Asian stocks fell this week, the third weekly decline in four, as concern the global recovery will falter caused commodity prices to drop and the yen to strengthen.

BHP Billiton Ltd, the world’s biggest mining company, dropped for a fifth week after copper and oil prices slumped. Honda Motor Co, which makes 51 percent of its revenue in North America, tumbled 10 percent on concern a stronger yen will hurt the value of its overseas revenue. STX Pan Ocean Co Ltd, South Korea’s biggest bulk carrier, sank 11 percent as shipping rates declined.

The MSCI Asia-Pacific Index lost 2.1 percent in the five days to Friday, adding to last week’s 0.8 percent decline. That pared the measure’s record 28 percent in the three months ended June 30 on optimism the global economy is stabilizing.

“The market is finally returning its focus to the present, rather than looking for an eventual recovery,” said Masaru Hamasaki, a Tokyo-based strategist at Toyota Asset Management Co, which oversees US$14 billion. “The economic rebound won’t be rapid. Share prices are beginning to reflect that.”

The Asian stock benchmark, which plunged by a record last year as the global economy slipped into recession, has now climbed 43 percent since reaching a more than five-year low on March 9. Stocks on the gauge now trade at 22.8 times reported earnings, compared with 15 times at the market trough in March and 14.9 for the US’ Standard & Poor’s 500 Index.

Taiwanese share prices are expected to consolidate next week as investors remain sidelined, looking for cues from the quarterly results of firms on Wall Street, dealers said on Friday.

Investors turned hesitant after a mixed performance dominated US markets, which failed to give a clear indication for future movements, they said.

Falling oil prices have prompted investors to take a cautious attitude toward a global economic recovery as demand remains weak, they added.

As a recent strong showing has pushed the index to move closer to the 6,800-6,900 range, stiff resistance may emerge next week, while technical support is expected at around 6,600 points, dealers said.

For the week to Friday, the TAIEX rose 104.46 points or 1.57 percent to 6,769.86 after a 3.12 percent increase a week earlier.

Average daily turnover stood at NT$119.37 billion (US$3.62 billion), compared with NT$107.42 billion the previous week.

“Institutional investors have started to take profit and run. If the market tests the 6,800-6,900 range, it could be another good chance for institutional investors to cut more holdings,” Concord Securities (康和證券) analyst Allen Lin said.

Before US stock heavyweights report second-quarter earnings later this month, investors are reluctant to trade on a lack of fresh hints, Lin said.

“I expect the market will be locked in see-saw trading with any gains to be immediately offset by profit-taking,” Lin said.

Other markets on Friday:

TOKYO: Flat. The Nikkei-225 dropped 3.78 points, or 0.04 percent, to 9,287.28 from Thursday.

HONG KONG: Down 0.46 percent. The Hang Seng Index ended down 82.17 points at 17,708.42.

SYDNEY: Up 0.82 percent. The S&P/ASX 200 was 30.8 points higher at 3,794.1.

SHANGHAI: Down 0.29 percent. The Shanghai Composite Index, which covers A and B shares, was down 9.10 points to 3,113.93.

SEOUL: Down 0.15 percent. The KOSPI lost 2.27 points to 1,428.62.

MUMBAI: Down 1.84 percent. The 30-share SENSEX fell 253.24 points to 13,504.22. Investors unwound positions ahead of the weekend, despite better-than-expected earnings from IT giant Infosys and higher industrial output, dealers said.

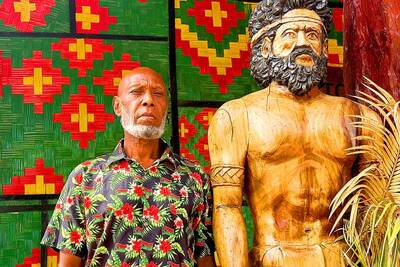

The paramount chief of a volcanic island in Vanuatu yesterday said that he was “very impressed” by a UN court’s declaration that countries must tackle climate change. Vanuatu spearheaded the legal case at the International Court of Justice in The Hague, Netherlands, which on Wednesday ruled that countries have a duty to protect against the threat of a warming planet. “I’m very impressed,” George Bumseng, the top chief of the Pacific archipelago’s island of Ambrym, told reporters in the capital, Port Vila. “We have been waiting for this decision for a long time because we have been victims of this climate change for

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

MASSIVE LOSS: If the next recall votes also fail, it would signal that the administration of President William Lai would continue to face strong resistance within the legislature The results of recall votes yesterday dealt a blow to the Democratic Progressive Party’s (DPP) efforts to overturn the opposition-controlled legislature, as all 24 Chinese Nationalist Party (KMT) lawmakers survived the recall bids. Backed by President William Lai’s (賴清德) DPP, civic groups led the recall drive, seeking to remove 31 out of 39 KMT lawmakers from the 113-seat legislature, in which the KMT and the Taiwan People’s Party (TPP) together hold a majority with 62 seats, while the DPP holds 51 seats. The scale of the recall elections was unprecedented, with another seven KMT lawmakers facing similar votes on Aug. 23. For a

All 24 lawmakers of the main opposition Chinese Nationalists Party (KMT) on Saturday survived historical nationwide recall elections, ensuring that the KMT along with Taiwan People’s Party (TPP) lawmakers will maintain opposition control of the legislature. Recall votes against all 24 KMT lawmakers as well as Hsinchu Mayor Ann Kao (高虹安) and KMT legislative caucus whip Fu Kun-chi (傅崐萁) failed to pass, according to Central Election Commission (CEC) figures. In only six of the 24 recall votes did the ballots cast in favor of the recall even meet the threshold of 25 percent of eligible voters needed for the recall to pass,