Wall Street’s rally could persist next week as investors’ conviction grows that the US economy is on track for a recovery. But retailers’ results, CPI and other consumer data could cast a pall if shoppers fail to show signs of life.

The focus will also be on the US Federal Reserve, which will release a statement on Wednesday afternoon at the end of its two-day interest rate-setting meeting. The central bank is expected to hold rates near zero. So investors will look for signals of an exit strategy from its efforts to prop up the financial system.

The US government’s retail sales data for last month as well as quarterly scorecards from major retailers, including Wal-Mart Stores Inc, J.C. Penney and Macy’s, will give a snapshot of the industry and how consumer spending is faring in the recession. So far, consumers have tightened their belts and shopped mostly for just the bare necessities as worries about job security take precedence.

Encouraging US manufacturing and employment data this week pushed all three major stock indexes to nine and 10-month highs. Analysts said the enthusiasm from the better-than-expected reports should carry over into next week.

The broad Standard & Poor’s 500 is up 49.4 percent from the 12-year closing low of early March after vaulting above the key 1,000 level this week.

On Friday, the Dow and the S&P 500 ended at closing highs for this year. Earlier this week, on Tuesday, the NASDAQ popped back above the 2,000 mark to end at 2,011.31 — its closing high for this year.

For the year, the S&P 500 is up 11.9 percent. The Dow Jones industrial average is up 6.8 percent and the NASDAQ Composite Index up 26.8 percent this year.

“All the fundamentals for recovery are now aligned,” said Steve Hagenbuckle, managing principal of TerraCap Partners, based in New York. He expects stocks to climb next week.

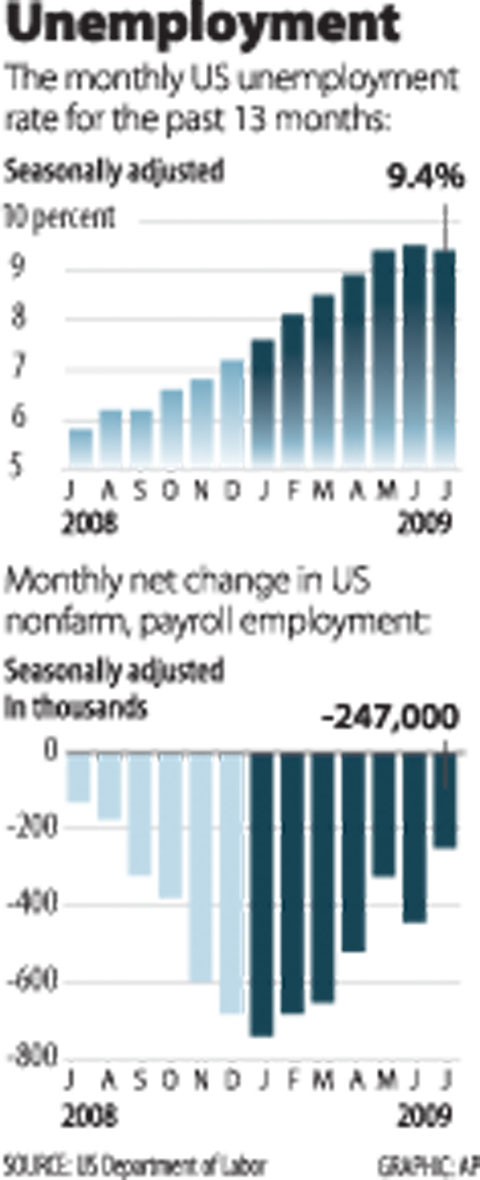

The non-farm payrolls report on Friday, in particular, boosted confidence after it showed the economy shed far fewer jobs than expected last month. While the job losses were still hefty — 247,000 jobs disappeared last month — the data provided the clearest signal yet that the economy was turning around.

Although this week’s data offered more evidence that some of the pillars of the economy are stabilizing at a better-than-expected rate, the recovery will still be a long process.

Analysts said the next point of focus for economic stabilization will be the consumer, whose spending accounts for about two-thirds of the US economy.

“We’re seeing the turning point right now,” said Kurt Karl, head of economic research and consulting for North America at Swiss Re in New York. “That should feed through to the consumer psyche and that will get things rolling, but it doesn’t look like a very fast-moving ball at this point.”

Wal-Mart, the discount king that’s also the largest retailer in terms of revenue, will be the biggest retailer reporting quarterly results next week. Investors will be keen to see if Wal-Mart benefits from shoppers looking for cheaper products. About about 140 million people walk through the doors of its 4,000 US stores each week.

Other data on tap in the week ahead include the international trade deficit for June on Wednesday, weekly initial jobless claims on Thursday, and the Fed’s report on Friday on industrial production and capacity utilization for last month.

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

Tsunami waves were possible in three areas of Kamchatka in Russia’s Far East, the Russian Ministry for Emergency Services said yesterday after a magnitude 7.0 earthquake hit the nearby Kuril Islands. “The expected wave heights are low, but you must still move away from the shore,” the ministry said on the Telegram messaging app, after the latest seismic activity in the area. However, the Pacific Tsunami Warning System in Hawaii said there was no tsunami warning after the quake. The Russian tsunami alert was later canceled. Overnight, the Krasheninnikov volcano in Kamchatka erupted for the first time in 600 years, Russia’s RIA

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an

South Korea yesterday said that it was removing loudspeakers used to blare K-pop and news reports to North Korea, as the new administration in Seoul tries to ease tensions with its bellicose neighbor. The nations, still technically at war, had already halted propaganda broadcasts along the demilitarized zone, Seoul’s military said in June after the election of South Korean President Lee Jae-myung. It said in June that Pyongyang stopped transmitting bizarre, unsettling noises along the border that had become a major nuisance for South Korean residents, a day after South Korea’s loudspeakers fell silent. “Starting today, the military has begun removing the loudspeakers,”