Australia’s central bank slashed interest rates by 100 basis points (bps) to a six-year low yesterday in an aggressive move against threats to growth posed by the global financial crisis.

The bigger-than-expected cut by the Reserve Bank of Australia (RBA) dropped the official cash rate to 4.25 percent, its lowest level since May 2002.

It was the fourth consecutive monthly cut by the RBA, which has sliced a total of 300bps off the official rate since September, as inflation fears give way to concern about the impact of slower world economic growth.

Most financial market economists had expected a 75bps reduction, although with the bank having opted for a big one percentage point cut in October a repeat was not totally unexpected.

The cut failed to boost the Australian stock market in the face of a major fall on Wall Street overnight, and share prices closed down 4.2 percent with major miners and financials leading the slide.

“Recent actions by governments and central banks to stabilize their respective financial systems have begun to take effect,” RBA Governor Glenn Stevens said in a statement. “Nonetheless, financial market sentiment remains fragile, as evidence accumulates of weak economic conditions in the major countries and a significant slowing in many emerging countries.”

The Australian economy had been more resilient than others, but recent data indicated that a significant moderation in demand and activity had occurred, he said, and it was likely inflation would soon start to fall.

Statistics released by the TD Securities-Melbourne Institute on Monday showed annual inflation fell from 3.9 percent in October to 3.0 percent last month — just at the top end of central bank’s 2.0 percent to 3.0 percent target.

“The previous inflation problem has been turned on its head,” TD Securities senior strategist Joshua Williamson said. “There has been a quite staggering turnaround in price pressures in recent months.”

The RBA noted, however, that there had been a major easing in monetary policy over the past few months along with a fiscal stimulus package by the government worth A$10.4 billion (US$6.76 billion).

“Together with the spending measures announced by the government, and a large fall in the Australian dollar exchange rate, significant policy stimulus will be supporting demand over the year ahead,” Stevens said.

Economists said the tone of the statement suggested the RBA could proceed with more caution next year, slowly lowering the cash rate to multi-decade lows under 4 percent.

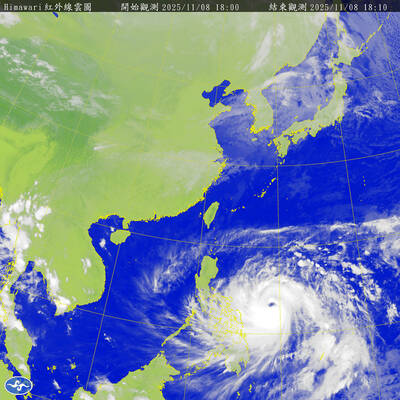

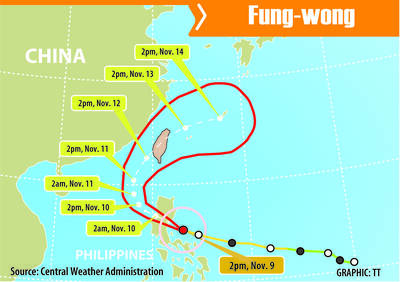

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city