The dollar ended mixed on Friday in volatile trading as the markets tried to assess the impact of a grim report showing more massive US job losses, suggesting a long road to economic recovery.

The euro rose to US$1.2652 at 10pm GMT after US$1.2538 late on Thursday in New York. The euro jumped to US$1.2738 just after the announcement of the US jobs figures.

The US dollar edged up to ¥98.27 after ¥98.03 on Thursday.

The US government said the US economy shed 651,000 jobs last month, in line with most forecasts but also underscoring the dire state of the economy as companies axe jobs to cope with an intensifying slump.

The US unemployment rate rose from 7.6 percent in January to 8.1 last month, the highest since December 1983.

Although traders said it was a calamitous report that could signal a delayed economic recovery, some said the market was reassured that it failed to live up to the so-called “whisper number” of 1 million job losses.

“A look at the intraday price action in both the equity and currency markets reveal that traders reacted positively and not negatively to the nonfarm payrolls report,” Kathy Lien at Global Forex Trading said.

Investors on Friday welcomed the Bank of England’s (BOE) announcement that it would become the first European central bank to use “quantitative easing” to boost the money supply.

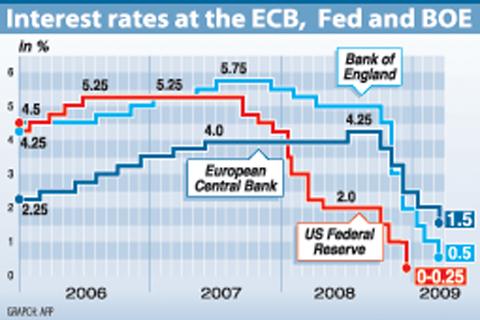

The BOE on Thursday cut its main rate by half a point to 0.50 percent, the lowest level in its 315-year history, and said it would pump £75 billion (US$106 billion) of newly created money into the financial system to combat a credit crunch.

The European Central Bank meanwhile slashed rates by 50 basis points to 1.5 percent and drastically revised its forecasts, predicting the eurozone economy will shrink 2.7 percent this year.

In late New York trading, the US dollar bought 1.1579 Swiss francs after SF1.1708 on Thursday.

The pound was at US$1.4076 from US$1.4113.

South Korea’s won and the Indian rupee led declines in Asian currencies this week on speculation investors will stay away from emerging-market assets as the global financial slump deepens.

The won posted its fifth weekly drop, approaching an 11-year low, on concern that global market turmoil will make it difficult for banks to raise funds needed to service overseas debt.

Malaysia’s ringgit slid for the fourth week as a government report showed exports tumbled the most in 15 years.

The won fell 1 percent this week to 1,550 per dollar at the 3pm local close, according to Seoul Money Brokerage Services Ltd. The currency touched 1,597, the lowest since 1998.

The rupee declined 1.1 percent to 51.7025 in Mumbai on Friday. The rupiah dropped 0.9 percent this week and traded at 12,090 in Jakarta, according to data compiled by Bloomberg.

The New Taiwan dollar gained 0.5 percent this week to NT$34.780 against the US currency, according to Taipei Forex Inc.

“Political risk declined in Taiwan, as it seems China is really intent on improving the relationship,” said Dariusz Kowalczyk, chief investment strategist at SJS Markets Ltd in Hong Kong. “There’s some relief in the currency market.”

The NT dollar could fall to NT$36 at the end of this month, Kowalczyk said.

The Philippine peso rebounded to 48.52 a dollar on Friday, after touching 49.26 on March 3 in Manila, the lowest level since Dec. 9, according to Tullett Prebon PLC.

Elsewhere, Malaysia’s ringgit ringgit dropped 0.4 percent this week to 3.7175 a dollar, the Thai baht traded at 36.07 versus 36.15 last week and Vietnam’s dong was little changed at 17,481.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better