Asian stocks posted their biggest weekly drop in almost a month as commodity prices fell and disappointing earnings damped confidence the global economy would sustain a recovery.

Mitsui & Co, a Japanese trading company that counts commodities as its biggest source of profit, slumped 6.1 percent. PetroChina Co (中石油) lost 8.4 percent in Hong Kong after quarterly earnings dropped. National Australia Bank Ltd retreated 3.4 percent in Sydney as the lender swung to a loss.

The MSCI Asia-Pacific Index lost 2.6 percent to 116.46 in the past week, its steepest dive since the five days ended Oct. 2, and retreated 1.3 percent last month. The gauge had risen for seven straight months to September on speculation government spending and looser monetary policies would accelerate the global rebound.

“Investors are wise to take some of their money off the table,” said Jonathan Ravelas, a strategist at Manila-based Banco de Oro Unibank Inc, which has about US$8 billion of assets.

“There is a lingering doubt in the market if the corporate earnings we are seeing are being driven by actual demand or is it all because of government stimulus spending,” he said.

The Asian stock index rose 1.55 percent on Friday, breaking a three-day losing streak, after separate government reports showed Japan’s jobless rate unexpectedly dropped and the US economy grew faster than economists had estimated.

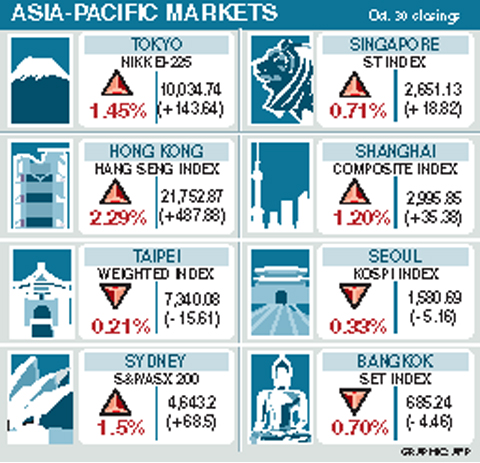

The Nikkei 225 Stock Average fell 2.4 percent in Tokyo, while Australia’s S&P/ASX 200 Index dropped 4.5 percent. Oil prices fell about 1 percent before Asian stock markets closed for the week, the first weekly drop this month.

The Hang Seng Index retreated 3.7 percent after the Hong Kong Monetary Authority raised deposit levels for luxury apartments last Friday.

Taiwanese share prices are expected to encounter further pressure next week with real estate firms in focus on worries that the central bank may reduce liquidity to prevent speculation, dealers said.

Hindered by high valuations, investors are likely to avoid large-cap electronic stocks amid fears that foreign institutional investors will cut their holdings, they said.

The market is expected to move down next week, testing the nearest support at around 7,250 points or even falling below the level, while any profit-taking may be capped at about 7,500, dealers said.

For the week to Friday, the weighted index fell 309.20 points, or 4.04 percent, to 7,340.08 after a 0.85 percent decline a week earlier.

Average daily turnover stood at NT$111.72 billion (US$3.44 billion), compared with NT$123.52 billion dollars a week ago.

“Investors, in particular foreign institutions, have embraced concerns that the market will suffer more corrections. Many are afraid that a dip below the key 7,000 point [level] is possible,” Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better

FLOOD RECOVERY: “Post-Typhoon Danas reconstruction special act” is expected to be approved on Thursday, the premier said, adding the flood control in affected areas would be prioritized About 200cm of rainfall fell in parts of southern Taiwan from Monday last week to 9am yesterday, the Central Weather Administration (CWA) said. Kaohsiung’s Taoyuan District (桃源) saw total rainfall of 2,205mm, while Pingtung County’s Sandimen Township (三地門) had 2,060.5mm and Tainan’s Nanhua District (南化) 1,833mm, according to CWA data. Meanwhile, Alishan (阿里山) in Chiayi County saw 1,688mm of accumulated rain and Yunlin County’s Caoling (草嶺) had 1,025mm. The Pingtung County Government said that 831 local residents have been pre-emptively evacuated from mountainous areas. A total of 576 are staying with relatives in low-lying areas, while the other 255 are in shelters. CWA forecaster