because it is our home country and we hope to contribute to improving the country’s unemployment rate.”

The planned logistics warehouse would create 100,000 jobs in the screw-and-bolt supply chain in a new industrial center, initiated by Jinn Her, in Greater Kaohsiung, Tsai said.

He said the construction of the logistics warehouse would be completed within a year after obtaining government approval.

Jinn Her, which trades its A shares on the Shenzhen stock market, makes screws and bolts mostly in Chinese factories.

It is also worth noticing that Sino Horizon Holdings Ltd (鼎固控股), a Shanghai-based property development company, plans to invest at least NT$300 million in building shopping malls and restaurants in Taiwan.

Sino Horizon is owned by Jason Chang (張虔生) and his family, which also operates the world's top chip packager Advanced Semiconductor Engineering Inc (ASE, 日月光半導體). Sino Horizon is expected to list on local stock market by the end of this year.

Tailife Co Ltd (台勵福), which makes forklift trucks, marked another example. Tailife said it planned to spend at least NT$1 billion to build production lines to make motors and other key components used in forklift trucks.

After making home appliances in China for more than two decades, home appliances maker Airmate Electrical (Shenzhen) Co Ltd (艾美特電器深圳) plans to launch an initial offering in the local stock market later this year and to expand its research and development center in Taiwan, company vice chairman Tsai Cheng-fu (蔡正富) said, citing the excellent talent pool here.

Airmate also plans to expand its own-brand home appliances business in Taiwan, Tsai said. Airmate makes home appliances and motors for local household brands such as Tatung Co (大同), Sampo Corp (聲寶) and TECO Electric and Machinery Co (東元電機), but sells Airmate home appliances in China.

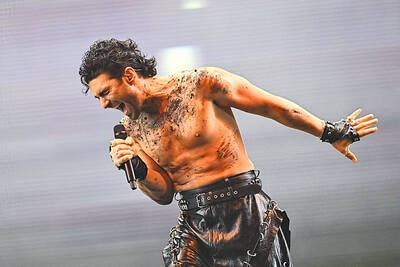

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

BIG BUCKS: Chairman Wei is expected to receive NT$34.12 million on a proposed NT$5 cash dividend plan, while the National Development Fund would get NT$8.27 billion Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday announced that its board of directors approved US$15.25 billion in capital appropriations for long-term expansion to meet growing demand. The funds are to be used for installing advanced technology and packaging capacity, expanding mature and specialty technology, and constructing fabs with facility systems, TSMC said in a statement. The board also approved a proposal to distribute a NT$5 cash dividend per share, based on first-quarter earnings per share of NT$13.94, it said. That surpasses the NT$4.50 dividend for the fourth quarter of last year. TSMC has said that while it is eager

‘IMMENSE SWAY’: The top 50 companies, based on market cap, shape everything from technology to consumer trends, advisory firm Visual Capitalist said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) was ranked the 10th-most valuable company globally this year, market information advisory firm Visual Capitalist said. TSMC sat on a market cap of about US$915 billion as of Monday last week, making it the 10th-most valuable company in the world and No. 1 in Asia, the publisher said in its “50 Most Valuable Companies in the World” list. Visual Capitalist described TSMC as the world’s largest dedicated semiconductor foundry operator that rolls out chips for major tech names such as US consumer electronics brand Apple Inc, and artificial intelligence (AI) chip designers Nvidia Corp and Advanced

Pegatron Corp (和碩), an iPhone assembler for Apple Inc, is to spend NT$5.64 billion (US$186.82 million) to acquire HTC Corp’s (宏達電) factories in Taoyuan and invest NT$578.57 million in its India subsidiary to expand manufacturing capacity, after its board approved the plans on Wednesday. The Taoyuan factories would expand production of consumer electronics, and communication and computing devices, while the India investment would boost production of communications devices and possibly automotive electronics later, a Pegatron official told the Taipei Times by telephone yesterday. Pegatron expects to complete the Taoyuan factory transaction in the third quarter, said the official, who declined to be