The financially troubled American Insurance Group (AIG) is to sell its local unit Philippine-American Life and General Insurance Co (Philam Life), the unit’s chief executive Jose Cuisia said yesterday.

About 10 local and foreign entities have expressed interest in acquiring all or parts of the group, which is involved in insurance, banking and asset management, Cuisia told a news conference.

He declined to give details and said no time frame had been set by AIG for the sale of the local unit known locally as Philam Life.

Cuisia put the Philippine unit’s net worth at 49.4 billion pesos (US$1.05 billion).

“AIG announced that it will refocus the company on its core property and casualty insurance business to repay its loan from the Federal Reserve Bank of New York,” Cuisia said.

He said he was “surprised” with the decision because Philam Life could be considered a “crown jewel” to AIG.

Philam Life is the Philippines’ most profitable and largest insurer, employing about 1,500 people and backed by assets worth 170 billion pesos.

“AIG is seeking top-rated, financially strong brand names with the capability to continue Philam Life’s legacy of leadership, strength, stability and dedication to its policy holders, employees and shareholders,” Cuisia said.

“This is an opportunity for local companies to own a trophy company,” he said, citing Philam Life’s leading role in local insurance.

He said AIG has hired investment banks JP Morgan and Blackstone to advise it on the sale.

The advisers will help AIG decide whether to sell Philam Life as a whole or part by part, he added.

He said the company remains “strongly capitalized” and would be able to meet all its commitments to depositors, investors and policy holders.

He said most of Philam Life’s investments were tied to government securities and bonds, and that the firm did not have any offshore exposure to troubled US financial institutions.

Cuisia said he was “not leading a management buyout” of the company.

Philam Life deputy president and chief operating officer Michel Khalaf said the company has for decades remained a “net contributor” to AIG.

While the company will seek to retain all its employees, he said there could be some “rationalization” if a buy-out led to duplication of jobs.

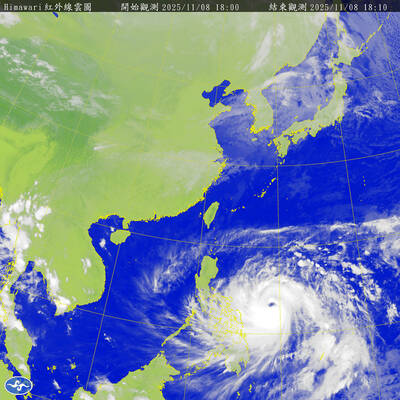

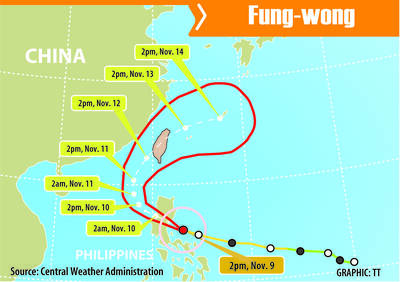

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city