Despite the return of US economic growth, Wall Street was in no mood to celebrate as it braced for a Federal Reserve interest rate decision and crucial monthly labor data in the week ahead.

“Volatility is clearly on the increase as markets attempt to digest what appear to be contradictory signals on the economy,” Brian Bethune and Nigel Gault, economists at IHS Global Insight, said in a client note.

After a slight dip the previous week, the blue-chip Dow Jones Industrial Average slid 2.6 percent over the week to finish Friday at 9,712.73.

The tech-heavy NASDAQ composite index plunged a sharp 5.1 percent to 2,045.11 over the week, while the broad-market Standard & Poor’s index gave back 4 percent at 1,036.19.

The major indices on Friday remained stuck in negative territory from the opening bell, a day after the steep rally had snapped four consecutive sessions of losses.

The downtrend followed the market’s 14-month high in the middle of last month, when the blue-chip Dow topped the psychological barrier of 10,000 points.

Though the Dow ended last month with its eighth consecutive monthly gain, the other two indices posted their first monthly drop since February.

“We are getting increasingly the sentiment expressed by investors that there are a lot of gains that have been generated this year after a dreadful 2008,” said Craig Peckham, an analyst with Jefferies, a US securities and investment banking group.

“That led to a fair amount of performance protection. We have not seen a great deal of willingness after this big rally to commit more capital to stocks,” he said.

Many analysts have pointed out that the market appeared overextended after the Dow rose more than 50 percent since its early March lows.

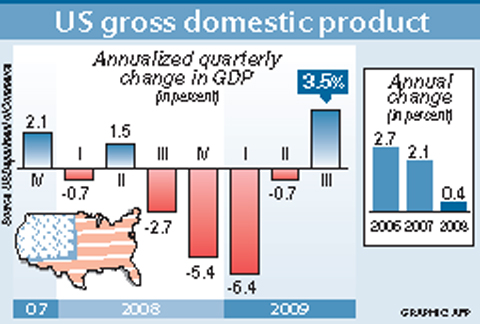

Spirits were only temporarily lifted after the US government reported on Thursday that GDP rose a stronger-than-expected 3.5 percent at an annual rate in the third quarter, after a year of contractions.

The news sparked the strongest single-session Dow rally since July, with blue-chips up 2.05 percent, but the euphoria quickly faded amid worries about the sustainability of GDP growth once emergency government support is withdrawn, despite a series of better-than-expected company earnings reports.

The Federal Reserve’s policymaking committee, the Federal Open Market Committee (FOMC), meets on Tuesday and Wednesday. The FOMC is widely expected to keep the Fed’s base interest rate target at an historic low of zero to 0.25 percent to help stimulate growth.

All eyes will be fixed on the FOMC rate decision to be announced on Wednesday and the accompanying statement, which will be pored over for signals on the direction of monetary policy as the economy emerges from recession that began in December 2007. Markets will also be focused on similar meetings of the European Central Bank and the Bank of England.

Bonds benefited from stock market weakness. The yield on the 10-year Treasury bond fell to 3.392 percent from 3.475 percent a week earlier and that on the 30-year bond dropped to 4.236 percent from 4.289 percent.

Bond yields and prices move in opposite directions.

Wall Street ended the week gripped by speculation that embattled CIT Group, a major lender to small and medium-sized businesses, would likely file for bankruptcy protection over the weekend.

Next week’s hefty macroeconomic calendar concludes with the closely watched monthly labor market report for last month.

The US unemployment rate rose to a 26-year high of 9.8 percent in September.

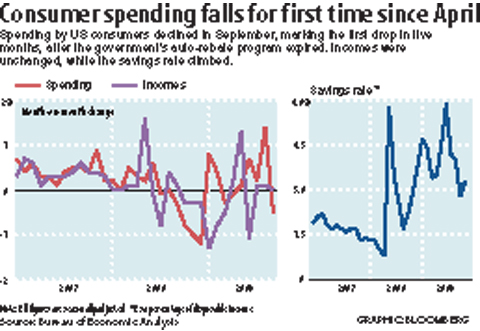

“There is a great deal of concern at this late stage of the year with where we are with jobs because the next two months are all about the consumer,” Marc Pado at Cantor Fitzgerald said. “Will they have the confidence to shop for the holidays?”

The calendar includes data on construction spending and the ISM manufacturing index tomorrow and industrial orders and the ISM services index on Tuesday.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better