Asian stocks rose for a fourth week after the US Federal Reserve pledged to keep borrowing costs near zero for an “extended period” and as the Bank of Japan (BOJ) expanded a bank-loan program.

Sony Corp, which makes Bravia televisions and the PlayStation 3 video-game system, gained 4.1 percent. Sony Financial Holdings Inc, a subsidiary, surged 12 percent after saying it will boost bond holdings. Kia Motors Corp, South Korea’s No. 2 automaker, jumped 14 percent in Seoul on speculation profit will beat estimates. BYD Co (比亞迪), a Chinese carmaker, advanced 11 percent in Hong Kong after brokerages lifted earnings forecasts for the company.

“It’s clear that the Fed is going to keep rates very accommodative to stimulate the growth recovery,” said Chris Hall, who helps manage about US$3.3 billion at Argo Investments in Adelaide, Australia. “The million-dollar question is the consumer’s ability to step up to the plate to support the economy.”

The MSCI Asia-Pacific Index climbed 1.4 percent to 124.92 this week. Stocks have rallied in the past six weeks as concern over monetary tightening and Greece’s debt receded, and as companies reported better-than-expected earnings.

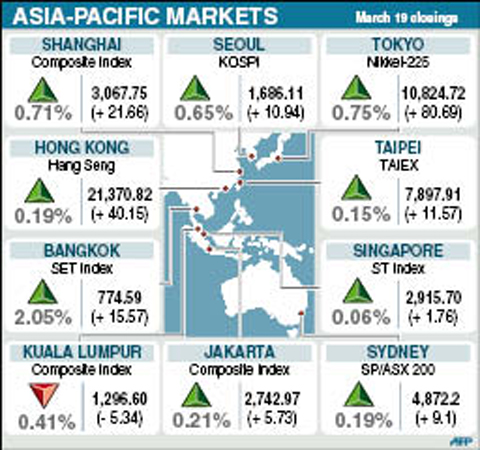

Japan’s Nikkei 225 Stock Average rose 0.7 percent this week, compared with increases of 1.1 percent for Australia’s S&P/ASX 200 Index, 1.4 percent for South Korea’s Kospi index and 0.8 percent for Hong Kong’s Hang Seng Index. The Shanghai Composite Index advanced 1.8 percent.

The MSCI Asia-Pacific Index rose this week after the US Federal Reserve said it will leave its benchmark interest rate near zero to safeguard the economic recovery. Separately, a US Labor Department report showed first-time applications for jobless benefits dropped in the week ended March 13, while the Federal Reserve Bank of Philadelphia’s general economic index rose this month to the highest level this year.

“The US economy is improving day by day, and so is the global economy,” said Hiroichi Nishi, an equities manager at Nikko Cordial Securities Inc in Tokyo. “People are beginning to expect better corporate earnings.”

The BOJ on Wednesday doubled a lending program aimed at stoking credit growth after the government stepped up calls to arrest deflation that’s hampering the economic recovery. It also held the overnight lending rate at 0.1 percent.

“It’s good that the bank is showing its willingness to cooperate with the government to curb deflation,” said Hiroshi Morikawa, a senior strategist at MU Investments Co, which manages the equivalent of US$14 billion in Tokyo.

The MSCI Asia-Pacific Index has gained about 9.5 percent from its lowest level in more than two months on Feb. 8, as better-than-estimated US employment data and a pledge of support from French President Nicolas Sarkozy for debt-stricken Greece bolstered confidence in the global recovery. The average price of stocks in the index has risen to about 19 times estimated earnings from 18 at last month’s low.

In other markets on Friday:

Singapore was flat, ending 1.76 points higher from Thursday at 2,915.70.

Manila fell 0.12 percent, or 3.72 points, from Thursday to 3,097.23.

Wellington closed 0.30 percent, or 9.72 points, higher from Thursday at 3,230.40.

Mumbai rose 0.34 percent, or 58.97 points, from Thursday to end at 17,578.23.

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

Tsunami waves were possible in three areas of Kamchatka in Russia’s Far East, the Russian Ministry for Emergency Services said yesterday after a magnitude 7.0 earthquake hit the nearby Kuril Islands. “The expected wave heights are low, but you must still move away from the shore,” the ministry said on the Telegram messaging app, after the latest seismic activity in the area. However, the Pacific Tsunami Warning System in Hawaii said there was no tsunami warning after the quake. The Russian tsunami alert was later canceled. Overnight, the Krasheninnikov volcano in Kamchatka erupted for the first time in 600 years, Russia’s RIA

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an

South Korea yesterday said that it was removing loudspeakers used to blare K-pop and news reports to North Korea, as the new administration in Seoul tries to ease tensions with its bellicose neighbor. The nations, still technically at war, had already halted propaganda broadcasts along the demilitarized zone, Seoul’s military said in June after the election of South Korean President Lee Jae-myung. It said in June that Pyongyang stopped transmitting bizarre, unsettling noises along the border that had become a major nuisance for South Korean residents, a day after South Korea’s loudspeakers fell silent. “Starting today, the military has begun removing the loudspeakers,”