Asian stocks fell this week as the deepening global recession slashed consumer demand, driving commodity prices lower and dragging down materials companies and oil drillers.

BHP Billiton Ltd, the world’s biggest mining company, dropped 16 percent after oil fell more than US$100 a barrel from its record in July and copper prices slumped. Honda Motor Co sank 21 percent as last month’s US sales plunged the most since 1981. Surfwear maker Billabong International Ltd tumbled 25 percent in Sydney after cutting its earnings forecast as its US customers deferred deliveries amid the economic contraction.

“The world is in recession and earnings will fall next year for most companies the world over, including Asia,” said Hugh Young, managing director at Aberdeen Asset Management Ltd in Singapore, overseeing about US$45 billion. “Asia is in pretty good shape for surviving, not in great shape for growing.”

The MSCI Asia-Pacific Index fell 3.8 percent to 79.52 this week. Raw-materials producers had the biggest percentage decline among the 10 industry groups.

MSCI’s Asian index has plunged 50 percent this year as global financial companies’ losses and writedowns from the collapse of the US subprime-mortgage market neared US$1 trillion. Shares on the MSCI gauge are now valued at 9.7 times trailing earnings after falling to as low as 8.2 times last month. That’s half the 19.5 times on Nov. 11 last year, when the measure hit a peak of 172.32. Prior to the current market turmoil, the price-earnings ratio never dropped below 10, according to Bloomberg data.

TAIPEI

Taiwanese share prices are expected to face further volatility next week amid uncertainty over electronics as global economic weakness compromises the sector’s profitability, dealers said.

Investors have turned more cautious after the high-tech sector was hard hit this week with several heavyweights having lowered their fourth quarter earnings outlook, they said.

They are looking into the sector’s sales data for last month, which are due by Wednesday, for a clear indication amid falling global consumption, they added.

However, financials may offset the impact from the high-tech sector’s losses as investors have hopes that Taiwan and China will sign a deal next year to increase banking exchanges, they said.

The market is expected to test the key 4,000-point support level in the week ahead, while any technical rebound may face stiff resistance at around 4,400 to 4,500 points, dealers said.

For the week to Friday, the weighted index lost 235.42 points, or 5.28 percent, at 4,225.07 after a 6.94 percent rise a week earlier.

Average daily turnover stood at NT$54.83 billion (US$1.64 billion), compared with NT$53.51 billion the previous week.

Other regional markets:

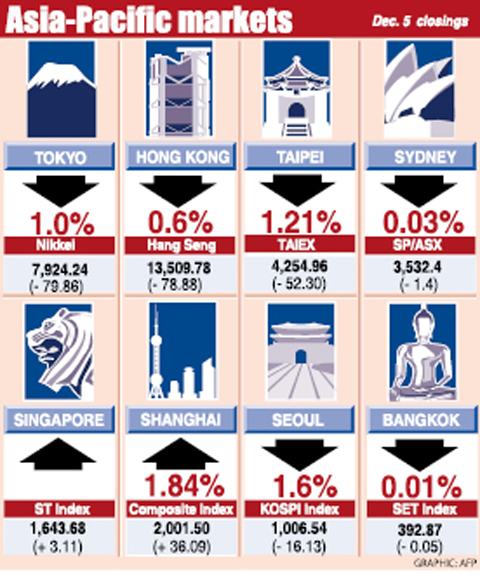

TOKYO: The benchmark Nikkei-225 index dropped 6.73 points, or 0.08 percent, to 7,917.51. The broader TOPIX index of all first section issues slipped 2.86 points, or 0.36 percent, to 786.02. Major bank stocks remained under pressure.

KUALA LUMPUR: Malaysian shares closed 1 percent lower. The Kuala Lumpur Composite Index lost 8.58 points to close at 838.28.

JAKARTA: Indonesian shares ended 0.3 percent lower. The Jakarta Composite Index closed 2.98 points lower at 1,202.34.

MANILA: Philippine share prices closed 0.1 percent lower. The composite index lost 1.93 points to 1,888.96.

WELLINGTON: New Zealand shares closed 0.88 percent lower. The benchmark NZX-50 index fell 23.96 points to 2,706.72.

MUMBAI: Indian shares fell 2.87 percent as investors locked in gains ahead of an economic stimulus package expected from India’s central bank on yesterday. The benchmark 30-share SENSEX fell 264.55 points to 8,965.2.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better