Citigroup Inc’s bid to boost its equity capital could result in the US government raising its stake in the troubled bank this week to as much as 40 percent, a person familiar with the talks said on Wednesday.

Citigroup already has received US$45 billion in US bailout money made up primarily of debt-like preferred shares, plus federal guarantees to cover losses on some US$300 billion in risky investments. It also has transferred control of its Smith Barney brokerage to Morgan Stanley in return for US$2.7 billion, and has prepared itself for more asset sales by splitting in two — effectively undoing the merger that created Citigroup a decade ago.

But the New York-based bank has been involved in talks with regulators over ways the government could help strengthen the bank still further. A deal could be hammered out within days, the person said, asking not to be named because the discussions are still ongoing.

While the exact details of the talks aren’t known, they could center on the terms of converting the government’s US$45 billion in preferred shares into common equity. The preferred shares carry a high interest rate, requiring a yearly payout of billions in coupon payments. But if converted to common stock, Citi’s annual dividend payout would be minimal since it’s been cut to just US$0.04 per share.

The price of that conversion would have to be negotiated, but for example, converting part of the preferred shares at a strike price near to Wednesday’s closing stock price of US$2.52 would add billions of new shares, taking the government’s stake to 40 percent of the enlarged equity share count. While that would dilute current shareholders’ investments, a wider equity base could calm investors since there would be more reserves in place to guard against further losses as the economy sours.

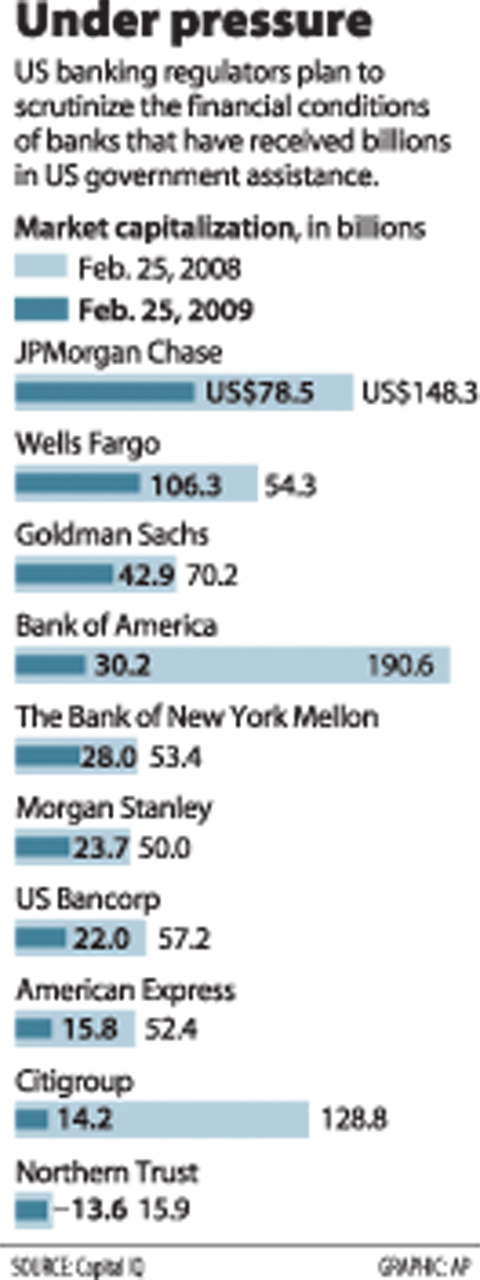

Citigroup’s talks continue as US officials haven’t specifically said which banks will be subject to the tests, but under the government’s criteria they would include large nationwide banks such as Citigroup, Bank of America Corp, JPMorgan Chase & Co and Wells Fargo & Co. The 19 largest banks hold two-thirds of the banking industry’s assets.

US Federal Reserve Chairman Ben Bernanke again spurned speculation on Wednesday that the government may nationalize Citigroup. But the Fed chief said it is possible the government could end up with a much bigger ownership stake in Citigroup or other banks.

