Asian stocks climbed for a third straight week as profits at companies from Sony Corp to Tata Motors Ltd exceeded estimates, lifting confidence the global economy is recovering.

Sony, the maker of Vaio computers and PlayStation 3 game consoles, jumped 12.9 percent in Tokyo as cost cuts led to a smaller-than-expected loss. Tata, the Indian automaker that owns Jaguar and Land Rover, rallied 13.1 percent following a gain in net income as production costs fell. PT Bumi Resources, Indonesia’s biggest coal producer, soared 37 percent after raising US$375 million to buy back shares and fund expansion.

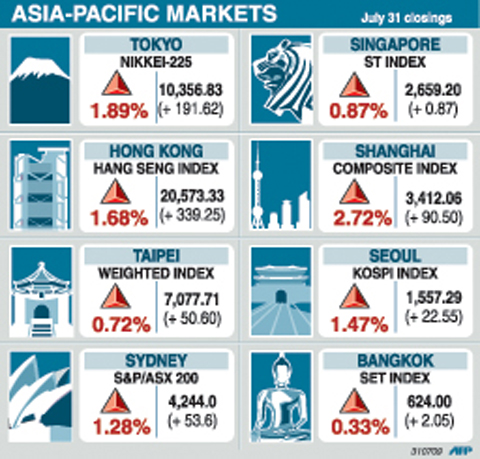

The MSCI Asia-Pacific Index advanced 3.6 percent this week to a 10-month high of 111.88. That capped an 8.4 percent climb last month and a fifth month of increases. Asian markets have rallied 58 percent since the MSCI benchmark dropped to a more-than five-year low on March 9.

“An earnings and economic recovery in the second half was rather like a wishful thought,” said Yoshinori Nagano, a senior strategist at Tokyo-based Daiwa Asset Management Co, which oversees the equivalent of US$90 billion. “That’s getting more likely now and increasing investors’ appetite for risk assets.”

Japan’s TOPIX index completed an 11-day winning streak, the longest since 1990, to rise 3.2 percent for the week.

Bumi helped Indonesia’s Jakarta Composite index rise 6.3 percent, the region’s strongest rally. China’s Shanghai Composite Index ended 1.2 percent higher, rebounding from its biggest one-day drop since November on Wednesday.

Sony climbed 13 percent to ¥2,675. The company reported a first-quarter net loss on Thursday that was less than half analysts’ estimates. Nomura Holdings Inc lifted its rating on the stock to “buy” from “neutral.”

“The April-June result was a surprise,” Nomura’s Eiichi Katayama wrote in a report. Cost cutting is progressing faster than expected and further reductions in purchasing expenses could lead to higher earnings forecasts, he said.

Taiwanese share prices are expected to trade in a narrow range as market sentiment turns cautious before high-tech firms release sales data for last month, dealers said on Friday.

Investors are watching the US closely for more economic data such as consumer prices in an attempt to get a clearer picture of the global economy, they said.

Wall Street is likely to continue dictating the direction of the local bourse as foreign institutional investors tend to follow US market movements, they added.

As it moves closer to 7,200, the market is expected to encounter profit taking pressure before moving below 7,000 with technical support at around 6,900, dealers said.

For the week, the weighted index rose 104.43 points, or 1.5 percent, to 7,077.71 after a 1.78 percent increase a week earlier. Average daily turnover stood at NT$146.38 billion (US$4.46 billion), compared with NT$143.43 billion a week ago.

While Taiwan Semiconductor Manufacturing Co (台積電) posted a jump in net profit for the second quarter on global demand, investors need more information to decide whether a broader recovery is on track, Grand Cathay Securities Corp (大華證券) analyst Mars Hsu said.

“TSMC represents just the upstream electronic sector. We want to know whether high-tech firms in the middle and downstream segments also fare well,” Hsu said.

Other regional markets on Friday:

JAKARTA: Up 1.09 percent. The Jakarta Composite Index gained 25.10 points to 2,323.23.

KUALA LUMPUR: Up 1.23 percent. The Kuala Lumpur Composite Index gained 14.24 points to 1,174.90.

MANILA: Up 1.21 percent.

The composite index rose 33.15 points to 2,798.33.

MUMBAI: Up 1.83 percent. The 30-share SENSEX rose 282.35 points to 15,670.31.

The index hit its highest level in more than a year.

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an

South Korea yesterday said that it was removing loudspeakers used to blare K-pop and news reports to North Korea, as the new administration in Seoul tries to ease tensions with its bellicose neighbor. The nations, still technically at war, had already halted propaganda broadcasts along the demilitarized zone, Seoul’s military said in June after the election of South Korean President Lee Jae-myung. It said in June that Pyongyang stopped transmitting bizarre, unsettling noises along the border that had become a major nuisance for South Korean residents, a day after South Korea’s loudspeakers fell silent. “Starting today, the military has begun removing the loudspeakers,”