Asian stocks advanced for a second week, sending the MSCI Asia-Pacific Index to its biggest gain since May on speculation a recovery in the global economy will boost corporate earnings.

James Hardie Industries NV, the biggest seller of home siding in the US, surged 24 percent in Sydney after reports showed US homes prices climbed. Chartered Semiconductor Manufacturing Ltd (特許)the world’s third-largest maker of customized chips, gained 6.7 percent in Singapore after reporting a lower-than-forecast loss in the second quarter. Jiangxi Copper Co (江西銅業), China’s largest producer of the metal, advanced 16 percent in Shanghai after copper prices advanced.

“The data is showing that things are past their worst,” said Tim Schroeders, who helps manage US$1 billion at Pengana Capital Ltd in Melbourne. “If we’ve seen a bottom, and things continue to improve in the second half, it just may be enough to buoy earnings.”

The MSCI Asia-Pacific Index climbed 4.5 percent to 108.00 this week, the biggest advance since the period ended May 8. The gauge has rallied 53 percent from a five-year low on March 9 amid optimism stimulus policies around the world will revive the global economy. The MSCI World Index gained 4.6 percent this week.

The MSCI Asia-Pacific Index has risen this week as US companies including Apple Inc reported better-than-expected results. South Korea said on Friday economic growth accelerated in the second quarter, while US data released on Thursday showed sales of existing homes rose 3.6 percent last month.

The data provided further evidence that the global economic recovery is on track. Last week, China and Singapore also reported economic growth accelerated in the second quarter.

Taiwanese shares are expected to move around the 7,000-point level in the week ahead, which will provide stiff resistance after recent significant gains, dealers said.

As the market repeatedly failed to leap the psychological hurdle this week, many investors have turned cautious in the near term, they said. Even if the market does pass 7,000, profit-taking is expected to immediately follow, while technical support may be seen at around 6,800.

With electronics firms, including Taiwan Semiconductor Manufacturing Co (台積電) reporting second-quarter results next week, the market is likely to be quiet before fresh hints on industrial fundamentals, they added.

For the week to July 24, the weighted index rose 122.29 points, or 1.78 percent, to 6,973.28 after a 1.2 percent increase a week earlier.

Average daily turnover stood at NT$143.43 billion (US$4.37 billion), compared with NT$128.01 billion a week ago.

“The market is running out of steam after a recent strong showing. Consolidation is expected to dictate market movements over the next few sessions,” Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said.

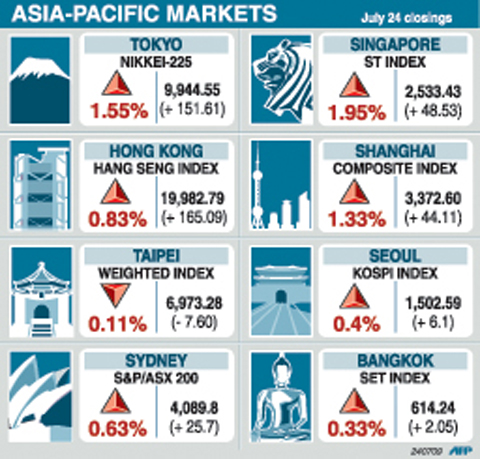

Other markets on Friday:

TOKYO: Up 1.55 percent. The Nikkei-225 climbed 151.61 points to 9,944.55. The index is at its highest in more than three weeks. Investors stopped short of pushing the Nikkei past 10,000 as concerns emerged that Wall Street may see profit-taking.

HONG KONG: Up 0.83 percent. The Hang Seng Index closed up 165.09 points at 19,982.79. The market had briefly gone as high as 20,063.39 soon after the opening due to hopes for the US economy.

SYDNEY: Up 0.63 percent. The S&P/ASX 200 added 25.7 points to reach 4,089.8.

SHANGHAI: Up 1.33 percent. The Shanghai Composite Index, which covers A and B shares, was up 44.11 points to 3,372.60. The key index ended at the highest level since June 3 last year.

MUMBAI: Up 0.97 percent. The 30-share SENSEX rose 147.92 points to 15,378.96.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better