A bidder has agreed to pay US$2.63 million for a steak lunch with the billionaire investor Warren Buffett in a charity auction held on eBay Inc’s Web site.

The highest bid in the 11th annual auction topped the previous record US$2.11 million paid in 2008 by Zhao Danyang (趙丹陽), a Hong Kong investor. Wealth manager Salida Capital Corp of Toronto won with a US$1.68 million bid last year.

The identity of the winning bidder could not immediately be determined after bidding closed Friday night.

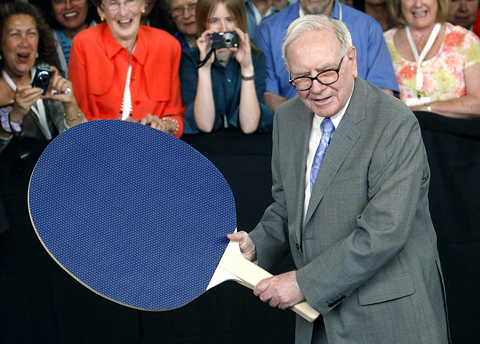

PHOTO: REUTERS

EBay was not immediately available for comment. Berkshire Hathaway Inc, Buffett’s insurance and investment company, did not immediately return a request for comment.

The winner and up to seven friends will dine with the world’s third-richest person at the Smith & Wollensky steakhouse in midtown Manhattan. Smith & Wollensky is also donating US$10,000.

As in his increasingly frequent television appearances, Buffett will talk about pretty much anything apart from what he is buying and selling.

Proceeds benefit the Glide Foundation, a San Francisco non-profit organization offering meals, healthcare, child care, housing and job training for the poor and homeless.

Glide is also known for lively Sunday morning services that include gospel music.

Buffett began auctioning the lunches in 2000 after his first wife Susan introduced him to Glide and its founder, the Reverend Cecil Williams.

In a Friday interview, Williams said the auction was critical to Glide because the economy has caused donations to fall 20 percent this year, while demand for Glide’s services was up 30 percent. Glide’s annual budget is about US$17 million.

The auction began on Sunday night and the top bid rose from US$1.8 million in the last hour. Nine bidders made a total of 77 bids. Entering Friday, the highest bid had been US$900,100, according to eBay.

Buffett, 79, built an estimated US$47 billion fortune running Omaha, Nebraska-based Berkshire, which operates about 80 businesses and has tens of billions of dollars of investments.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose to No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc (廣達) at 348th, Pegatron Corp (和碩) at 461st, CPC Corp, Taiwan (台灣中油) at 494th and Wistron Corp (緯創) at

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong