Gold hit another historic high this week close to US$1,200 per ounce as trade was driven by central bank purchases and the struggling greenback, before pulling lower as Dubai rattled global markets.

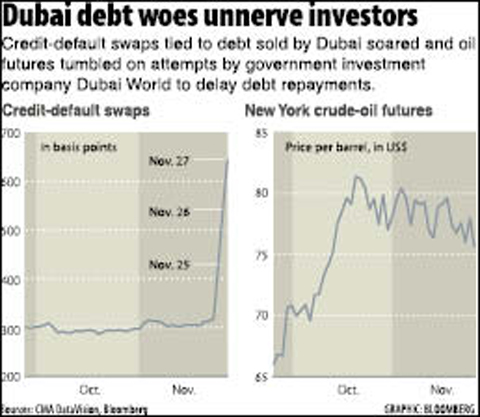

Many investors dumped shares in alarm on Friday, sending Asian and US markets plunging as fears of debt defaults sowed fresh concern for the world economy after Dubai’s shock request to suspend major loan repayments.

However, Europe’s leading stock indices rebounded, reversing earlier sharp losses that were driven by Dubai’s shock debt announcement.

“News from Dubai, according to which two local state-owned companies plan to reschedule their debt, lead to a firmer US dollar, which in turn had put gold massively under pressure,” Commerzbank analyst Carsten Fritsch said.

The development “put commodity prices across the board under great pressure,” Fritsch added.

PRECIOUS METALS: Gold hit a record high above US$1,195 an ounce for the first time, spurred by a purchase of IMF gold by Sri Lanka’s central bank, before pulling lower as the news from Dubai hit traders’ screens.

On the London Bullion Market, gold surged as high as US$1,195.13 on Thursday, extending its record-breaking run, before sliding as investors cashed in profits.

Gold won support in recent weeks from inflationary fears and increasing moves by central banks to diversify assets into gold.

The IMF said on Wednesday it had sold 10 tonnes of gold to Sri Lanka’s central bank for US$375 million as part of a restructuring of its financial resources.

The latest sale brought the total IMF gold sold to central banks to 212 tonnes. India bought 200 tonnes last month for US$6.7 billion and Mauritius bought 2 tonnes on Nov. 11 for US$71.7 million.

Prices had also smashed their way to record levels on Wednesday on a newspaper report that India was mulling the purchase of more IMF gold reserves.

By late Friday on the London Bullion Market, gold rallied to US$1,166.50 an ounce from US$1,140 a week earlier.

Silver dipped to US$17.98 an ounce from US$18.18.

On the London Platinum and Palladium Market, platinum slid to US$1,426 an ounce at the late fixing on Friday from US$1,435 the previous week.

Palladium eased to US$358 an ounce from US$360.

OIL: The price of oil slumped to a seven-week low point close to US$72 on Friday with investors spooked by a shock call from the Dubai government to suspend the debt of a key state company, analysts said.

New York’s main contract, light sweet crude for January delivery, reached US$72.39 — the lowest level since the start of last month.

“The sole reason for the oil price dump can be summed up in one word: Dubai,” said Tamas Varga, an analyst at PVM Oil Associates. “If the 2008 recession was started by banks overlending then the current debt problem in Dubai is a big warning sign that we’re not out of the woods yet.”

Oil prices began falling sharply on Thursday as news of Dubai’s request emerged.

By Friday on the New York Mercantile Exchange, light, sweet crude for delivery in January slid to US$74.90 compared with US$76.71 a week earlier.

On London’s InterContinental Exchange, Brent North Sea crude for January delivery sank to US$76.10 from US$77.03 a week earlier.

Nvidia Corp yesterday unveiled its new high-speed interconnect technology, NVLink Fusion, with Taiwanese application-specific IC (ASIC) designers Alchip Technologies Ltd (世芯) and MediaTek Inc (聯發科) among the first to adopt the technology to help build semi-custom artificial intelligence (AI) infrastructure for hyperscalers. Nvidia has opened its technology to outside users, as hyperscalers and cloud service providers are building their own cost-effective AI chips, or accelerators, used in AI servers by leveraging ASIC firms’ designing capabilities to reduce their dependence on Nvidia. Previously, NVLink technology was only available for Nvidia’s own AI platform. “NVLink Fusion opens Nvidia’s AI platform and rich ecosystem for

WARNING: From Jan. 1 last year to the end of last month, 89 Taiwanese have gone missing or been detained in China, the MAC said, urging people to carefully consider travel to China Lax enforcement had made virtually moot regulations banning civil servants from making unauthorized visits to China, the Control Yuan said yesterday. Several agencies allowed personnel to travel to China after they submitted explanations for the trip written using artificial intelligence or provided no reason at all, the Control Yuan said in a statement, following an investigation headed by Control Yuan member Lin Wen-cheng (林文程). The probe identified 318 civil servants who traveled to China without permission in the past 10 years, but the true number could be close to 1,000, the Control Yuan said. The public employees investigated were not engaged in national

CAUSE AND EFFECT: China’s policies prompted the US to increase its presence in the Indo-Pacific, and Beijing should consider if this outcome is in its best interests, Lai said China has been escalating its military and political pressure on Taiwan for many years, but should reflect on this strategy and think about what is really in its best interest, President William Lai (賴清德) said. Lai made the remark in a YouTube interview with Mindi World News that was broadcast on Saturday, ahead of the first anniversary of his presidential inauguration tomorrow. The US has clearly stated that China is its biggest challenge and threat, with US President Donald Trump and US Secretary of Defense Pete Hegseth repeatedly saying that the US should increase its forces in the Indo-Pacific region

ALL TOGETHER: Only by including Taiwan can the WHA fully exemplify its commitment to ‘One World for Health,’ the representative offices of eight nations in Taiwan said The representative offices in Taiwan of eight nations yesterday issued a joint statement reiterating their support for Taiwan’s meaningful engagement with the WHO and for Taipei’s participation as an observer at the World Health Assembly (WHA). The joint statement came as Taiwan has not received an invitation to this year’s WHA, which started yesterday and runs until Tuesday next week. This year’s meeting of the decisionmaking body of the WHO in Geneva, Switzerland, would be the ninth consecutive year Taiwan has been excluded. The eight offices, which reaffirmed their support for Taiwan, are the British Office Taipei, the Australian Office Taipei, the