Asian stocks had their second-best week this year after China slashed interest rates, spurring speculation government measures will pull the global economy out of recession and boost demand.

Inpex Corp, Japan’s largest energy explorer, jumped 26 percent in Tokyo after oil had its best week in six months. Zijin Mining Group Co, China’s largest gold producer, surged 25 percent as bullion climbed. Guangzhou R&F Properties Co jumped 41 percent after China cut its key lending rate by the most in 11 years to revive the world’s fourth-largest economy, three weeks after the government announced a stimulus plan worth more than US$500 billion.

“Sentiment is stabilizing,” said Kwon Hyeuk-boo, a fund manager at Daishin Investment Trust Management Co in Seoul, which oversees about US$1.4 billion in assets. “Investors are buying into expectations that support measures will keep coming. China’s strong will to support its economy is serving as a key catalyst to Asian markets.”

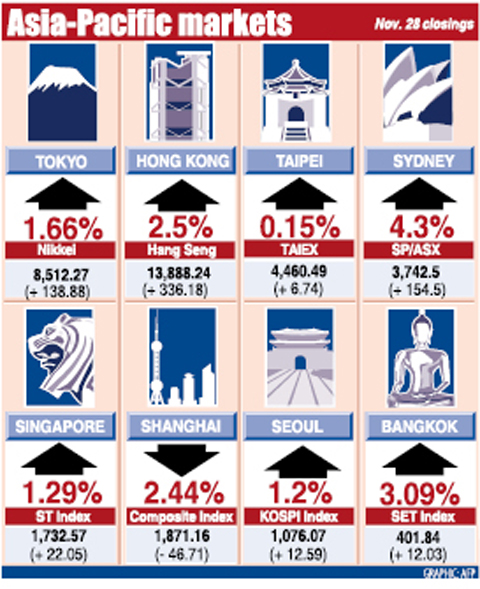

The MSCI Asia-Pacific Index rose 6.8 percent to 82.67, the second-best gain this year, surpassed only by a 6.9 percent rally at the end of last month, when central banks from Japan to Taiwan lowered borrowing costs. Commodities producers had the biggest gains among the 10 industry groups.

Japan’s Nikkei 225 Stock Average advanced 7.6 percent to 8,512.27. Elpida Memory Inc, Japan’s biggest memory-chip maker, climbed 27 percent after saying it plans to gain control of a production venture with Taiwan’s Powerchip Semiconductor Corp (力晶半導體).

Elpida jumped 27 percent to ¥445. The Tokyo-based chipmaker will increase its stake in joint venture Rexchip Electronics Corp (瑞晶) to 52 percent, Hsinchu-based Powerchip said on Thursday. The investment will give Elpida control of a factory that runs on the latest technology for making computer-memory chips at a fraction of the cost of building a plant.

Asian shares also climbed after the US Federal Reserve committed US$800 billion to unfreeze credit markets, while Citigroup Inc received a US$306 billion government rescue and the EU proposed a 200 billion euro (US$257 billion) spending package.

The gain for MSCI’s Asia-Pacific index pared this month’s drop to 3.8 percent, the seventh monthly decline and the longest losing streak since the gauge began in December 1987.

MSCI’s Asian index has plunged 48 percent this year as global financial companies’ losses and writedowns from the collapse of the US subprime-mortgage market neared US$1 trillion.

Shares on the MSCI gauge are now valued at 10.2 times trailing earnings after falling to as low as 8.2 times last month. That compares with 19.5 times on Nov. 11 last year, when the measure hit a peak of 172.32. Prior to the current market turmoil, the price-earnings ratio never dropped below 10, Bloomberg data show.

The People’s Bank of China on Wednesday cut its one-year lending rate by 108 basis points to 5.58 percent, less than three weeks after announcing a 4 trillion yuan (US$586 billion) economic stimulus plan. China is the largest trading partner for Japan and Australia and was the biggest contributor to global economic growth last year.

TAIPEI

Taiwanese share prices are expected to encounter strong resistance in the week ahead as the index approaches the upper technical 4,500 to 4,600 point range, dealers said on Friday.

Despite a recent significant technical rebound, market confidence remains weak amid lingering concerns over a global economic downturn and further volatility on Wall Street, they said.

Investors have turned cautious before bellwether electronics companies release their sales figures for this month, starting from next week, to give a clearer indication on economic fundamentals, they added.

While profit taking may continue to weigh in the market next week, a short-term technical support could be seen at around 4,100 points, dealers said.

For the week to Friday, the weighted index closed up 289.39 points, or 6.94 percent, at 4,460.49 after a 6.32 percent fall a week earlier.

Other regional markets:

KUALA LUMPUR: Malaysian shares closed 0.4 percent lower. The Kuala Lumpur Composite Index shed 3.84 points to end the day at 866.14.

JAKARTA: Indonesian shares ended 3.3 percent higher. The Jakarta Composite Index rose 39.47 points to 1,241.54.

MANILA: Philippine share prices closed 0.2 percent higher. The composite index added 4.56 points to 1,971.57. Trading resumes on Tuesday as markets will be closed tomorrow for a public holiday.

WELLINGTON: New Zealand shares closed 1.58 percent higher. The benchmark NZX-50 index rose 42.22 points to 2,710.96.

MUMBAI: Indian shares closed up 0.73 percent. The benchmark 30-share SENSEX rose 66 points to 9,092.72.

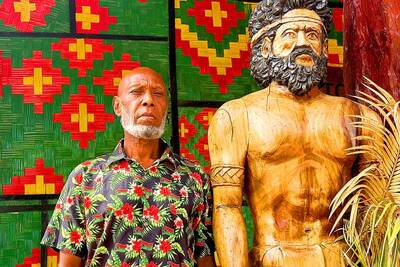

The paramount chief of a volcanic island in Vanuatu yesterday said that he was “very impressed” by a UN court’s declaration that countries must tackle climate change. Vanuatu spearheaded the legal case at the International Court of Justice in The Hague, Netherlands, which on Wednesday ruled that countries have a duty to protect against the threat of a warming planet. “I’m very impressed,” George Bumseng, the top chief of the Pacific archipelago’s island of Ambrym, told reporters in the capital, Port Vila. “We have been waiting for this decision for a long time because we have been victims of this climate change for

MASSIVE LOSS: If the next recall votes also fail, it would signal that the administration of President William Lai would continue to face strong resistance within the legislature The results of recall votes yesterday dealt a blow to the Democratic Progressive Party’s (DPP) efforts to overturn the opposition-controlled legislature, as all 24 Chinese Nationalist Party (KMT) lawmakers survived the recall bids. Backed by President William Lai’s (賴清德) DPP, civic groups led the recall drive, seeking to remove 31 out of 39 KMT lawmakers from the 113-seat legislature, in which the KMT and the Taiwan People’s Party (TPP) together hold a majority with 62 seats, while the DPP holds 51 seats. The scale of the recall elections was unprecedented, with another seven KMT lawmakers facing similar votes on Aug. 23. For a

All 24 lawmakers of the main opposition Chinese Nationalists Party (KMT) on Saturday survived historical nationwide recall elections, ensuring that the KMT along with Taiwan People’s Party (TPP) lawmakers will maintain opposition control of the legislature. Recall votes against all 24 KMT lawmakers as well as Hsinchu Mayor Ann Kao (高虹安) and KMT legislative caucus whip Fu Kun-chi (傅崐萁) failed to pass, according to Central Election Commission (CEC) figures. In only six of the 24 recall votes did the ballots cast in favor of the recall even meet the threshold of 25 percent of eligible voters needed for the recall to pass,

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen