US stocks ended a volatile week on the upside on Friday, with investors worrying about the global recovery and facing a new batch of housing and inflation data on the world’s largest economy.

“Financial markets continued to thrash around ... as investors remained generally risk-averse and indecisive about how the future would unfold,” US economists at IHS Global Insight said in a note to clients.

“These fears were exacerbated by the usual pundits proclaiming that the economic Armageddon that they had predicted for 2009, while delayed, would indeed finally explode onto the scene in the second half of 2010,” economists Nigel Gault and Brian Bethune said.

Over the week, the Dow Jones Industrial Average rose 2.51 percent to 10,211.07 points. The blue-chip index seesawed between losses and gains through Thursday, finally closing higher for a second day running on Friday.

The tech-rich NASDAQ rose 1.10 percent from the previous Friday to 2,243.60 points.

The Standard & Poor’s 500 index, a broad measure of the markets, advanced 2.51 percent over the week to 1,091.60 points.

“It is pretty simple why the market got an uptick percent this week — because the week was relatively absent of any macroshocks coming from the eurozone,” Craig Peckham at Jefferies said.

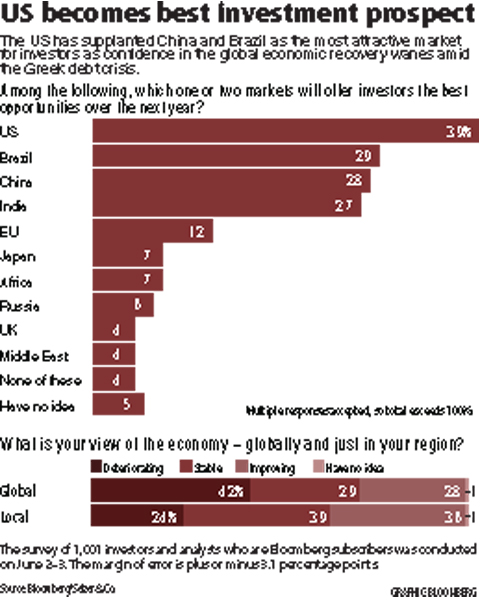

Market sentiment improved slightly on the eurozone, where Greece’s debt crisis has exposed the troubled finances of other members of the currency-sharing bloc and sent the euro tumbling against the US dollar.

The BP oil-spill crisis in the Gulf of Mexico, the worst environmental disaster in US history, was expected to loom large again over the markets.

The British oil giant’s share price has plunged by as much as 49 percent, wiping tens of billions of dollars off its market value, since the BP-operated Deepwater Horizon rig sank on April 22 after a deadly explosion two days earlier.

The oil well continues to spew massive amounts of crude into the Gulf that have defied attempts at firm estimates.

The disaster has hammered other energy shares and raised speculation about BP’s long-term viability.

The markets likely will keep a close eye on the political ramifications of the crisis as US President Barack Obama’s administration and Congress hold meetings with BP leaders. The round began yesterday with Obama holding talks with British Prime Minister David Cameron by phone about the oil spill.

The White House summoned BP chairman Carl-Henric Svanberg to a meeting with Obama in Washington on Wednesday.

Investors will have a full calendar of economic data to scan in search of the direction of the world’s largest economy.

Wednesday will be charged, with reports due on last month’s housing starts and building permits, wholesale inflation and industrial production.

On Thursday, weekly initial jobless claims will provide a snapshot on the troubled labor market, where the unemployment rate stands at 9.7 percent.

Consumer prices data on the same day will round out the inflation picture, while the Conference Board’s index of leading economic indicators may shed some light on the recovery outlook.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better