The Wall Street resurgence of the past weeks has pundits pondering: Has a new bull market begun after 17 months of horrific losses? Or is this just another heartbreaking “bear market” rally?

Bulls and bears both claim evidence in their favor after three consecutive weekly gains for the main US indexes.

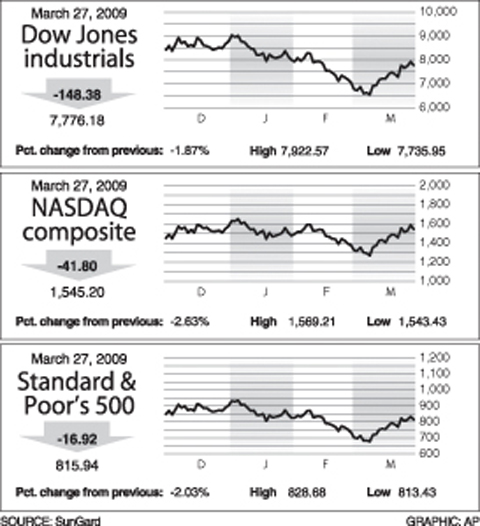

Over the week to Friday, the Dow Jones Industrial Average lifted 6.84 percent to 7,776.18 and the Standard & Poor’s 500 index rallied 6.17 percent to 815.94.

The technology-heavy NASDAQ posted a weekly gain of 6.03 percent to end on Friday at 1,545.20.

The major indexes have rallied at least 20 percent from lows hit early this month, giving rise to claims that the bear is dead and a new bull market has arrived.

Robert Brusca at FAO Economics called the 20 percent jump “a technical signal to kill the bear market.”

Even with hefty gains, the Dow index of blue chips and broad-market S&P 500 index remain down more than 40 percent from all-time highs hit in October 2007. Hence, the bear is still alive, by these measures.

Bob Dickey at RBC Wealth Management said it is too soon to call a new bull market despite the snapback.

“In olden times, these moves may have qualified as a new bull market, but in this day of much higher volatility, it will take more of a gain to reverse the bear trend, which, according to our measures, would take a move above 8,500 on the Dow to become official,” he said.

“That would mean waiting for a move of over 30 percent from the lows in order to create more bullish confidence,” he said.

Still, he said the horrendous selloffs may have led to “major market lows” early this month, “which makes us lean heavily in favor of a more meaningful uptrend than the bounce we have had so far.”

In the coming week, the market must grapple with grim economic realities: US auto sales this month are expected to show more hefty declines and Friday’s payrolls report is likely to reflect staggering new job losses, making it harder to sustain a recovery.

But many analysts say there are hopeful signs that the US economy may be stabilizing after a long and deep recession, which could mean the stock market will find its footing as well.

“Despite the doom and gloom outlook by some economists and the pessimistic feel on Main Street, recent economic data has shown signs of improvement,” said Kathy Lien at Global Forex Trading, citing upturns in consumer spending and several indicators on manufacturing.

“Although this is partially due to the overly pessimistic forecasts, the data also suggests that the economy could be stabilizing,” she said.

Larry Kantor at Barclays Capital said markets were ready to look forward to rosier times.

“We believe that the latest rally will have stronger legs, and thus marks an inflection point,” he said.

Kantor said the aggressive efforts by policymakers around the world and a massive decline in inventories sets the stage for better economic output.

“Reflecting all of this, we are now recommending that investors become more aggressive and take risk across a broader range of assets,” he said.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better