The US Federal Reserve said on Wednesday the US economy was showing signs of leveling out two years after the onset of the deepest financial crisis in decades, and it moved to phase out one emergency measure.

The US central bank also kept its benchmark short-term interest rate steady near zero and said it would likely stay there for an extended period to guide the way to recovery.

The Fed made its clearest statement to date that it sees the recession nearing an end and that shattered financial markets are healing.

“Information since the Federal Open Market Committee met in June suggests economic activity is leveling out,” the Fed said, referring to its policy-setting panel. “Conditions in financial markets have improved in recent weeks.”

It is the first time since last August that the committee’s has not characterized the economy as contracting, weakening, or slowing.

Many peg the onset of the crisis to French bank BNP Paribas’ move in August 2007 to freeze funds because of problems with US subprime mortgages. In the months that followed, the US economy toppled into the most damaging financial crisis and painful recession in decades, and the economic malaise spread around the world.

“They see the worst with the economy is behind us but they don’t want to jump the gun and pull back quickly,” said Craig Thomas, a senior economist at PNC Financial Services in Pittsburgh.

The Fed cautioned that the economy remains fragile as employers continue to cut jobs and businesses trim investment.

The recession has seen tax revenues fall and spending rise, leading to a record federal budget deficit expected to top US$1.84 trillion in the current fiscal year.

Recent reports imply that the economy may be coming out of its swoon and that job losses, which have topped 6 million since the recession began in December 2007, may be moderating.

Still, the Fed renewed its warning that economic activity is likely to stay soft for “a time.”

Household spending, while stabilizing, is still weak as a result of the grim labor market and tight credit, it said.

To quell worries the Fed’s bloated balance sheet may sow the seeds of dangerous inflation once the recovery gains traction, Fed Chairman Ben Bernanke has taken pains to explain the Fed has tools to pull money out of the financial system to prevent price pressures from building.

Some analysts also worry the Fed’s easy money policies are setting the stage for another asset bubble, just as an extended period of low rates in the early part of the decade encouraged the housing boom that triggered the crisis.

The central bank cautiously moved to pull back some of that help for the economy on Wednesday, signaling it would slowly phase out a program to buy US$300 billion in longer-term Treasuries by the end of October.

“To promote a smooth transition in markets as these purchases of Treasury securities are completed, the committee has decided to gradually slow the pace of these transactions and anticipates that the full amount will be purchased by the end of October,” the Fed said.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

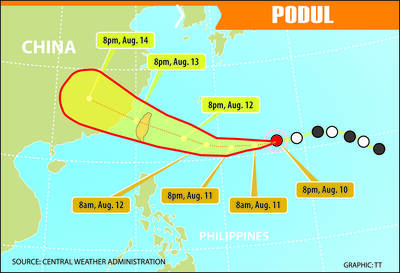

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an