Asian stocks rose for a second week as the US, Japan and Hong Kong cut interest rates and oil prices tumbled, boosting optimism that costs for companies will fall and help resuscitate economic growth.

Mitsubishi UFJ Financial Group Inc, Japan’s biggest bank, gained 16 percent in Tokyo, while Sumitomo Mitsui Financial Group Inc surged 17 percent.

Qantas Airways Ltd jumped 18 percent in Sydney as crude oil slumped below US$34 a barrel. Samsung Electronics Co climbed 5.3 percent as the benchmark gauge of memory prices climbed for the first time since June.

Taiwanese shares are expected to gain momentum next week. Buying from local institutional investors to dress up their books should boost prices as the year approaches an end, dealers said on Friday.

Interest may focus on the bellwether electronic sector, with attractive valuations after they have been battered on weakening global demand, they said.

Financial stocks may draw market attention on hopes of increasing cross-strait banking exchanges, they said.

The market is expected to overcome technical resistance at around 4,800 points and may gain further to test 5,000 points next week, while any profit taking is likely to be capped at the 4,600 point level, dealers said.

For the week to Friday, the weighted index closed up 213.25 points, or 4.76 percent, at 4,694.52 after a 6.06 percent increase a week earlier.

Average daily turnover stood at NT$71.38 billion (US$2.20 billion), compared with NT$85.11 billion a week ago.

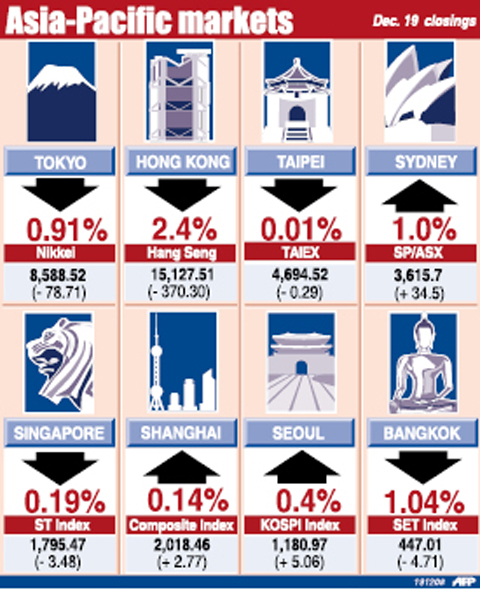

TOKYO

Tokyo shares ended down 0.91 percent.

The Tokyo Stock Exchange’s benchmark Nikkei index fell 78.71 points to 8,588.52.

HONG KONG

Hong Kong share prices closed 2.4 percent lower. The benchmark Hang Seng Index closed down 370.30 points at 15,127.51 on turnover of HK$57.38 billion (US$7.40 billion). The market has risen 2.51 percent over the week.

SYDNEY

Shares closed up 1 percent. The benchmark S&P/ASX200 rose 34.5 points to 3,615.7, while the broader All Ordinaries was up 25.5 points at 3,547.2. A total of 2.1 billion shares worth A$7.24 billion (US$5 billion) changed hands.

Mining giant BHP Billiton lost 3.5 percent to A$29.92, while Rio Tinto dropped 2.48 percent to A$39.01.

SHANGHAI

Chinese shares closed up 0.14 percent. The benchmark Shanghai Composite Index was 2.77 points higher at 2,018.46 on turnover of 73.0 billion yuan (US$10.7 billion).

SEOUL

South Korean shares closed 0.4 percent higher. The KOSPI index ended up 5.06 points at 1,180.97. Volume was 677.14 million shares worth 5.31 trillion won (US$4.12 billion).

SINGAPORE

Singapore shares closed 0.19 percent lower. The blue-chip Straits Times Index closed down 3.48 points at 1,795.47 on volume of 984 million shares worth S$847 million (US$584 million).

KUALA LUMPUR

Malaysian shares closed 0.5 percent lower. The Kuala Lumpur Composite Index lost 4.1 points to close at 876.40.

BANGKOK

Thai shares closed 1.04 percent lower. The Stock Exchange of Thailand composite index lost 4.71 points to close at 447.01 points on turnover of 3.29 billion shares worth 11.00 billion baht (US$320 million).

JAKARTA

Indonesian shares ended 0.3 percent lower. The Jakarta Composite Stock Index closed 3.48 points down at 1,348.28 in thin trade.

MANILA

Philippine shares closed 0.1 percent higher. The composite index rose 2.07 points to 1,903.53 points.

UKRAINE, NVIDIA: The US leader said the subject of Russia’s war had come up ‘very strongly,’ while Jenson Huang was hoping that the conversation was good Chinese President Xi Jinping (習近平) and US President Donald Trump had differing takes following their meeting in Busan, South Korea, yesterday. Xi said that the two sides should complete follow-up work as soon as possible to deliver tangible results that would provide “peace of mind” to China, the US and the rest of the world, while Trump hailed the “great success” of the talks. The two discussed trade, including a deal to reduce tariffs slapped on China for its role in the fentanyl trade, as well as cooperation in ending the war in Ukraine, among other issues, but they did not mention

Japanese Prime Minister Sanae Takaichi yesterday lavished US President Donald Trump with praise and vows of a “golden age” of ties on his visit to Tokyo, before inking a deal with Washington aimed at securing critical minerals. Takaichi — Japan’s first female prime minister — pulled out all the stops for Trump in her opening test on the international stage and even announced that she would nominate him for a Nobel Peace Prize, the White House said. Trump has become increasingly focused on the Nobel since his return to power in January and claims to have ended several conflicts around the world,

GLOBAL PROJECT: Underseas cables ‘are the nervous system of democratic connectivity,’ which is under stress, Member of the European Parliament Rihards Kols said The government yesterday launched an initiative to promote global cooperation on improved security of undersea cables, following reported disruptions of such cables near Taiwan and around the world. The Management Initiative on International Undersea Cables aims to “bring together stakeholders, align standards, promote best practices and turn shared concerns into beneficial cooperation,” Minister of Foreign Affairs Lin Chia-lung (林佳龍) said at a seminar in Taipei. The project would be known as “RISK,” an acronym for risk mitigation, information sharing, systemic reform and knowledge building, he said at the seminar, titled “Taiwan-Europe Subsea Cable Security Cooperation Forum.” Taiwan sits at a vital junction on

LONG-HELD POSITION: Washington has repeatedly and clearly reiterated its support for Taiwan and its long-term policy, the Ministry of Foreign Affairs said US Secretary of State Marco Rubio yesterday said that Taiwan should not be concerned about being used as a bargaining chip in the ongoing US-China trade talks. “I don’t think you’re going to see some trade deal where, if what people are worried about is, we’re going to get some trade deal or we’re going to get favorable treatment on trade in exchange for walking away from Taiwan,” Rubio told reporters aboard his airplane traveling between Israel and Qatar en route to Asia. “No one is contemplating that,” Reuters quoted Rubio as saying. A US Treasury spokesman yesterday told reporters