The European Central Bank (ECB) will do its utmost to restore confidence in the economy, president Jean-Claude Trichet said yesterday, hinting at further emergency measures to spur lending.

“Central banks must do all they can to restore, preserve and foster confidence among households and corporations in order to pave the way for sustainable prosperity,” he said in a speech to an economic think-tank here.

But he said the ECB must tread a fine line between doing too little or too much.

“We must maintain the appropriate balance between the need to take action that is commensurate with the gravity of today’s situation and the equally essential obligation to return to a path that is sustainable in the medium to long term,” he said.

Trichet indicated that the bank might unveil unorthodox monetary policy measures at next month’s meeting of the governing council.

“In our economy banks play such a dominant role that non-standard measures need to be implemented first and foremost through the intervention, and with the active participation, of banks,” he said.

The ECB has so far resisted pressure from financial markets for so-called quantitative easing measures to pump cash into the financial system, like those adopted by the US Federal Reserve, the Bank of England and the Bank of Japan.

The ECB earlier this month lowered its key lending rate by a quarter point to a record low 1.25 percent and Trichet said at the time that a further “measured” reduction in borrowing costs was possible.

Trichet reiterated his view that this year would be “a very difficult year” but that there should be a recovery next year.

In Japan, the central bank cut its economic evaluation in seven of the country’s nine regions, saying companies and consumers were spending less as the recession deepened.

The Bank of Japan said the regional economy has been “deteriorating significantly,” lowering its overall assessment in a quarterly report released in Tokyo yesterday.

Bank of Japan Governor Masaaki Shirakawa said that weaker outlays by businesses and households would prolong the recession even as exports and production start to improve.

Shirakawa told the branch managers that companies were less willing to spend because profits were falling more steeply than before. Consumer spending was weakening because households were facing declining wages and job cuts, he said.

Global financial markets remain under “severe strain” and Japanese companies both large and small are struggling to obtain funding, the governor said.

Some indications of a recovery are emerging. Consumer confidence rose to a five-month high last month, Japan’s Cabinet Office said yesterday, as the government began handing out cash to households as part of stimulus measures and the Nikkei 225 Stock Average rebounded from a 26-year low.

The US Federal Reserve said in its Beige Book this week that the US contraction eased across several of the biggest regions last month, with some industries “stabilizing at a low level.”

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

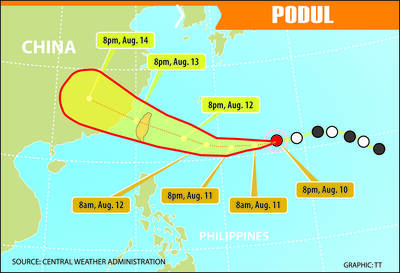

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an