The US Federal Reserve on Wednesday approved a request by GMAC, the troubled financial arm of General Motors, to become a bank holding company, allowing it to tap government bailout funds and emergency loans.

The move, announced only hours before Christmas Day, boosts the prospects of General Motors after the US government last week approved a US$13.4 billion rescue loan package for GM and Chrysler to stave off collapse amid tight credit and dismal sales.

GMAC faced possible bankruptcy, jeopardizing financing for GM car dealers and customers, and its demise could have dragged down the Detroit automaker’s fortunes with it.

“In light of the unusual and exigent circumstances affecting the financial markets, and all other facts and circumstances, the Board has determined that emergency conditions exist that justify expeditious action on this proposal” for changing GMAC’s legal status, the Fed said in its decision, which the board approved four votes to one.

Under the move, GM and Cerberus Capital Management must reduce their ownership stakes in GMAC, the Fed said.

GM, which owns 49 percent of GMAC, has to cut its ownership share to less than 10 percent in voting shares and equity. Cerberus, the private equity owner of Chrysler, must reduce its 51-percent stake to no more than 14.9 percent in voting shares and 33 percent in total equity, the decision said.

The move will “benefit the public by strengthening GMAC’s ability to fund the purchases of vehicles manufactured by GM and other companies and by helping to normalize the credit markets for such purchases,” the Fed said.

GMAC chief executive Alvaro de Molina in a statement hailed the decision as “a key turning point” for the company.

“It is critically important to our company and the broader economy to resume responsible lending to consumers and businesses,” he said.

GMAC, by becoming a federally regulated bank holding company, becomes the latest firm to gain access to a share of the US$700 billion government bailout package initially introduced to shore up financial firms.

Debt-strapped GMAC had said earlier this month it did not expect the Federal Reserve would grant its request as it could not meet capital requirements.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

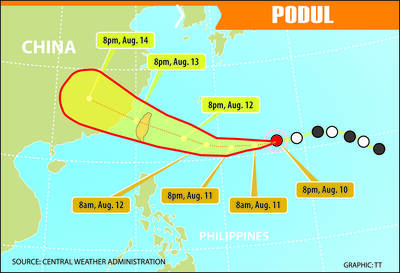

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an