US stocks have staged five consecutive weeks of gains, but analysts asked investors to brace for a tough ride as earnings results of key recession-battered companies emerge in the coming weeks.

Shares ended the holiday-shortened week on a high note with the blue chip Dow index posting a stunning three-digit gain on Thursday on the back of projections by banking giant Wells Fargo of a record first-quarter profit.

Friday was a market holiday.

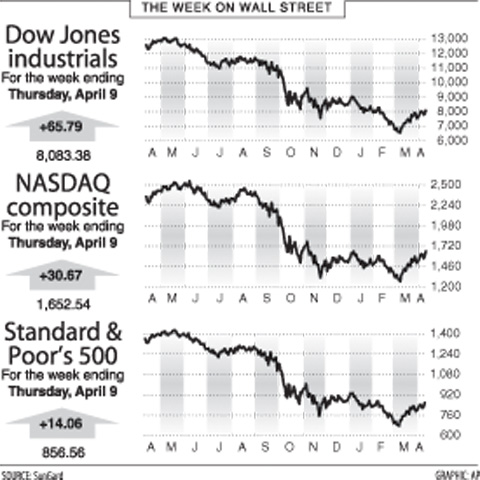

The Dow Jones Industrial Average rose 0.82 percent to finish the week at 8,083.38, its highest closing level in two months.

The Dow’s fifth weekly gain is the best performance since fall 2007.

The broad Standard & Poor’s 500 index rose 1.67 percent to 856.56 over the week, while the tech-heavy NASDAQ was up 1.89 percent to 1,652.54.

The corporate earnings reporting season for the first quarter began on Tuesday with US aluminum giant Alcoa declaring a hefty US$497 million net loss on plunging prices for the key metal amid the global economic downturn.

Its second consecutive quarterly loss was higher than expected by most analysts and underscored the depth of the 16-month-old US recession flooding listed companies with red ink.

Following Alcoa’s result, the markets turned cautious on light trading ahead of financial results of other key companies, including financial institutions such as Citigroup, JPMorgan Chase and Goldman Sachs the coming week.

But Wells Fargo, scheduled to announce its results on April 22, made a surprise announcement on Thursday that it expected a “record” net income of some US$3 billion for the first quarter, trouncing Wall Street estimates and sparking a rally before market closed the week.

The US budget deficit accelerated last month to hit a record nearly US$1 trillion just halfway through the current fiscal year, as the US government moved to bail out troubled institutions, government data showed on Friday.

The deficit for the first six months of the fiscal year which began on Oct. 1 was US$956.8 billion, according to the Treasury’s monthly statement of receipts and outlays.

Receipts during the six-month period to last month were US$989.83 billion, while outlays amounted to nearly US$1.95 trillion, the data showed.

Last month’s US deficit of US$192.27 billion was higher than the US$160 billion expected by most analysts, coming on the back of money poured by US President Barack Obama’s administration to rescue financial institutions.

All six months of the fiscal year so far recorded red ink. The last time the US plunged into a consecutive six month deficit was during the October 2003 to March 2004 period, officials said.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better