Asian stocks posted the biggest weekly drop in 13 months on concern a US$700 billion US bank bailout will fail to stimulate demand for the region’s exports.

Toyota Motor Corp fell 14 percent this week, the most in 21 years, after its US car sales plunged 32 percent last month. BHP Billiton, the world’s biggest miner, dropped 15 percent as commodity prices headed for their biggest weekly decline in 50 years. Babcock & Brown Ltd paced a drop in financial stocks, sliding 20 percent, as borrowing costs increased.

“Investors are worried that economic conditions and earnings will still deteriorate even with this rescue plan,” said Masaru Hamasaki, a senior strategist at Toyota Asset Management Co in Tokyo, which manages US$3.3 billion. “The weakening global demand is becoming more of a concern to many investors.”

The MSCI Asia-Pacific Index dropped 8 percent this week, the most since the five days ended Aug. 17 last year, when credit markets first seized up as the US subprime mortgage crisis prompted banks to rein in lending. The index has slumped 33 percent this year as the credit crunch brought down banks including Lehman Brothers Holdings Inc.

The index tumbled 3.9 percent on Monday after the US House of Representatives blocked the first passage of the rescue plan.

A measure of commodity producers tumbled 14.9 percent, the most since at least 1995, when Bloomberg data on the index was first compiled. All 10 industry groups declined.

Toyota, the world’s No. 2 carmaker, fell 14 percent this week to ¥4,080 (US$38.78), its biggest loss since October 1987. The company said it offered no-interest loans on 11 models in the US, where its sales tanked the most in 21 years.

Markets were closed on Friday in South Korea, China and Indonesia for public holidays.

TAIPEI

Taiwanese share prices are expected to encounter resistance next week amid concerns over the global financial system ahead of the US bailout package vote, dealers said on Friday.

Even if the rescue plan is passed in Congress, investors are still keeping their fingers crossed as they assess the outcome after the package is implemented, they said.

Dealers also remained worried about the domestic economy as the tainted Chinese milk product scandal has further undermined the already weak local consumption, they added.

The market is expected to test 5,500 points again next week on economic concerns at home and abroad, while any technical rebound may be capped with the index moving closer to the key 6,000-point level, dealers said.

In the week to Friday, the TAIEX closed down 187.40 points, or 3.16 percent, at 5,742.23 after a 0.68 percent fall a week earlier.

Average turnover stood at NT$66.51 billion (US$2.07 billion), compared with NT$88.72 billion a week ago.

The weighted index on Friday rose 38.51 points, or 0.68 percent, to 5,742.23 from Thursday, off a low of 5,558.35 and a high of 5,747.73, on turnover of NT$67.12 billion. Gainers led losers by 998 to 617, with 382 stocks unchanged.

“The reduced trading volume showed weak market confidence as global financial woes continue to haunt investors here,” President Securities (統一證券) analyst Steven Huang said.

“Few can be sure whether the US rescue plan will effectively stem the difficulties in the banking system even if it gets approved. We are at a critical moment,” Huang said.

TOKYO

Japanese shares tumbled 1.94 percent, dealers said.

The Tokyo Stock Exchange’s benchmark Nikkei-225 index lost 216.62 points to 10,938.14, below the key 11,000 points level for the first time since May 2005. The index plunged 8 percent over the week.

The broader TOPIX index of all first section shares lost 29 points, or 2.69 percent, on Friday to end at 1,047.97.

HONG KONG

Share prices dropped 2.9 percent, dealers said. The benchmark Hang Seng Index dropped 528.71 points to 17,682.40.

SYDNEY

Australian shares dropped 1.4 percent, dealers said. The benchmark S&P/ASX 200 closed down 65.7 points at 4,695.4, while the broader All Ordinaries shed 71.3 points to end the week at 4,702.8.

MANILA

Philippine share prices closed 1.78 percent lower, dealers said.

The composite index fell 46.68 points to 2,566.21.

SINGAPORE

Shares closed 2.81 percent lower, dealers said. The blue-chip Straits Times Index fell 66.48 points to 2,297.12.

There were 137 risers against 302 decliners, with 866 stocks unchanged.

KUALA LUMPUR

Malaysian share prices closed 0.2 percent lower, dealers said.

The Kuala Lumpur Composite Index dropped 1.98 points to close at 1,016.70.

BANGKOK

Thai share prices closed 1.28 percent lower, dealers said.

The Stock Exchange of Thailand (SET) composite index lost 7.64 points to close at 590.05 points.

WELLINGTON

New Zealand share prices fell 2.51 percent, dealers said.

The benchmark NZX-50 index fell 81.10 points to close at 3,151.54.

MUMBAI

Indian shares slumped 4.05 percent. The BSE benchmark 30-share SENSEX index fell 529.35 points or 4.05 percent to 12,526.32, its lowest level since April last year.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

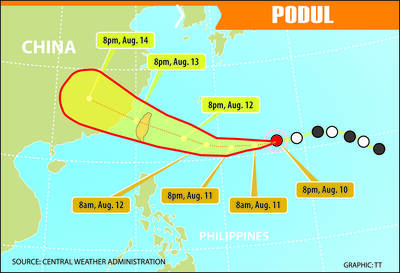

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an