Oil prices pulled back on Friday after OPEC questioned whether crude can remain so high and the US dollar gained against the euro.

On the New York Mercantile Exchange, benchmark light, sweet crude for July delivery fell US$1.88 to settle at US$134.86 while, in London, July Brent crude lost US$1.84 to settle at US$134.25 on the ICE Futures exchange.

Friday’s close puts the price of the NYMEX contract more than US$4 below the all-time trading high it struck last Friday, but still more than 10 percent higher than it was before its latest surge, which began just over a week ago. The price for a barrel has swung back and forth in a band about US$10 wide since then.

In its monthly market report, OPEC said oil’s recent volatility “reconfirms the view that current price levels do not reflect supply and demand realities.”

The cartel also lowered its global demand forecast for this year, saying it now expected demand to increase by 1.28 percent to an average of 86.9 million barrels per day, down from a previous forecast of 1.35 percent.

“A review of prospects for the remainder of the year also shows little support for prices to remain at current levels,” OPEC said.

That downward revision follows similar moves by the US Energy Department and the International Energy Agency earlier in the week.

Phil Flynn, an analyst at Alaron Trading Corp in Chicago, said the revised forecasts suggest global demand for oil is slowing. That trend could accelerate, he added, if prices don’t come down soon.

“It’s a sign that maybe the bull run could come to an end. You don’t want to say that for sure, but you’re starting to see some shifts,” Flynn said.

Oil prices were also pressured by speculation that Saudi Arabia may boost production following a report in the Middle East Economic Survey, an industry publication.

Crude prices have fluctuated widely since they surged nearly US$11 in a single session to a trading record above US$139 a week ago. Some investors believe prices could yet push higher, while others think prices are due to fall, perhaps sharply.

Analysts call oil’s current wavering “range-trading,” as traders await direction from a significant move in the dollar or change in supply-and-demand fundamentals.

“There is no driver out there to cause prices to break out of this range yet,” said Victor Shum, an energy analyst with Purvin Gertz in Singapore.

A stronger US dollar also helped keep oil prices in check on Friday.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

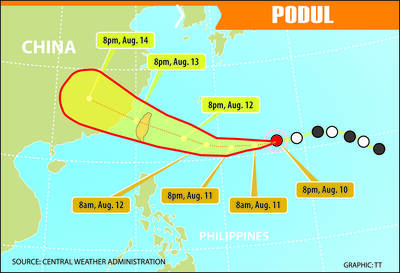

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an