Asian stocks rose for a second week as record sales at Intel Corp and unprecedented economic growth in Singapore overshadowed weak US factory reports and a slowdown in China.

LG Corp, the largest shareholder in the world’s third-biggest maker of mobile phones, surged 12 percent to 73,700 won as Intel’s second quarter sales beat estimates. DBS Group advanced 3.9 percent in Singapore after the city-state announced its economy expanded at a record 18.1 percent pace in the first half of this year. Li & Fung Ltd (利豐), the biggest supplier to retailers including Wal-Mart Stores Inc and Target Corp, dropped 3.4 percent in Hong Kong as US Federal Reserve officials downgraded their outlook for the US economy and retail sales slowed.

The MSCI Asia-Pacific Index climbed 0.05 points, or less than 0.1 percent, this week to 116.23, its smallest weekly advance since October 2005. A late surge by Indian shares pulled the index into positive territory after declining US factory output and weaker-than-expected earnings at Google Inc had seen the Asian gauge erase gains from earlier in the week.

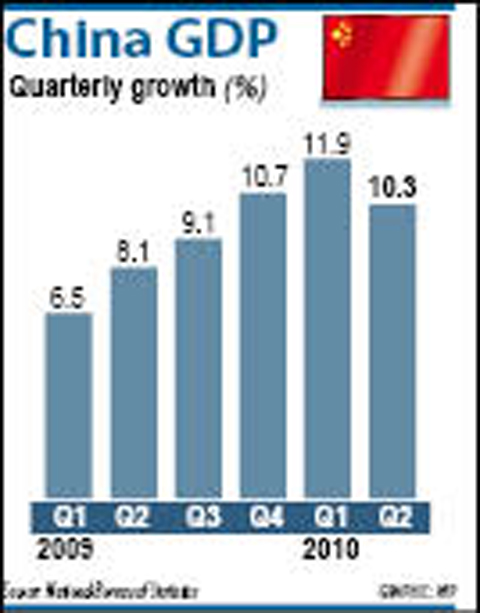

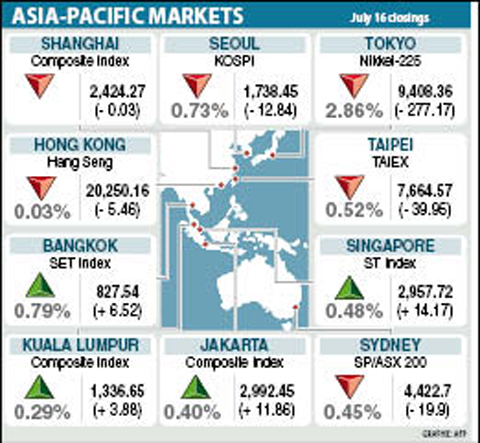

Japan’s Nikkei 225 Stock Average declined 1.9 percent this week, led by banks after the ruling party lost control of the upper house in elections. China’s Shanghai Composite Index lost 1.9 percent as China’s expansion slowed.

Hong Kong’s Hang Seng Index declined 0.6 percent. Australia’s S&P/ASX 200 Index rose 0.6 percent. South Korea’s KOSPI Index rose 0.9 percent. Singapore’s Straits Times Index climbed 1.4 percent after its economy grew at a record pace.

Singapore’s GDP expanded at a 26 percent annualized pace in the second quarter from the previous three months, after a revised 45.9 percent gain in January to March, the trade ministry said on Wednesday. Growth in the first half was the fastest since records began in 1975, prompting the government to predict GDP will rise 13 percent to 15 percent this year.

Gains by technology stocks were pared after Google, owner of the world’s most popular search engine, reported profit was US$6.45 a share in the second quarter. Analysts had estimated US$6.52, according to a Bloomberg survey.

Taiwan’s TAIEX fell 39.95 points, or 0.5 percent, to 7,664.57 at the close of Taipei trading on Friday. The benchmark index advanced 0.2 percent this week.

Taiwanese share prices fell largely in response to losses posted by other regional markets amid concerns over the pace of global economic recovery, dealers said.

Select large high-tech stocks continued to take a beating as the market feared global consumption would be affected, while the financial sector extended its gains from the previous session on hopes that increasing cross-strait exchanges will boost their bottom lines.

Other markets on Friday:

Manila closed down 0.72 percent, or 24.95 points, from Thursday at 3,442.68 points.

Wellington slipped 0.55 percent from Thursday, pushing the benchmark NZX 50 Index below 3,000 points, despite a 5 percent increase for New Zealand Refining company. The NZX-50 index was down 16.56 points at 2,985.760.

Jakarta rose 0.40 percent, or 11.86 points, from Thursday to an all-time closing high of 2,992.45 as foreign funds bought banks and blue-chip mining stocks.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

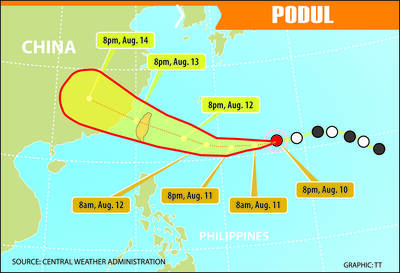

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

Tropical Storm Podul strengthened into a typhoon at 8pm yesterday, the Central Weather Administration (CWA) said, with a sea warning to be issued late last night or early this morning. As of 8pm, the typhoon was 1,020km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, moving west at 23kph. The storm carried maximum sustained winds of 119kph and gusts reaching 155kph, the CWA said. Based on the tropical storm’s trajectory, a land warning could be issued any time from midday today, it added. CWA forecaster Chang Chun-yao (張竣堯) said Podul is a fast-moving storm that is forecast to bring its heaviest rainfall and strongest