A jittery bond market and economic “green shoots” notwithstanding, the Federal Reserve is likely to reaffirm a commitment to pump money into the economy to battle recession, analysts say.

The Federal Open Market Committee (FOMC) led by Fed chairman Ben Bernanke is expected at a two-day meeting opening tomorrow to maintain its near-zero base interest rate along with a variety of programs providing easy liquidity to the financial system.

Scott Brown, chief economist at Raymond James & Associates, said any shift in policy or emphasis by the Fed could rattle financial markets and imperil a fragile recovery taking root.

“I don’t think the Fed members want to do or say too much,” Brown said. “They don’t want to rock the boat.”

Brown said that at some point the Fed will need to lay the groundwork for reducing its unprecedented stimulus, to avert a surge in inflation.

“You are looking at low inflation and a lot of lack in the economy,” he said. “The Fed is committed to keeping the lending rate very low for a long time.”

Cary Leahey, senior economist at Decision Economics, said the Fed may take the unusual step of signaling a specific time frame for maintaining its easy money policy, to counter the bond market, which has been pushing up rates in anticipation of a potential hike this year.

“The FOMC must be perturbed that some people are pricing in a Fed tightening this year, which seems almost ludicrous given how close we came to the brink of Armageddon,” Leahey said. “We’re not even sure the economy has hit bottom.”

Leahey said that by tradition, “the Fed doesn’t tighten credit until the unemployment rate peaks, and that won’t happen until 2010, so I think the bond market is way ahead of the Fed.”

The Fed has already embarked on a massive program to purchase up to US$1.2 trillion in government and agency debt in an effort to bring down a variety of interest rates it does not control.

Bernanke calls the effort “credit easing” while others call it “quantitative easing.” It is aimed at lifting the economy out of its worst crisis in decades.

But a sharp rise in bond yields, which translates into higher lending rates for mortgages, has raised fears that the recovery could falter despite Fed efforts.

The yield on 10-year bonds has jumped as high as 4 percent before settling back a bit, and this has lifted mortgage rates from recent record lows.

Leahey said this rise “is very much a positive development” because it reflects a normalization of the financial system, which suffered a near-meltdown after last year’s collapse of investment giant Lehman Brothers.

He also said that if the economy is getting back on track, the housing market will be able to absorb a modest rise in interest rates.

This argues against any move by the Fed to boost rates to control inflation and appease the bond market, Leahey said.

“If they hike rates in the next six months and the economy falls back, a certain Fed chairman will not get reappointed and a certain president will not get reelected, and neither one wants that to happen,” he said.

Some argue the Fed will want to acknowledge the “green shoots” of recovery to help boost confidence.

“There is increasing evidence that the recession is ending and that a return to positive growth is imminent,” Barclays Capital economist Dean Maki said. “Given this backdrop, the Fed is likely to sound more upbeat on growth prospects than its April statement that ‘the pace of contraction appears to be somewhat slower.’”

But he said that the Fed “will likely want to balance this upbeat view with some rhetoric emphasizing headwinds still facing the economy, and it will likely aim to convince investors that tightening is not imminent.”

Robert Brusca of FAO Economics said he sees signs of a “V-shaped” recovery and added: “If I’m right it puts the Fed in a very difficult position.”

“If the economy is starting to recover the Fed may need to raise interest rates on the early side, to reassure the bond market,” he said. “But it doesn’t want to raise rates enough to spook the bond market and stop the recovery in its tracks.”

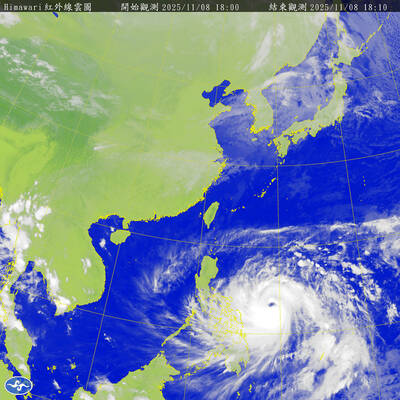

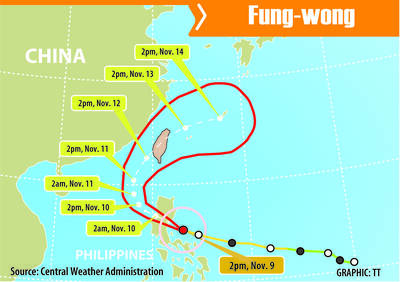

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city