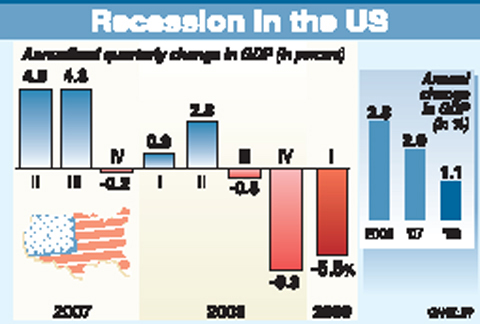

Wall Street limped to the end of what appears to be a positive quarter in the past week amid doubts about whether the economy can rebound and the market can keep upward momentum in the second half of the year.

With the year’s midpoint coming up, a key for stocks in the holiday-shortened week ahead will be Thursday’s report on US unemployment and payrolls, which comes a day early with US markets closed for Friday’s Independence Day celebration.

The report is seen as one of the best indicators of economic momentum and could provide clues about the timing and strength of a rebound from the worst recession in decades.

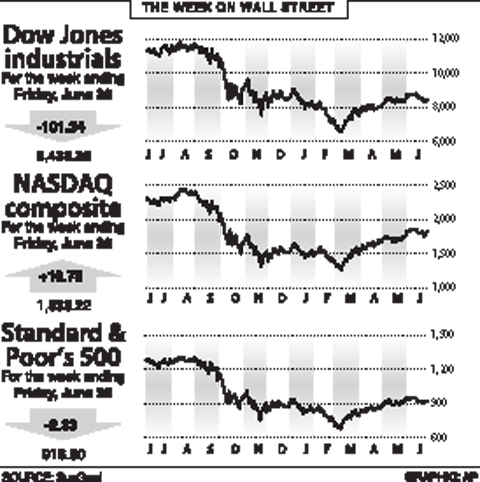

The blue-chip Dow Jones Industrial Average dropped 1.2 percent to 8,438.39 in the week to Friday, a second weekly drop after a four-week winning streak.

The technology-heavy NASDAQ rose 0.59 percent on the week to 1,838.22 while the broad-market Standard & Poor’s 500 index declined 0.25 percent to 918.90.

Many say that despite the lackluster week, the market is sensing that the US and global economies will soon come out of their deep slump, yet some of that has already been reflected in the 40 percent jump in the broad indexes since March.

Mark Luschini, chief investment strategist at Janney Montgomery Scott, said there was some trepidation about how far the rally can run, with the S&P index still up some 35 percent from its March lows.

“The dilemma amongst market participants at the moment relates to whether the weakness was merely the stock market taking a well-deserved breather or did it warn of something more sinister,” he said.

“On one hand, the rally germinated from improving news on the economic front and confidence returning to the financial markets ... On the other hand, the ‘green shoots’ metaphor is a tad worn at this juncture and the market’s budding skepticism is based on the need to realize actual good news rather than advancing on news that is just comparatively less bad,” Luschini said.

The US Federal Reserve calmed some nerves over the past week as it made no change in its near-zero interest rate policy and signaled it would keep its stimulus efforts on track without pulling back or expanding the effort.

The announced extension of key lending programs put into place to counter the credit crisis appeared to generate confidence.

“By extending its lending facilities into next year, the Federal Reserve sent a strong message to financial markets on Thursday that interest rates will remain unchanged for the foreseeable future,” Ryan Sweet at Moody’s Economy.com said.

Nariman Behravesh, chief economist at IHS Global Insight, said there was growing evidence the worldwide slump is ending.

“The light at the end of the tunnel is shining a little brighter,” he said. “The world economy will begin its recovery in the second half of 2009 as the global inventory correction winds down. The timing and speed of regional recoveries will vary, with Asia leading, the United States coincident, and much of Europe lagging behind.”

But analysts say Thursday’s payrolls report could be a key for the economy and the stock market.

Bonds rose as inflation fears ebbed. The yield on the 10-year Treasury bond dropped to 3.506 percent from 3.789 percent a week earlier and that on the 30-year bond declined to 4.303 percent from 4.522 percent. Bond yields and prices move in opposite directions.

The coming week also features data on monthly US auto sales, consumer confidence and a purchasing managers’ index on the manufacturing sector.

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

Tsunami waves were possible in three areas of Kamchatka in Russia’s Far East, the Russian Ministry for Emergency Services said yesterday after a magnitude 7.0 earthquake hit the nearby Kuril Islands. “The expected wave heights are low, but you must still move away from the shore,” the ministry said on the Telegram messaging app, after the latest seismic activity in the area. However, the Pacific Tsunami Warning System in Hawaii said there was no tsunami warning after the quake. The Russian tsunami alert was later canceled. Overnight, the Krasheninnikov volcano in Kamchatka erupted for the first time in 600 years, Russia’s RIA

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an

South Korea yesterday said that it was removing loudspeakers used to blare K-pop and news reports to North Korea, as the new administration in Seoul tries to ease tensions with its bellicose neighbor. The nations, still technically at war, had already halted propaganda broadcasts along the demilitarized zone, Seoul’s military said in June after the election of South Korean President Lee Jae-myung. It said in June that Pyongyang stopped transmitting bizarre, unsettling noises along the border that had become a major nuisance for South Korean residents, a day after South Korea’s loudspeakers fell silent. “Starting today, the military has begun removing the loudspeakers,”