Singaporean sovereign wealth fund Temasek Holdings, which invested billions in investment bank Merrill Lynch, yesterday reported a record profit of S$18.2 billion (US$12.8 billion).

But the state-linked investment firm in control of some of Asia’s best-known companies warned that slowing global economic growth following the US financial crisis could limit future opportunities.

“The fallout of the credit crisis will continue to dampen the global economy over the next 24 months, with sharply escalated oil and food prices beginning to test inflation expectations,” company chairman S. Dhanabalan said.

The record annual profit for the year to March covered a period during which Temasek invested US$4.9 billion in Merrill Lynch.

That deal followed the financial crisis and global credit crunch sparked by the meltdown in the US subprime mortgage sector. Sovereign wealth funds like Temasek have stirred controversy after rescuing big banks hit by the crisis.

The funds, government-created investment vehicles, have emerged as a potent force in global markets, sparking concerns that their investment policies are too opaque and could threaten national security.

Temasek, which has claimed a record of transparency, said strong operating performance by its portfolio companies “and healthy realized gains from its direct investment activities” contributed to its record profit.

It said in a statement that its portfolio rose in value to S$185 billion, up 13 percent from S$164 billion the previous year.

But Dhanabalan said Temasek was worried about risks from an environment of high inflation and slowing growth, sometimes referred to as “stagflation.”

Dhanabalan said: “This presents huge socio-political as well as economic risks in the next three to five years. Opportunities may be limited in such a scenario.”

Temasek is the largest shareholder in Merrill, which announced last month that it was dumping billions of dollars of mortgage debt at a steep loss and raising US$8.5 billion in new capital, including US$3.4 billion from Temasek.

The Singaporean fund first invested in the US bank Merrill Lynch in December, with a requirement that if Merrill raised more capital within 12 months at a lower share price, Temasek would be compensated for the difference.

The proviso kicked in for the most recent Temasek investment into Merrill, with the fund putting that US$2.5 billion compensation back into the US bank along with another US$900 million.

Temasek said for the first time net investments outside Asia were S$10 billion, exceeding net investments within Asia of S$5 billion.

Its exposure to economies outside Asia increased from 22 percent of its portfolio to 26 percent, due to the Merrill Lynch stake and investments in Latin America and Russia, the company said.

For the financial year, Temasek reported total shareholder return of seven percent by market value. That compares with the 27 percent in the previous year.

Temasek controls Singapore Airlines, Neptune Orient Lines and Singapore Telecommunications as well as other major regional firms.

It is one of two Singapore government investment vehicles along with the Government of Singapore Investment Corp.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

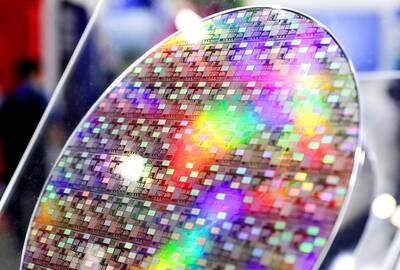

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better