Speculation mounted yesterday that Japan’s central bank could cut its super-low interest rates this week to tackle a looming recession in Asia’s largest economy.

It would be the first such move since March 2001 when the Bank of Japan introduced an unprecedented policy of almost free credit to try to pull the economy out of the deflationary doldrums.

The Bank of Japan (BoJ) “is leaning toward” reducing its key rate by 25 basis points to 0.25 percent following the recent plunge on the Tokyo stock market, the influential Nikkei Shimbun business daily reported, without naming its sources.

“The falling stock market is a very strong incentive for a rate cut. It is conceivable that the BoJ might reduce the rate to close to zero again eventually,” said Tetsuro Okada, an economist at the Japan Research Institute.

The Japanese economy shrank in the second quarter of this year and there are increasing fears that it is once again in recession, which is usually defined as two straight quarters of economic contraction.

Japanese industrial output rose 1.2 percent last month from the previous month, beating the market expectation of a 0.5 percent rise, official figures showed yesterday.

But the gain came after a sharp 3.5 percent drop in August and the outlook remained gloomy, with the government forecasting a fall of 2.3 percent this month and a drop of 2.2 percent next month.

The bleak outlook is “another piece of evidence that the Bank of Japan could use to lower interest rates, if they so wish,” said Masamichi Adachi, senior economist at JP Morgan Securities.

“The data show that the speed of economic slowdown has accelerated,” he said.

But a rate cut would be mostly symbolic in Japan, which already has the lowest borrowing costs of the major economies, analysts said.

Japan’s financial system may be relatively resilient amid the global credit crunch, “but a rate cut would demonstrate that Japan was doing something in coordination with the international community,” Okada said.

The Nikkei index has dropped nearly 40 percent over the past three months amid the worst global financial crisis in decades.

The US Federal Reserve was widely expected to deliver another cut in its interest rates later yesterday and markets expect further interest rate cuts in Europe as well.

Analysts said that it was still uncertain whether the Bank of Japan would move this week.

“My guess is that the BoJ would take a step-by-step approach before actually cutting the rate,” said Adachi of JP Morgan

“If it lowers the rate, perhaps even back to the near-zero level, it means that the BoJ would not have any more room to reduce it further,” he said.

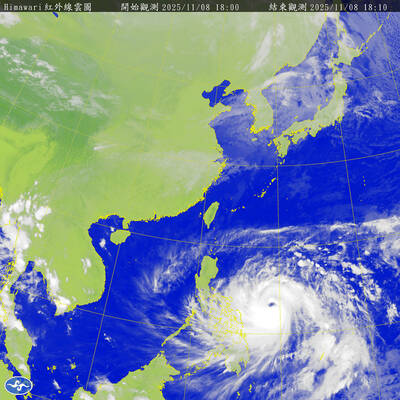

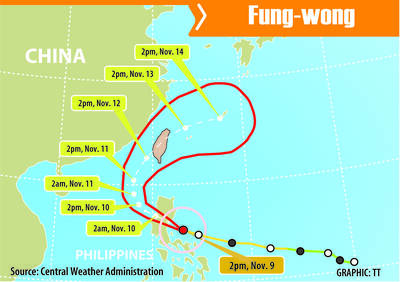

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city