European stocks declined for a sixth week to their lowest in three years as oil surged to a record, fueling inflation, while companies from banks to retailers said a slowdown in economic growth is hurting earnings.

Michelin & Cie, the world’s second-largest tiremaker, and Volkswagen AG, Europe’s biggest carmaker, slid. Carrefour SA, the region’s largest retailer, sank to its lowest in more than five years after saying sales growth slowed. Bank of Ireland PLC fell after saying the economy is “adversely impacting” profit. Wienerberger AG led construction stocks lower on earnings.

The Dow Jones STOXX 600 Index sank 3.3 percent this week to 270.36, for the longest weekly declining streak since January. The index is down 26 percent this year as a rout led by banks trimmed more than US$11 trillion from global equities.

“The market is very nervous,” said Edouard Carmignac, chief investment officer at Carmignac Gestion, which oversees US$24 billion in Paris. “We can’t see very clearly. The increase in raw materials prices is decreasing buying power and creating inflationary pressure.”

Record oil prices, accelerating inflation and more than US$400 billion in credit-related losses threaten to push the US into recession and stifle profit growth. Earnings for STOXX 600 companies are expected to drop 2.3 percent this year, according to data compiled by Bloomberg. That compares with an estimate for a 0.7 percent decrease a month ago.

“Investors are focusing on the return of worries about the financial industry,” said Alexandre Iatrides, a fund manager at Richelieu Finance in Paris, which oversees US$6.2 billion. “There’s still the specter of a crisis. That adds to concern about the economic slowdown and the rise in oil prices.”

National benchmark indexes retreated in all of the 18 western European markets. Germany’s DAX Index fell 1.9 percent this week. France’s CAC 40 lost 3.9 percent. The UK’s FTSE 100 slipped 2.8 percent, bringing its loss from last year’s high to 22 percent. The STOXX 50 retreated 2.9 percent, and the Euro STOXX 50, a measure for the euro region, slid 2.4 percent.

The Bank of England kept its key interest rate unchanged at 5 percent on July 10, in line with economists’ predictions, as policy makers weighed the threat of Britain’s first recession in a generation against the risk of accelerating inflation.

“We expect the markets to stay lower,” Rainer Gerdau, head of equity strategy at Saxo Bank A/S, said in a Bloomberg Television interview. “It is too early for a turn-around, the recession is yet to come.”

Crude oil rose to a record on concerns that Israel may be preparing to attack Iran, while a strike in Brazil and renewed militant activity in Nigeria threaten to cut supplies. The contract for August delivery reached an all-time high of US$147.27 a barrel on the New York Mercantile Exchange.

Michelin retreated 8.2 percent. Volkswagen lost 4 percent.

Air Berlin PLC sank 18 percent. Europe’s third-biggest low-cost airline pulled out of talks to buy German charter carrier Condor from Thomas Cook Group PLC after fuel costs surged.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

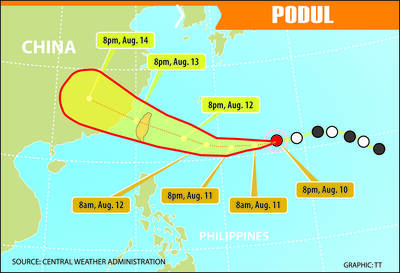

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

Tropical Storm Podul strengthened into a typhoon at 8pm yesterday, the Central Weather Administration (CWA) said, with a sea warning to be issued late last night or early this morning. As of 8pm, the typhoon was 1,020km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, moving west at 23kph. The storm carried maximum sustained winds of 119kph and gusts reaching 155kph, the CWA said. Based on the tropical storm’s trajectory, a land warning could be issued any time from midday today, it added. CWA forecaster Chang Chun-yao (張竣堯) said Podul is a fast-moving storm that is forecast to bring its heaviest rainfall and strongest