Australia's Westpac Banking Corp is unlikely to raise its A$18.3 billion (US$17.5 billion) offer for St. George Bank Ltd unless rivals counter its bid, chairman Ted Evans said yesterday.

The Sydney-based bank's all-share offer is attractive, Evans told the Australian Broadcasting Corp's Inside Business program yesterday.

St. George Bank is open to higher takeover bids and is free to consider rival proposals until shareholders vote on Westpac’s offer, the Australian newspaper reported yesterday, citing chief executive officer Paul Fegan.

“We made a compelling bid that would see us right through this,” Evans said. “It’s compelling on price but it’s even more compelling on the operating model that we are offering. I’d be very surprised if anyone can or would match that.”

Westpac’s acquisition of St. George would make the group the nation’s second-largest lender and the biggest home-loan provider. Rivals National Australia Bank Ltd and Commonwealth Bank of Australia said they are watching the developments.

St. George’s board recommended Westpac’s offer on Tuesday and agreed not to seek other offers for a two-week period. Westpac is offering 1.31 of its shares for each of St. George’s, giving investors in the target company 28 percent of the enlarged group.

Westpac’s initial offer had been lower, Evans said, without providing details.

The offer is also designed to limit likely customer losses by maintaining the St. George brand, all of its branches and all of its automatic teller machines, he said.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

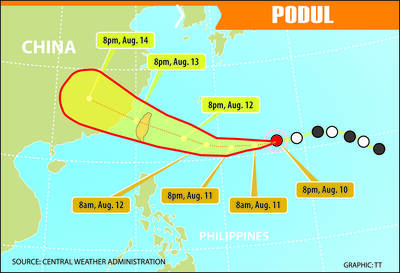

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

Tropical Storm Podul strengthened into a typhoon at 8pm yesterday, the Central Weather Administration (CWA) said, with a sea warning to be issued late last night or early this morning. As of 8pm, the typhoon was 1,020km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, moving west at 23kph. The storm carried maximum sustained winds of 119kph and gusts reaching 155kph, the CWA said. Based on the tropical storm’s trajectory, a land warning could be issued any time from midday today, it added. CWA forecaster Chang Chun-yao (張竣堯) said Podul is a fast-moving storm that is forecast to bring its heaviest rainfall and strongest