Where’s the bottom? Bruised investors on Wall Street keep asking the question after another brutal week of losses. But a growing sense of fear and gloom make it risky to bet that the worst is over for the shrinking US economy and stock market.

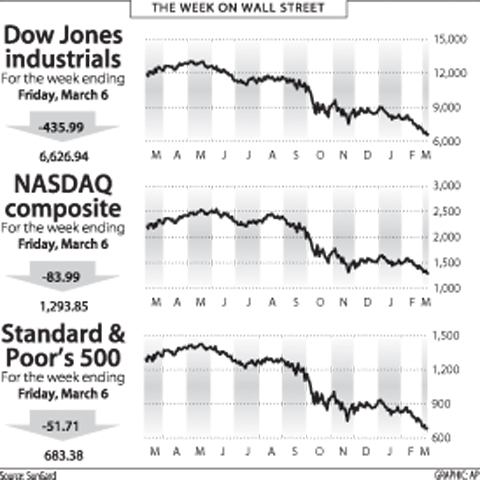

The relentless bear market savaged the Dow Jones Industrial Average of blue-chips, which fell 6.17 percent on the week to 6,626.94, just above a 12-year low.

The broad-market Standard & Poor’s 500 sank to its level since 1996 over the past week, and lost 7.03 percent for the week to 683.38.

The technology-heavy NASDAQ composite fell 6.1 percent over the week to 1,293.85.

The Dow and S&P have already plunged 24 percent so far this year and the NASDAQ nearly 18 percent.

The horrific bear market has been reinforced by fears of an ever-deepening worldwide slump that has hit small and large firms alike, forcing massive job cuts and denting consumer spending as part of a downward economic spiral.

Some say the market, down over 50 percent from 2007 highs, has priced in a deep recession but may have to fall further if the slump becomes a depression — which could erase stock values by 90 percent if it follows the pattern of the 1930s.

“Investors should not rush in,” said Richard Berner, economist at Morgan Stanley. “Now that equities stand at 14-year lows and 55 percent below their October 2007 highs, they do reflect a lot of bad news — but maybe not quite enough. The further slide in production that we expect suggests that the near-term risks for earnings point down, and a rapid turnaround seems unlikely.”

The yield on the 10-year US Treasury bond fell back to 2.828 percent from 3.041 percent a week earlier and that on the 30-year bond eased to 3.503 percent from 3.722 percent.

FORCED LABOR: A US court listed three Taiwanese and nine firms based in Taiwan in its indictment, with eight of the companies registered at the same address Nine companies registered in Taiwan, as well as three Taiwanese, on Tuesday were named by the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) as Specially Designated Nationals (SDNs) as a result of a US federal court indictment. The indictment unsealed at the federal court in Brooklyn, New York, said that Chen Zhi (陳志), a dual Cambodian-British national, is being indicted for fraud conspiracy, money laundering and overseeing Prince Holding Group’s forced-labor scam camps in Cambodia. At its peak, the company allegedly made US$30 million per day, court documents showed. The US government has seized Chen’s noncustodial wallet, which contains

SUPPLY CHAIN: Taiwan’s advantages in the drone industry include rapid production capacity that is independent of Chinese-made parts, the economic ministry said The Executive Yuan yesterday approved plans to invest NT$44.2 billion (US$1.44 billion) into domestic production of uncrewed aerial vehicles over the next six years, bringing Taiwan’s output value to more than NT$40 billion by 2030 and making the nation Asia’s democratic hub for the drone supply chain. The proposed budget has NT$33.8 billion in new allocations and NT$10.43 billion in existing funds, the Ministry of Economic Affairs said. Under the new development program, the public sector would purchase nearly 100,000 drones, of which 50,898 would be for civil and government use, while 48,750 would be for national defense, it said. The Ministry of

SENATE RECOMMENDATION: The National Defense Authorization Act encourages the US secretary of defense to invite Taiwan’s navy to participate in the exercises in Hawaii The US Senate on Thursday last week passed the National Defense Authorization Act (NDAA) for Fiscal Year 2026, which strongly encourages the US secretary of defense to invite Taiwan’s naval forces to participate in the Rim of the Pacific (RIMPAC) exercise, as well as allocating military aid of US$1 billion for Taiwan. The bill, which authorizes appropriations for the military activities of the US Department of Defense, military construction and other purposes, passed with 77 votes in support and 20 against. While the NDAA authorizes about US$925 billion of defense spending, the Central News Agency yesterday reported that an aide of US

NINE-IN-ONE ELECTIONS: Prosecutors’ offices recorded 115 cases of alleged foreign interference in the presidential election campaign from August 2023 to Dec. 13 last year The National Security Bureau (NSB) yesterday said that it has begun planning early to counter Chinese interference in next year’s nine-in-one elections as its intelligence shows that Beijing might intensify its tactics, while warning of continued efforts to infiltrate the government and military. The bureau submitted a report to the Legislative Yuan ahead of a meeting today of the Foreign Affairs and National Defense Committee. “We will research situations in different localities and keep track of abnormalities to ensure that next year’s elections proceed without disruption,” the bureau said. Although the project is generally launched during election years, reports of alleged Chinese interference