In the case of Citigroup, Bernanke said, “we’ll see how their test works out and what evolves.”

Citigroup has not been the only financial institution to crumble under the growing avalanche of loan defaults. Last year, Bear Stearns Cos collapsed, Lehman Brothers Holdings Inc went bankrupt and American International Group Inc (AIG), Fannie Mae and Freddie Mac got bailed out and taken over by the government. As an insurer of the toxic assets plaguing the credit markets, AIG has hemorrhaged far more money than Citigroup.

But having been the largest US financial institution and a highly recognizable brand around the world, Citigroup has embodied for many people what went wrong with the global banking system: It grew too big and complicated, and veered too far away from its primary goal of serving the public’s financial needs.

Citigroup started falling apart in 2007, when sliding home prices led to a surge in loan defaults and in turn, a plunge in the value of bonds backed by loans. In the fourth quarter — as Citigroup’s board replaced Prince with Vikram Pandit — the bank posted a nearly US$10 billion loss. It hasn’t turned a profit since.

The company’s stock price has suffered massive losses in recent months. Opening last year near US$30, the stock had already lost 30 percent of its value by Oct. 1. The first two months of this year have seen its shares slide another 64 percent, giving the bank a market cap below US$14 billion, a far cry from the more than US$100 billion market cap it held a year ago.

Taiwanese Olympic badminton men’s doubles gold medalist Wang Chi-lin (王齊麟) and his new partner, Chiu Hsiang-chieh (邱相榤), clinched the men’s doubles title at the Yonex Taipei Open yesterday, becoming the second Taiwanese team to win a title in the tournament. Ranked 19th in the world, the Taiwanese duo defeated Kang Min-hyuk and Ki Dong-ju of South Korea 21-18, 21-15 in a pulsating 43-minute final to clinch their first doubles title after teaming up last year. Wang, the men’s doubles gold medalist at the 2020 and 2024 Olympics, partnered with Chiu in August last year after the retirement of his teammate Lee Yang

FALSE DOCUMENTS? Actor William Liao said he was ‘voluntarily cooperating’ with police after a suspect was accused of helping to produce false medical certificates Police yesterday questioned at least six entertainers amid allegations of evasion of compulsory military service, with Lee Chuan (李銓), a member of boy band Choc7 (超克7), and actor Daniel Chen (陳大天) among those summoned. The New Taipei City District Prosecutors’ Office in January launched an investigation into a group that was allegedly helping men dodge compulsory military service using falsified medical documents. Actor Darren Wang (王大陸) has been accused of being one of the group’s clients. As the investigation expanded, investigators at New Taipei City’s Yonghe Precinct said that other entertainers commissioned the group to obtain false documents. The main suspect, a man surnamed

The government is considering polices to increase rental subsidies for people living in social housing who get married and have children, Premier Cho Jung-tai (卓榮泰) said yesterday. During an interview with the Plain Law Movement (法律白話文) podcast, Cho said that housing prices cannot be brought down overnight without affecting banks and mortgages. Therefore, the government is focusing on providing more aid for young people by taking 3 to 5 percent of urban renewal projects and zone expropriations and using that land for social housing, he said. Single people living in social housing who get married and become parents could obtain 50 percent more

DEMOGRAPHICS: Robotics is the most promising answer to looming labor woes, the long-term care system and national contingency response, an official said Taiwan is to launch a five-year plan to boost the robotics industry in a bid to address labor shortages stemming from a declining and aging population, the Executive Yuan said yesterday. The government approved the initiative, dubbed the Smart Robotics Industry Promotion Plan, via executive order, senior officials told a post-Cabinet meeting news conference in Taipei. Taiwan’s population decline would strain the economy and the nation’s ability to care for vulnerable and elderly people, said Peter Hong (洪樂文), who heads the National Science and Technology Council’s (NSTC) Department of Engineering and Technologies. Projections show that the proportion of Taiwanese 65 or older would