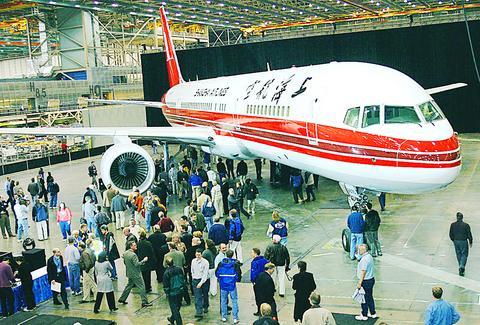

The Boeing Co has closed out the 757 commercial jet program with the last of the 1,050 jets to roll off the assembly line.

T-shirts showing a 757 with the words, "Celebrate the Legacy," were worn by thousands of past and present Boeing workers on Thursday at a ceremony marking the end of two decades of production of the 200-passenger plane in this Seattle suburb.

PHOTO: EPA

"A big chunk of my life has been spent on this program," said Clyde Brown, who worked on the 757 line from the start more than 22 years ago to the end. "That plane has been good to me."

The last 757 is scheduled for delivery to Shanghai Airlines in April.

Brown and many other workers will now work on another plane that figured in the demise of the 757 -- the newest models of the 737, also made in Renton. No layoffs from the end of 757 production are planned.

Alan Mulally, head of the company's commercial airplane division, said Boeing plans to "crank up" 737 production but gave no details.

Boeing, based in Chicago, announced in July that after cutting more than 27,000 jobs in three years, about 3,000 workers will be hired in the Puget Sound region by Dec. 31.

Many are in technical and engineering jobs for the 7E7 program in Everett and a military program to equip the 737 airframe as a Navy submarine-hunting aircraft.

Any new hires for 737 production were factored into Boeing's employment forecast in July, a spokeswoman said.

Mulally was an engineer on the original design team for the 757 program, which was headed by Philip Condit, who went on to become chief executive of Boeing but resigned earlier this year in an uproar over the use of dubious methods to win government contracts.

At the ceremony Mulally noted that all but 20 of the 757s remain in service worldwide.

"It has one of the great safety records of any plane in the world," he said.

One unique feature for Boeing was simultaneous design of the single-aisle 757 and the widebody 767, which is assembled in Everett.

Despite differences in size and range, they were designed with common flight decks so pilots trained on one could fly the other with little additional training, resulting in big cost savings for airlines.

Sales of 757s reached a peak of 99 planes in 1992 but declined to 45 by 2000, then plummeted in the airline industry slump that followed the terrorist attacks of Sept. 11, 2001.

Two of the three planes seized by the terrorists were 757s. One hit the Pentagon and the other crashed into a field in Pennsylvania after passengers stormed the cockpit.

Factors in the end of the line for the 757 include development of bigger, more economical and longer-range 737 models, the 7E7 Dreamliner that Boeing plans to begin building in 2006 and competition from Airbus SAS.

Still, Mulally said predicted that Boeing would be providing product support for the 757 for "the next 30 to 40 years."

MAJOR BENEFICIARY: The company benefits from TSMC’s advanced packaging scarcity, given robust demand for Nvidia AI chips, analysts said ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip packaging and testing service provider, yesterday said it is raising its equipment capital expenditure budget by 10 percent this year to expand leading-edge and advanced packing and testing capacity amid strong artificial intelligence (AI) and high-performance computing chip demand. This is on top of the 40 to 50 percent annual increase in its capital spending budget to more than the US$1.7 billion to announced in February. About half of the equipment capital expenditure would be spent on leading-edge and advanced packaging and testing technology, the company said. ASE is considered by analysts

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

Huawei Technologies Co’s (華為) latest smartphones carry a version of the advanced made-in-China processor it revealed last year, results from an independent analysis showed. This underscored the Chinese company’s ability to sustain production of the controversial chip. The Pura 70 series unveiled last week sports the Kirin 9010 processor, research firm TechInsights found during a teardown of the device. This is a newer version of the Kirin 9000s, made by Semiconductor Manufacturing International Corp (SMIC, 中芯) for the Mate 60 Pro, which had alarmed officials in Washington who thought a 7-nanometer chip was beyond China’s capabilities. Huawei has enjoyed a resurgence since