Switzerland’s largest bank, UBS, is expected to announce the biggest loss in the country’s history tomorrow when it releases its results for last year, a year that saw the national icon tarnished by the subprime crisis.

But if there is a silver lining for the bank, which has been the target of a huge state rescue package, it lies in the fact that analysts say UBS has now hit bottom after its stock price fell 82 percent since the summer of 2007.

For that reason, the loss of nearly 20 billion Swiss francs (US$17.2 billion) the bank is expected to announce for last year should not surprise markets, analysts said.

“The bank has already publicized its problems to a large degree and the fall in the stock price should not be so large,” a trader in Zurich said.

In November, UBS posted a net profit of SF296 million for the third quarter following a year of losses, but warned that a renewed loss was looming for the following quarter.

The numbers expected to be unveiled tomorrow are staggering, reflecting the fact that UBS was one of the banks hardest hit by the US subprime loan crisis.

Its annual net loss is believed to be between SF14.1 billion and SF19.4 billion, estimates from Swiss financial news agency AWP said.

The loss for the fourth quarter alone is expected to be between SF5.9 billion and SF7.5 billion for the bank, which has already written down about US$46.9 billion in assets.

“The fourth quarter was clearly difficult for UBS,” a Deutsche Bank commentary said, adding however that removing “toxic” non-liquid assets with help from the Swiss central bank along with restructuring efforts meant “UBS has passed the worst.”

Customer confidence in the bank has in turn taken a hit, posing a major problem for UBS, which has hemorrhaged capital as a result.

Under a rescue plan unveiled in October, the Swiss government injected SF6 billion in new capital into UBS and lent US$54 billion to the bank to transfer its non-liquid assets into a separate fund.

The massive spread of so-called “toxic” assets — mainly linked to financial instruments now worth very little because of the US home-loan crisis — throughout the global banking system is at the core of the crisis since it broke in August 2007.

The bank also said last month that it would slash more jobs from its trading unit, adding to 9,000 job reductions already announced over the past year.

With its reputation tarnished, the damage only became worse when UBS went ahead with bonus payments, sparking accusations that it was misusing the rescue money.

Swiss media have reported that the payments total SF2 billion instead of the initially planned SF3 billion.

NATIONAL SECURITY THREAT: An official said that Guan Guan’s comments had gone beyond the threshold of free speech, as she advocated for the destruction of the ROC China-born media influencer Guan Guan’s (關關) residency permit has been revoked for repeatedly posting pro-China content that threatens national security, the National Immigration Agency said yesterday. Guan Guan has said many controversial things in her videos posted to Douyin (抖音), including “the red flag will soon be painted all over Taiwan” and “Taiwan is an inseparable part of China,” while expressing hope for expedited “reunification.” The agency received multiple reports alleging that Guan Guan had advocated for armed reunification last year. After investigating, the agency last month issued a notice requiring her to appear and account for her actions. Guan Guan appeared as required,

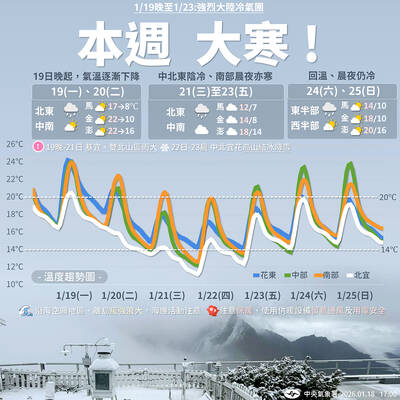

A strong cold air mass is expected to arrive tonight, bringing a change in weather and a drop in temperature, the Central Weather Administration (CWA) said. The coldest time would be early on Thursday morning, with temperatures in some areas dipping as low as 8°C, it said. Daytime highs yesterday were 22°C to 24°C in northern and eastern Taiwan, and about 25°C to 28°C in the central and southern regions, it said. However, nighttime lows would dip to about 15°C to 16°C in central and northern Taiwan as well as the northeast, and 17°C to 19°C elsewhere, it said. Tropical Storm Nokaen, currently

PAPERS, PLEASE: The gang exploited the high value of the passports, selling them at inflated prices to Chinese buyers, who would treat them as ‘invisibility cloaks’ The Yilan District Court has handed four members of a syndicate prison terms ranging from one year and two months to two years and two months for their involvement in a scheme to purchase Taiwanese passports and resell them abroad at a massive markup. A Chinese human smuggling syndicate purchased Taiwanese passports through local criminal networks, exploiting the passports’ visa-free travel privileges to turn a profit of more than 20 times the original price, the court said. Such criminal organizations enable people to impersonate Taiwanese when entering and exiting Taiwan and other countries, undermining social order and the credibility of the nation’s

‘SALAMI-SLICING’: Beijing’s ‘gray zone’ tactics around the Pratas Islands have been slowly intensifying, with the PLA testing Taiwan’s responses and limits, an expert said The Ministry of National Defense yesterday condemned an intrusion by a Chinese drone into the airspace of the Pratas Islands (Dongsha Islands, 東沙群島) as a serious disruption of regional peace. The ministry said it detected the Chinese surveillance and reconnaissance drone entering the southwestern parts of Taiwan’s air defense identification zone early yesterday, and it approached the Pratas Islands at 5:41am. The ministry said it immediately notified the garrison stationed in the area to enhance aerial surveillance and alert levels, and the drone was detected in the islands’ territorial airspace at 5:44am, maintaining an altitude outside the effective range of air-defense weaponry. Following