Asian stocks rose for a second week as optimism that government measures worldwide will ease the financial crisis offset cuts in earnings forecasts at Mizuho Financial Group Inc and Hitachi Ltd.

BHP Billiton Ltd and Kawasaki Kisen Kaisha Ltd led gains among mining and shipping companies after China cut some tariffs on raw material and component imports. Mitsubishi UFJ Financial Group Inc led banks lower as rival Mizuho, Japan’s second-largest lender, cut its earnings target. Hitachi, which makes electrical equipment, slumped 6.5 percent after forecasting the biggest loss by an Asian electronics maker.

“Fiscal and monetary stimulus policies have helped improve sentiment,” said Binay Chandgothia, who oversees about US$1.5 billion as chief investment officer at Principal Asset Management Co in Hong Kong. “These measures will benefit the economy, although there will be more earnings downgrades.”

The MSCI Asia-Pacific Index rose 0.4 percent to 83.42 in the past five days, adding to the previous week’s 3.5 percent increase. The gauge is down 6.9 percent this year amid mounting signs the global recession has hurt corporate profits.

Toyota Motor Corp, the world’s largest automaker, on Friday widened its loss prediction on slowing demand in the US and in Japan. Mitsubishi UFJ cut its full-year profit forecast after the stock market closed on Friday.

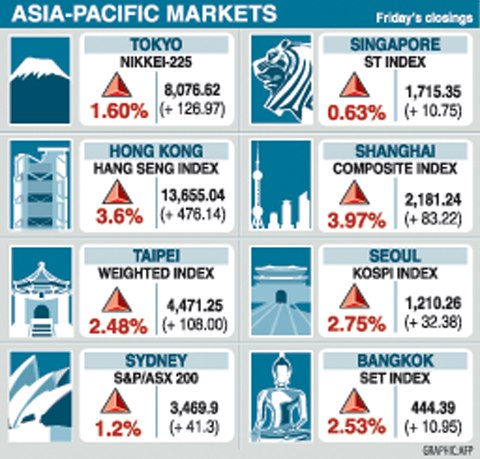

The Nikkei 225 Stock Average added 1 percent last week, while Hong Kong’s Hang Seng index climbed 2.8 percent. China’s Shanghai Composite Index surged 9.6 percent.

Stocks have fallen this year amid mounting signs the financial crisis, which has caused more than US$1 trillion in credit-related losses, is hurting corporate earnings. With banks tightening lending, bankruptcies among Japan’s listed companies reached an annual postwar record last year, according to Tokyo Shoko Research Ltd.

Governments around the world are stepping up efforts to ease the crisis that the IMF predicts will cause global growth to almost grind to a halt this year.

Indonesia’s central bank this week lowered its benchmark interest rate for a third straight month. China’s government started investing a second allocation of a 4 trillion yuan (US$580 billion) economic stimulus package, the official Xinhua News Agency reported.

China’s State Council, or Cabinet, also this week said that components and raw materials that “really needed to be imported” will be exempted from import duties.

Taiwanese share prices are expected to encounter strong technical resistance before the market moves above 4,500 points in the week ahead, dealers said on Friday.

The bourse is likely to drop at the beginning of the week before regaining momentum in the second half owing to adequate liquidity as more institutional investors return to rebuild positions, they said.

Bellwether electronic shares may lead the gains on their attractive valuations after a sell-off ahead of the Lunar New Year holiday last month.

But the financial sector is likely to underperform the broader market on bad loan fears amid the economic meltdown, they added.

The market is expected to fall to between 4,200 and 4,300 points on technical factors early on but is likely to overcome the resistance to jump to around 4,550 later, dealers said.

In the week to Friday, the weighted index rose 223.28 points or 5.26 percent to 4,471.25 after a 2.71 percent fall the week before the Lunar New Year holiday.

Average daily turnover stood at NT$59.76 billion (US$1.77 billion), compared with NT$43.41 billion at the close of the previous trading week.

“The technical resistance ahead of 4,500 points is stiff. It is time for the market to pull back to some extent after a strong showing this week,” Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said.

But, as many investors remain empty-handed after unloading their holdings before the holiday, the market will be filled with liquidity.

“They [investors] are still hunting bargains. Any technical downturn will provide them with good buying opportunities,” Shih said.

With trading turnover expanding, Shih said he expects large cap stocks, in particular electronics, to continue to be the favorites of institutional investors.

CALL FOR SUPPORT: President William Lai called on lawmakers across party lines to ensure the livelihood of Taiwanese and that national security is protected President William Lai (賴清德) yesterday called for bipartisan support for Taiwan’s investment in self-defense capabilities at the christening and launch of two coast guard vessels at CSBC Corp, Taiwan’s (台灣國際造船) shipyard in Kaohsiung. The Taipei (台北) is the fourth and final ship of the Chiayi-class offshore patrol vessels, and the Siraya (西拉雅) is the Coast Guard Administration’s (CGA) first-ever ocean patrol vessel, the government said. The Taipei is the fourth and final ship of the Chiayi-class offshore patrol vessels with a displacement of about 4,000 tonnes, Lai said. This ship class was ordered as a result of former president Tsai Ing-wen’s (蔡英文) 2018

UKRAINE, NVIDIA: The US leader said the subject of Russia’s war had come up ‘very strongly,’ while Jenson Huang was hoping that the conversation was good Chinese President Xi Jinping (習近平) and US President Donald Trump had differing takes following their meeting in Busan, South Korea, yesterday. Xi said that the two sides should complete follow-up work as soon as possible to deliver tangible results that would provide “peace of mind” to China, the US and the rest of the world, while Trump hailed the “great success” of the talks. The two discussed trade, including a deal to reduce tariffs slapped on China for its role in the fentanyl trade, as well as cooperation in ending the war in Ukraine, among other issues, but they did not mention

Japanese Prime Minister Sanae Takaichi yesterday lavished US President Donald Trump with praise and vows of a “golden age” of ties on his visit to Tokyo, before inking a deal with Washington aimed at securing critical minerals. Takaichi — Japan’s first female prime minister — pulled out all the stops for Trump in her opening test on the international stage and even announced that she would nominate him for a Nobel Peace Prize, the White House said. Trump has become increasingly focused on the Nobel since his return to power in January and claims to have ended several conflicts around the world,

GLOBAL PROJECT: Underseas cables ‘are the nervous system of democratic connectivity,’ which is under stress, Member of the European Parliament Rihards Kols said The government yesterday launched an initiative to promote global cooperation on improved security of undersea cables, following reported disruptions of such cables near Taiwan and around the world. The Management Initiative on International Undersea Cables aims to “bring together stakeholders, align standards, promote best practices and turn shared concerns into beneficial cooperation,” Minister of Foreign Affairs Lin Chia-lung (林佳龍) said at a seminar in Taipei. The project would be known as “RISK,” an acronym for risk mitigation, information sharing, systemic reform and knowledge building, he said at the seminar, titled “Taiwan-Europe Subsea Cable Security Cooperation Forum.” Taiwan sits at a vital junction on