Marc Faber, publisher of the Gloom, Boom and Doom report, yesterday reiterated his criticism of money printing practices, which he believes will continue in the US, Europe and elsewhere, causing bubbles such as those seen in the Chinese real-estate market.

“A third wave of quantitative easing by the US Federal Reserve is just a matter of time,” said Faber, a contrarian investor who has been referred to as “Doctor Doom” for a number of years.

Printing money is the way global governments will evade debt crises, such as the one that is gripping Europe, Faber said in Taipei.

Photo: CNA

That would forestall the crisis rather than solve it, keeping prices elevated for assets like stocks, real estate in some areas and precious metal, he said.

Loose monetary policies, including low interest rates, intended as a short-term fix, can have unintended consequences later, Faber said.

While central banks can inject fresh funds into the markets, they cannot control where the funds flow, he said, adding that money printing has encouraged speculation on commodities whose prices have gone up faster than real demand in recent years.

“Some people will benefit from money printing that deflates the purchasing power of currency ... but the middle and lower--income classes are being hurt,” said Faber, an investment adviser focused on value investments, who owns Marc Faber Ltd.

Countries with resources are basking in the trend in light of their sharp increases in international reserves, which Faber said was symptomatic of monetary inflation and a shift in wealth.

The fast-growing economy of China has pushed up its inflationary pressures, with the bubble in the real-estate sector on the brink of bursting, Faber said.

“Don’t believe China’s consumer price index stands only at 5 percent,” he said. “The truth is somewhere between 12 percent and 15 percent ... The real-estate bubble is so evident that Chinese property shares are very weak as the volume of real-estate transactions goes down and prices fall.”

Faber said China would follow the practice of quantitative easing if it has to choose between printing money and a concrete recession.

The Chinese bubble will burst eventually, in three months or in three years; when it happens, it will have devastating consequences for the global economy, he said.

“Chinese invented paper. They know how to print money,” Faber said.

Still, the ongoing shifting balance of economic power from industrialized countries to emerging economies is building up geopolitical tensions, especially in the Middle East and Central Asia, he said.

All the West needs to do to contain China is seize control of oil supplies, but China and the countries dependent on oil imports would not allow that for the sake of self-preservation, Faber said.

He recommended risk diversification against the current backdrop, but took a dim view of government bond purchases as they would mean trust in the easy monetary policy.

Rather, he suggests owning physical gold, equities and Asian real estate that will prove a better defense against inflation.

Greece, Faber said, is bankrupt whether Europe likes to admit it or not, and the European Central Bank will print money to postpone a systematic failure.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52

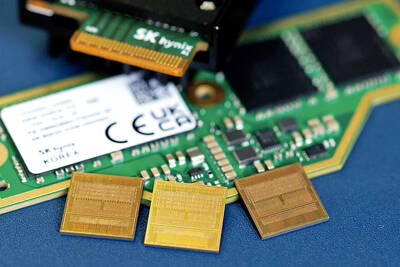

OPPORTUNITY: Supply of conventional DRAM chips tightened after the world’s major memory makers focused on manufacturing chips utilized in AI servers DRAM chipmaker Nanya Technology Corp (南亞科技) yesterday reported a spike in revenue for last month, as severe supply constraints prompted chip price hikes, almost doubling the company’s annual revenue last year from the previous year. Revenue soared 444.87 percent last month to NT$12.02 billion (US$381.4 million), from NT$2.21 billion a year earlier. That brought fourth-quarter revenue to NT$30.17 billion, from NT$6.58 billion for the same period in 2024. On a quarterly basis, revenue jumped 60.65 percent from NT$18.78 billion. Last year, revenue soared 95.09 percent to NT$66.59 billion from NT$32.13 billion in 2024, the company said. Supply of conventional DRAM