Factories in China and India cranked up production last month and Japanese business morale rose to its highest in more than a year on signs of improving global demand, boosting hopes for a sustainable economic recovery.

China’s official purchasing managers’ index (PMI) rose to 55.1 last month from 52.0 in February, beating expectations and pointing to brisk first-quarter GDP growth that could spur further policy tightening by the central bank.

Sub-indexes for output, new orders, new export orders, imports and job creation all rose strongly, as did input prices, highlighting mounting inflationary pressures as the economy surges and companies look to pass on rising costs to consumers.

The headline PMI from a parallel HSBC/Markit survey rose to 57.0, the third-highest level in the six-year history of the survey, from 55.8 in February. A reading above 50 means activity is expanding.

“Another substantially high headline manufacturing PMI reading, combined with strong growth of exports, points to an acceleration in industrial production and likely over 11 percent GDP growth in the first quarter,” Qu Hongbin (屈宏斌), chief economist for China at HSBC, said in a statement yesterday. “With inflation pressures rapidly accumulating, this increases the risk of interest rate hikes in the coming months.”

Strong demand from China, the world’s third-largest economy, is proving a boon for its neighbors as Asia’s major Western export markets have been far slower to recover.

South Korea reported that exports last month rose 35.1 percent from a year earlier, beating an expected 32.9 percent rise.

“Taking into account that our main trading partners are China and other emerging markets and those markets are still flourishing, we can expect a positive outlook for the first half of the year,” said Kim Jae-eun, an economist at Hyundai Securities in Seoul.

Japan has also seen a steady export recovery, driven largely by sales to China, which has helped offset persistently weak domestic demand that is hobbling the economy.

The Bank of Japan’s “tankan” survey yesterday showed morale among the country’s big manufacturers, the biggest beneficiaries of the export rise, improved to its best level since the failure of Lehman Brothers shocked financial markets in September 2008.

Large manufacturers expect export sales to grow 4.5 percent this year and next year, compared with an expected 18.3 percent decline in the fiscal year that ended on Wednesday, though they remain cautious about boosting wages or spending on new plants and equipment.

Japanese manufacturing activity slowed slightly last month, but a rise in export orders to the highest in almost six years suggested production would grow.

India’s factories were also busier last month, though growth slowed from a 20-month high in February as companies faced mounting cost pressures.

While South Korea’s year-on-year export numbers appear impressive, investment bank ING said monthly export growth may have moderated from February, highlighting concerns in Asia that the global recovery may be slower and more uneven than expected.

Chinese government economist Zhang Liqun (張立群) said time would tell whether the improvement in global demand could be sustained.

“From the demand side, the strong recovery in exports might not be sustainable and actual investment growth is slowing. So the outlook for growth in demand and orders is still not clear,” he said.

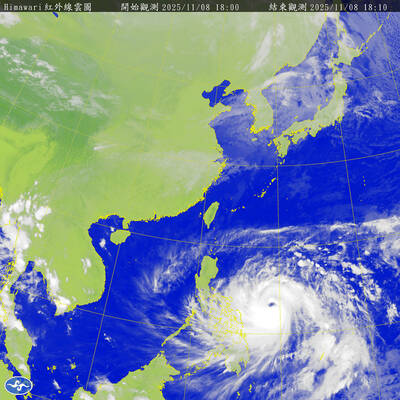

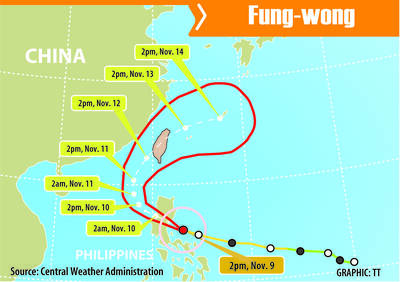

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

Taiwan’s exports soared to an all-time high of US$61.8 billion last month, surging 49.7 percent from a year earlier, as the global frenzy for artificial intelligence (AI) applications and new consumer electronics powered shipments of high-tech goods, the Ministry of Finance said yesterday. It was the first time exports had exceeded the US$60 billion mark, fueled by the global boom in AI development that has significantly boosted Taiwanese companies across the international supply chain, Department of Statistics Director-General Beatrice Tsai (蔡美娜) told a media briefing. “There is a consensus among major AI players that the upcycle is still in its early stage,”

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had