Asian stocks fell this week, ending a two-week rally, as companies lowered earnings forecasts amid mounting evidence that economies are slowing.

Commonwealth Bank of Australia fell 20 percent after saying bad loans may double and Australian business confidence fell to a record low. Citizen Holdings Co dropped 9.7 percent after cutting its profit forecast. Hana Financial Group Inc tumbled 36 percent after Fitch Ratings cut its outlook on South Korean banks.

China’s CSI 300 Index posted the biggest weekly gain since April, led by steelmakers, after the government announced a US$586 billion stimulus plan.

GRAPHIC: AFP

The MSCI Asia-Pacific Index fell 4.7 percent to 82.10 this week, snapping a two-week rally. Financial and technology stocks had the biggest falls among the 10 industry groups.

Japan’s Nikkei 224 Stock Average lost 1.4 percent this week and Australia’s S&P/ASX 200 Index dropped 7.5 percent. Most other markets in the region fell.

Asia-Pacific equities retreated on mounting evidence economies are slowing. China’s industrial output missed estimates, while South Korea’s exports increased at the slowest pace in 13 months last month. In the US, the Treasury scrapped plans to buy mortgage assets to focus on supporting consumer credit.

The MSCI index for the Asia-Pacific region has lost more than half its value since the peak in November last year in the rout triggered by a widening global credit crisis that originated in the US subprime mortgage market. That left shares on the gauge valued at 10 times trailing earnings after last month falling to as low as 8.2 times. Prior to the current turmoil, it never dropped below 10, Bloomberg data dating back to 1995 show.

TAIPEI

Taiwanese share prices are expected to extend losses next week as investors remain concerned over a global economic recession, dealers said on Friday.

Fears of volatility on Wall Street are likely to impact the local bourse owing to uncertainty after the US government changed tack on its use of a US$700 billion mortgage bailout package, they said.

Foreign institutional investors may continue to sell the bellwether electronics sector as it feels the pinch amid falling global demand, they said.

The market is expected to test the nearest technical resistance at around 4,200 points next week owing to fragile confidence, while a technical rebound is likely to follow with a cap at around 4,500 points, dealers said.

For the week to Friday, the weighted index closed down 289.63 points or 6.11 percent at 4,452.70, after a 2.63 percent fall a week earlier.

TOKYO

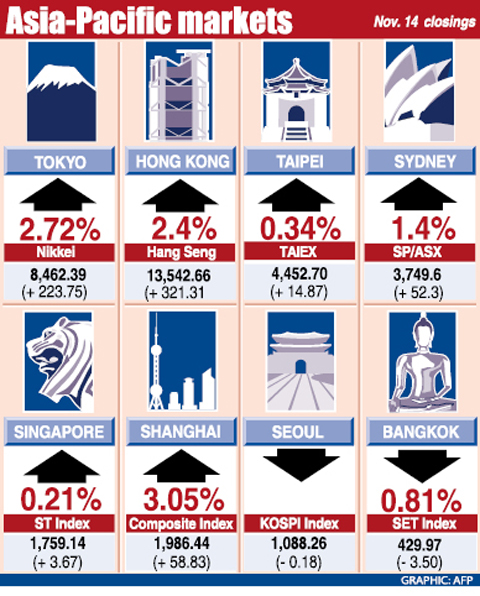

Japanese share prices gained 2.72 percent on Friday.

The Tokyo Stock Exchange’s benchmark climbed 223.75 points to finish at 8,462.39 after jumping more than 5 percent in early trading.

The broader TOPIX index of all first-section shares rose 9.38 points or 1.12 percent to 846.91. Exporters rallied after the US dollar jumped against the yen overnight, although the greenback eased back in Asian trading on Friday.

SHANGHAI

Chinese share prices jumped 3.05 percent. The benchmark Shanghai Composite Index, which covers A and B shares, closed up 58.83 points to 1,986.44.

Property developers gained on hopes that lower mortgage rates would give a boost to weakening demand.

KUALA LUMPUR

Malaysian share prices closed flat. The Kuala Lumpur Composite Index was up 1.06 points or 0.12 percent to closed at 881.65.

JAKARTA

Indonesian shares ended up 0.4 percent. The Jakarta Composite Index rose 4.67 points to 1,264.38.

MANILA

Philippine share prices closed 3.07 percent higher. The composite index rose 59.08 points to 1,978.05 points.

WELLINGTON

New Zealand share prices closed 1.39 percent higher. The benchmark NZX-50 index rose 38.05 points to close at 2,767.67.

MUMBAI

Indian shares fell 1.58 percent. The benchmark 30-share SENSEX fell 150.91 points to 9,385.42, at a near three-year low.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better

FLOOD RECOVERY: “Post-Typhoon Danas reconstruction special act” is expected to be approved on Thursday, the premier said, adding the flood control in affected areas would be prioritized About 200cm of rainfall fell in parts of southern Taiwan from Monday last week to 9am yesterday, the Central Weather Administration (CWA) said. Kaohsiung’s Taoyuan District (桃源) saw total rainfall of 2,205mm, while Pingtung County’s Sandimen Township (三地門) had 2,060.5mm and Tainan’s Nanhua District (南化) 1,833mm, according to CWA data. Meanwhile, Alishan (阿里山) in Chiayi County saw 1,688mm of accumulated rain and Yunlin County’s Caoling (草嶺) had 1,025mm. The Pingtung County Government said that 831 local residents have been pre-emptively evacuated from mountainous areas. A total of 576 are staying with relatives in low-lying areas, while the other 255 are in shelters. CWA forecaster