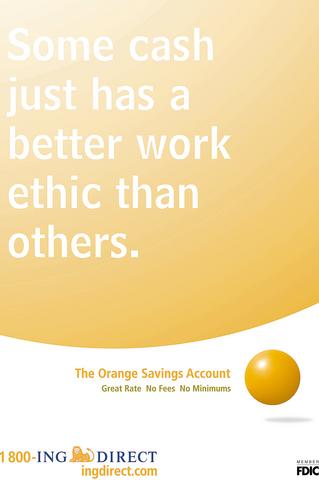

ING Direct, the online bank best known for the orange ball tossed around in its commercials, has gained a profitable foothold in the US by wooing customers fed up with the minuscule interest rates offered by most banks.

Next week, ING Direct will introduce a US$50 million fine-tuning of that approach from Bartle Bogle Hegarty, as it attempts to convince skittish stock market investors that its savings accounts would also make a fine investment option.

PHOTO: NY TIMES

ING Direct, a subsidiary of the Dutch financial services company ING, wants to add 500,000 new customers this year, to go with the the 1 million it has acquired since entering the US market in September 2000.

But the online bank's inroads into the US market could run into some obstacles. If the stock market's fortunes rise, or the traditional banks increase their interest rates, ING Direct's key selling point could lose some of its attraction.

ING Direct executives do not seem too worried. The online bank's products have become increasingly attractive as investors bail out of the declining stock market only to be underwhelmed by the interest rates banks are paying on savings accounts or money-market funds.

"Its financial instruments are as safe as a bank and safer than the stock market," said Jerry Silva, an analyst with TowerGroup, a Needham, Mass.-based research company that is part of Reuters. "And it gives you flexibility and doesn't lock you in the way a traditional CD would."

As of Jan. 31, ING Direct's annual interest rate on its savings account, the only account it offers, will be 2.3 percent. Currently, the average savings account interest rate is 0.80 percent, while the average money market account pays an interest rate of 0.73 percent, according to Bankrate.

ING Direct has used this spread to become the 95th largest bank in the US in less than three years of operation, according to the latest rankings from American Banker. The bank is already profitable, posting a nine-month net profit of US$21.5 million through Sept. 30, compared to a US$32.5 million net loss in the same period the previous year.

ING Direct has avoided the fate of a number of other Internet banks by keeping its costs and offerings to a minimum. Customers can bank either online or by phone. And ING Direct does not offer checking accounts or impose any fees, service charges or minimum requirements on its products.

To maintain its momentum, ING Direct is tweaking its approach. It dropped its original agency, Howard, Merrell & Partners, of Raleigh, North Carolina, and is boosting its spending by US$15 million from last year and more than doubling the US$22 million it spent in 2001.

David Lewis, ING Direct's chief marketing officer, said the bank's original ads were directed at "value-conscious, savvy, thrifty, well-informed consumers who like finding a good deal."

He said the new ads are aimed at these customers, as well as at individuals who would normally not view a savings account as a good place for their funds.

This group would be more likely to use money-market funds, scoffing at savings accounts as unsophisticated and a poor investment, with a low yield, he said. "The new campaign is meant to expand the category, to show that the account has a great yield and can be looked at as liquid," he said.

The campaign's two TV commercials, which will debut Feb. 3 and 17, combine film and animation, and retain the orange ball. The first spot shows a disheveled man roaming through his home while his animated money dances around the rooms. Fed up with the money's aimless activity, he sits down at his computer and signs up for the company's "orange" savings account.

The second spot depicts money rushing out of a bank vault, through the streets of a city, to a car dealership, where its owner is considering the purchase of a vintage car.

"We wanted the spots to be about people's relationship to money," said Kevin McKeon, executive creative director of the New York office of Bartle Bogle Hegarty, which is 49 percent owned by the Publicis Groupe.

Ian Rubin, research director of Financial Insights, a subsidiary of International Data Corp, a Framingham, Massachusetts-based consulting firm, said: "I think the message is great. They're saying `This can be fun, it doesn't have to be stodgy.' If it gets people thinking about savings accounts and CDs who wouldn't think twice about them, it can drive a lot of people to look at ING as an option."

BYPASSING CHINA TARIFFS: In the first five months of this year, Foxconn sent US$4.4bn of iPhones to the US from India, compared with US$3.7bn in the whole of last year Nearly all the iPhones exported by Foxconn Technology Group (富士康科技集團) from India went to the US between March and last month, customs data showed, far above last year’s average of 50 percent and a clear sign of Apple Inc’s efforts to bypass high US tariffs imposed on China. The numbers, being reported by Reuters for the first time, show that Apple has realigned its India exports to almost exclusively serve the US market, when previously the devices were more widely distributed to nations including the Netherlands and the Czech Republic. During March to last month, Foxconn, known as Hon Hai Precision Industry

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and the University of Tokyo (UTokyo) yesterday announced the launch of the TSMC-UTokyo Lab to promote advanced semiconductor research, education and talent development. The lab is TSMC’s first laboratory collaboration with a university outside Taiwan, the company said in a statement. The lab would leverage “the extensive knowledge, experience, and creativity” of both institutions, the company said. It is located in the Asano Section of UTokyo’s Hongo, Tokyo, campus and would be managed by UTokyo faculty, guided by directors from UTokyo and TSMC, the company said. TSMC began working with UTokyo in 2019, resulting in 21 research projects,

Ashton Hall’s morning routine involves dunking his head in iced Saratoga Spring Water. For the company that sells the bottled water — Hall’s brand of choice for drinking, brushing his teeth and submerging himself — that is fantastic news. “We’re so thankful to this incredible fitness influencer called Ashton Hall,” Saratoga owner Primo Brands Corp’s CEO Robbert Rietbroek said on an earnings call after Hall’s morning routine video went viral. “He really helped put our brand on the map.” Primo Brands, which was not affiliated with Hall when he made his video, is among the increasing number of companies benefiting from influencer

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) yesterday expressed a downbeat view about the prospects of humanoid robots, given high manufacturing costs and a lack of target customers. Despite rising demand and high expectations for humanoid robots, high research-and-development costs and uncertain profitability remain major concerns, Lam told reporters following the company’s annual shareholders’ meeting in Taoyuan. “Since it seems a bit unworthy to use such high-cost robots to do household chores, I believe robots designed for specific purposes would be more valuable and present a better business opportunity,” Lam said Instead of investing in humanoid robots, Quanta has opted to invest