British Prime Minister Gordon Brown joined his German and French counterparts on Thursday in calling for G20 leaders to impose tough global rules on bank bonuses, after holding out for days to weaken plans for caps on individual payments.

French sources said the prime minister delayed joining the Franco-German plan for three days this week until a proposal for an absolute cap on individual traders’ bonuses linked to company profits or revenue was watered down.

Brown sought the concessions before agreeing to sign a letter drafted by German Chancellor Angela Merkel and French President Nicolas Sarkozy, and eventually published yesterday. It had been due to be published with fanfare on Monday, according to French sources. Brown, determined to protect the interests of the City of London, insisted that the French plan for a bonus cap should only be examined, rather than endorsed, leaving a Labour prime minister taking a less radical stance than the two conservative European leaders.

Britain regards bonus caps linked to annual profits as impractical, but Brown’s office insists it is nevertheless backing unprecedented tough action in the face of evidence that banks are reverting to past excesses.

The letter, designed as a common EU negotiating position before the G20 summit in Pittsburgh this month, has been published ahead of a two-day meeting of G20 finance ministers in London yesterday. The meeting aimed to rebuild momentum before the summit amid fears that the political will to combat the recession and bankers’ excesses is ebbing away.

The letter proposes internationally binding rules that will tightly link City bonuses to performance and allow for a clawback if a firm subsequently underperforms. The rules, some already adopted by the Financial Services Authority, would be policed nationally, the letter proposes, but any large bank recognized as failing to apply the rules would face sanctions and might lose its mandate to trade.

The letter also proposes that risky speculation should be curtailed by increasing all banks’ capital requirements, something the G20 proposed in April, but on which there has been little subsequent progress. A deadline of March next year is proposed for the abolition of tax havens.

In the most contentious section, the leaders of the three largest European economies propose to “explore ways to limit total variable remuneration in a bank either to a proportion of total compensation or the banks’ revenues/profits.”

Sarkozy touted his diplomatic success in persuading Brown to sign up to the initiative. He said: “The letter that I am sending this afternoon about bonuses will have a little surprise in it. It will be signed by Mrs Merkel and myself; it will also be signed by Mr Gordon Brown. Even the English understand that we have to regulate, we have to limit and that there are unacceptable scandals.”

The letter claims Europe’s people are “deeply shocked at the revival of reprehensible practices,” despite taxpayers’ money having been mobilized to support the financial sector.

The UK treasury wants bonuses to be paid over five years with some of the money clawed back if there is a weakening in the bank’s subsequent performance. It also proposes that much of the bonus will come in non-cash payments such as stocks.

The G20 meeting this weekend will discuss when and how to coordinate an exit from the current round of fiscal stimulus. Germany, clearly emerging from recession and averse to inflation-inducing deficits, is pressing hardest for a swift international slowdown in public spending. But in a speech in Scotland, British finance minister Alistair Darling said that targeted public spending was still needed. He insisted worldwide recovery would occur next year, but said “the biggest risk lay in thinking the job’s done.”

Citing growth in equity markets, stabilization of the US housing market and growth in Asia, he said: “There are now visible signs that global confidence is returning. That is why I continue to believe that we will see growth in our economy resume around the turn of the year.”

But Britain has the backing of the Americans to argue that a premature end to government spending runs the risk of creating a double dip recession, a theme Brown will press in a speech tomorrow and on a visit to Berlin to see Merkel tomorrow.

Tim Geithner, the US treasury secretary, on the way to London on Thursday, insisted it was not yet time for governments to wind down their stimulus packages.

“You’re seeing the first signs of positive growth in this country and around the world. We’ve come a very long way but we have to be realistic, we’ve got a long way to go still,” he said.

George Osborne, Britain’s shadow chancellor, said the spending wind-down had to start immediately, arguing: “[The] British government is still in complete denial despite having the largest deficit of all.”

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

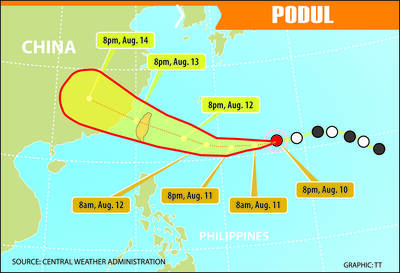

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an